Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BARRYS BATTING CAGES LTD. Please include a T-account with trail marks. It was November 3, 2012, and Rachel Barry had just completed her third year

BARRYS BATTING CAGES LTD.

Please include a T-account with trail marks.

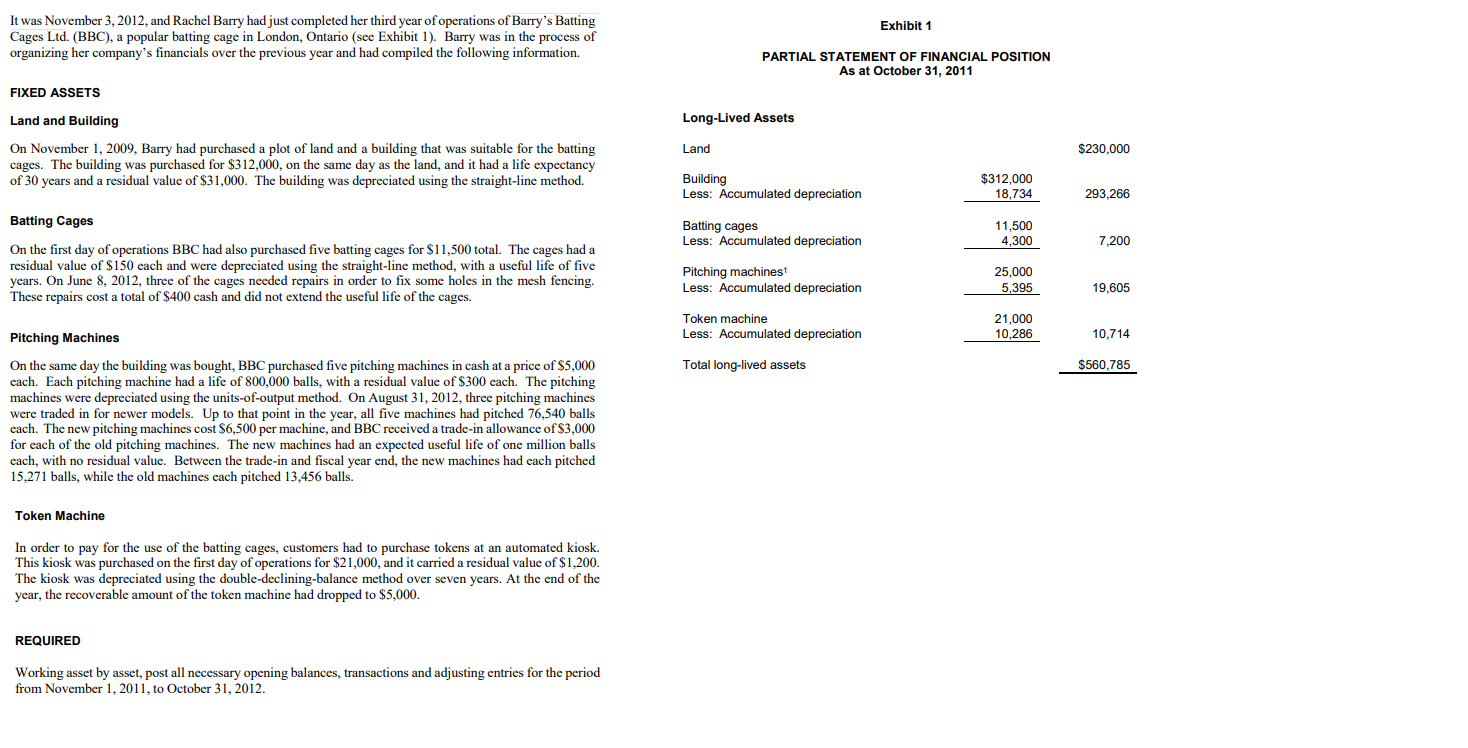

It was November 3, 2012, and Rachel Barry had just completed her third year of operations of Barry's Batting Cages Ltd. (BBC), a popular batting cage in London, Ontario (see Exhibit 1). Barry was in the process of organizing her company's financials over the previous year and had compiled the following information. FIXED ASSETS Land and Building On November 1, 2009, Barry had purchased a plot of land and a building that was suitable for the batting cages. The building was purchased for $312,000, on the same day as the land, and it had a life expectancy of 30 years and a residual value of $31,000. The building was depreciated using the straight-line method. Batting Cages On the first day of operations BBC had also purchased five batting cages for $11,500 total. The cages had a residual value of $150 each and were depreciated using the straight-line method, with a useful life of five years. On June 8, 2012, three of the cages needed repairs in order to fix some holes in the mesh fencing. These repairs cost a total of $400 cash and did not extend the useful life of the cages. Pitching Machines On the same day the building was bought, BBC purchased five pitching machines in cash at a price of $5,000 each. Each pitching machine had a life of 800,000 balls, with a residual value of $300 each. The pitching machines were depreciated using the units-of-output method. On August 31, 2012, three pitching machines were traded in for newer models. Up to that point in the year, all five machines had pitched 76,540 balls each. The new pitching machines cost $6,500 per machine, and BBC received a trade-in allowance of $3,000 for each of the old pitching machines. The new machines had an expected useful life of one million balls each, with no residual value. Between the trade-in and fiscal year end, the new machines had each pitched 15,271 balls, while the old machines each pitched 13,456 balls. Token Machine In order to pay for the use of the batting cages, customers had to purchase tokens at an automated kiosk. This kiosk was purchased on the first day of operations for $21,000, and it carried a residual value of $1,200. The kiosk was depreciated using the double-declining-balance method over seven years. At the end of the year, the recoverable amount of the token machine had dropped to $5,000. REQUIRED Working asset by asset, post all necessary opening balances, transactions and adjusting entries for the period from November 1, 2011, to October 31, 2012. Exhibit 1 PARTIAL STATEMENT OF FINANCIAL POSITION As at October 31, 2011Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started