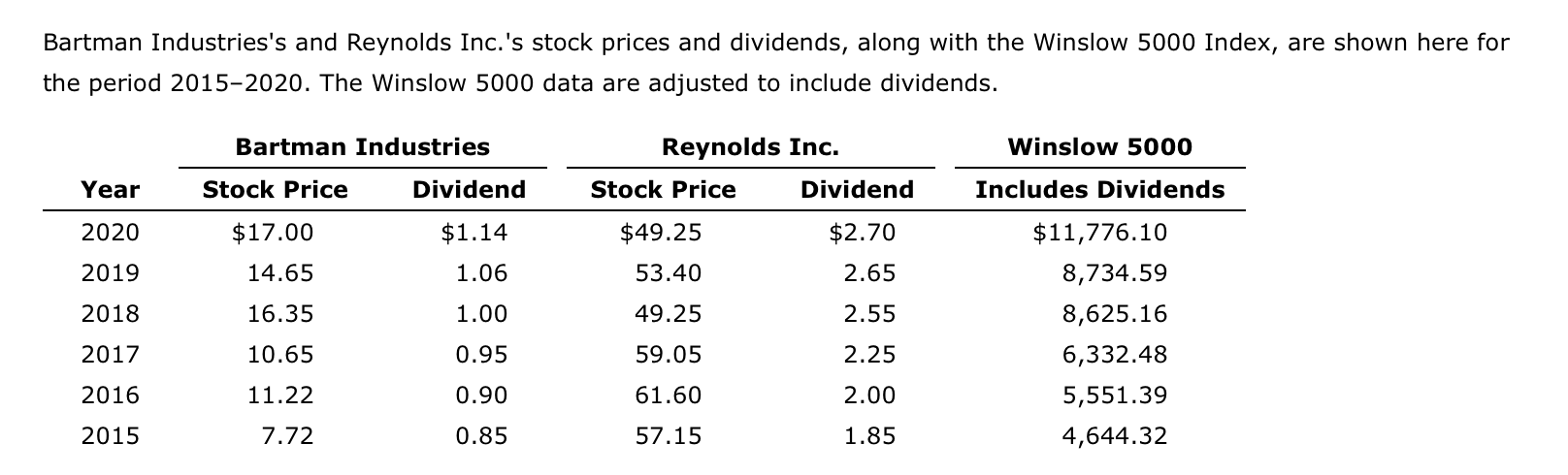

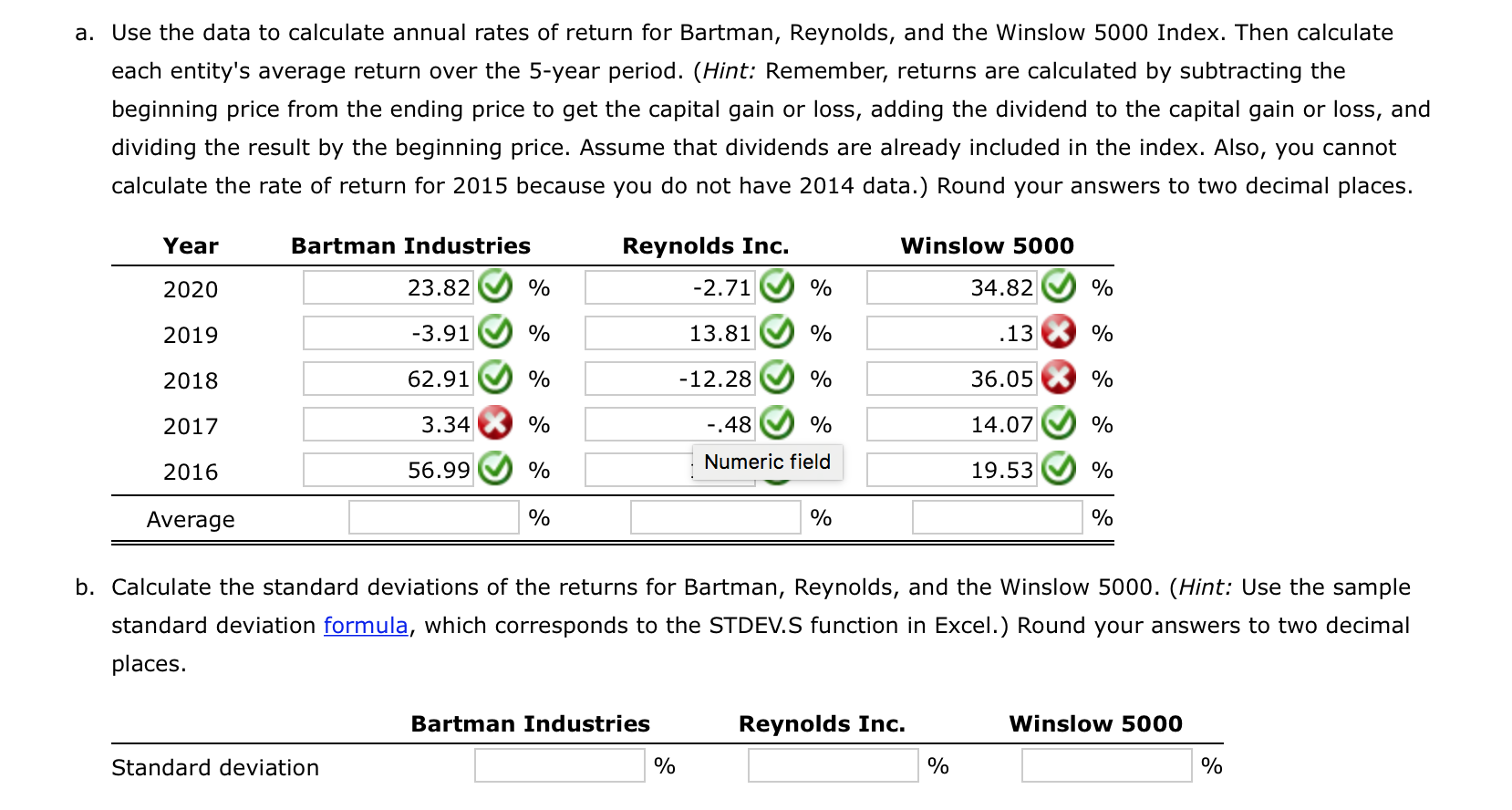

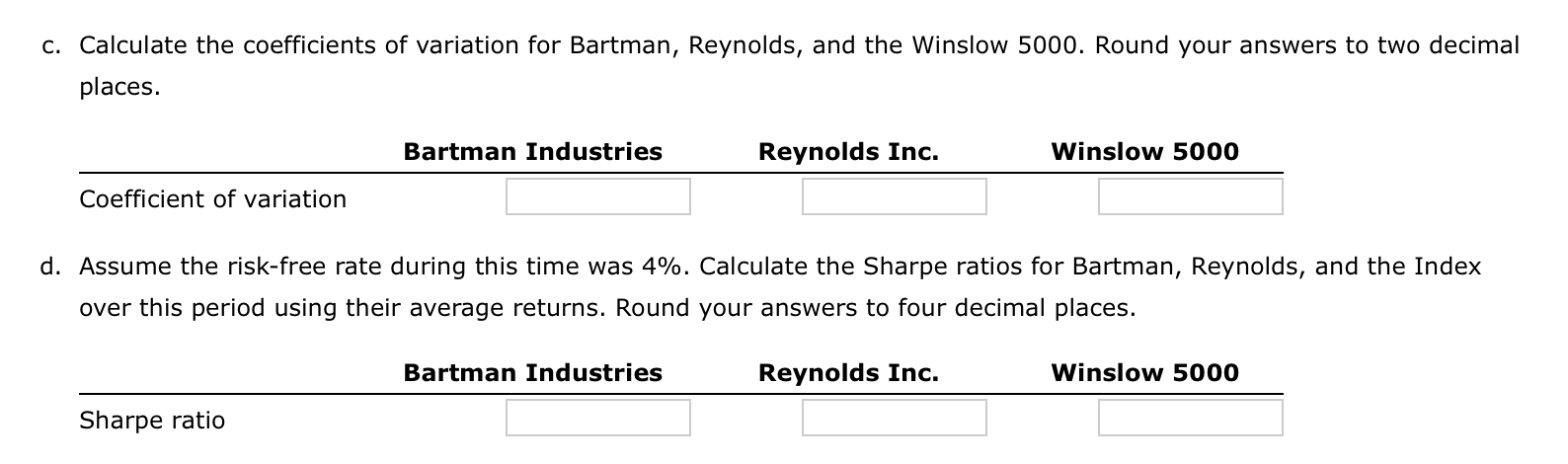

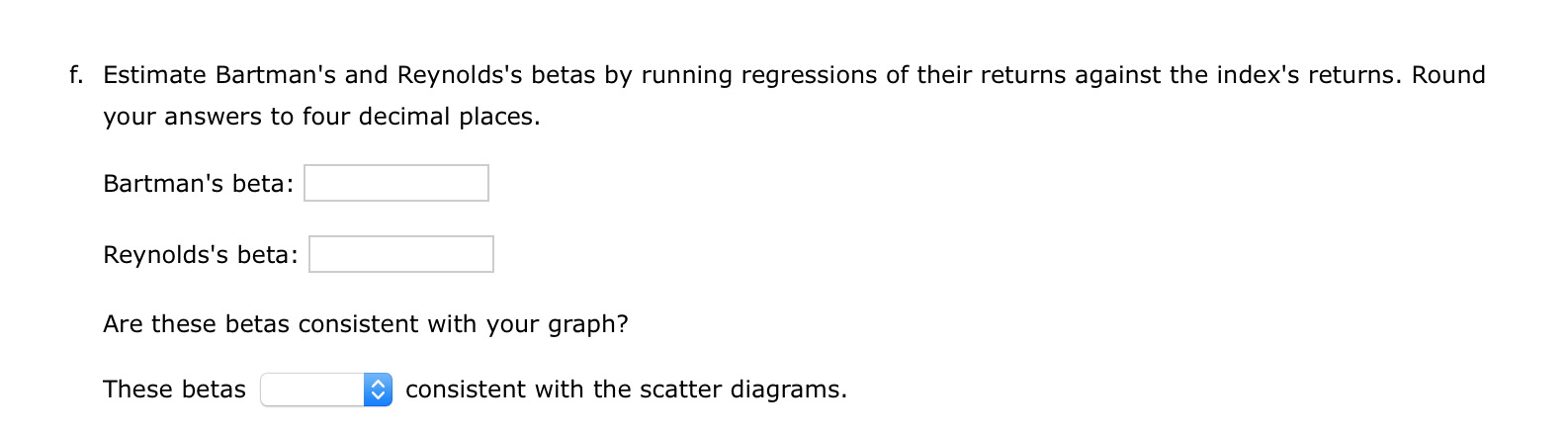

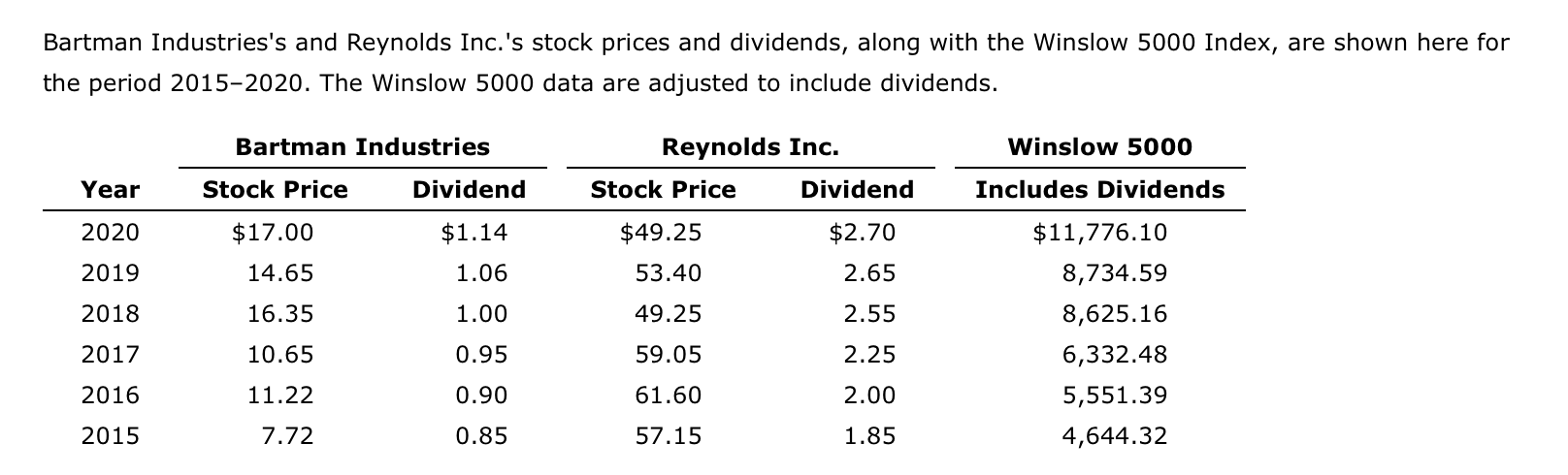

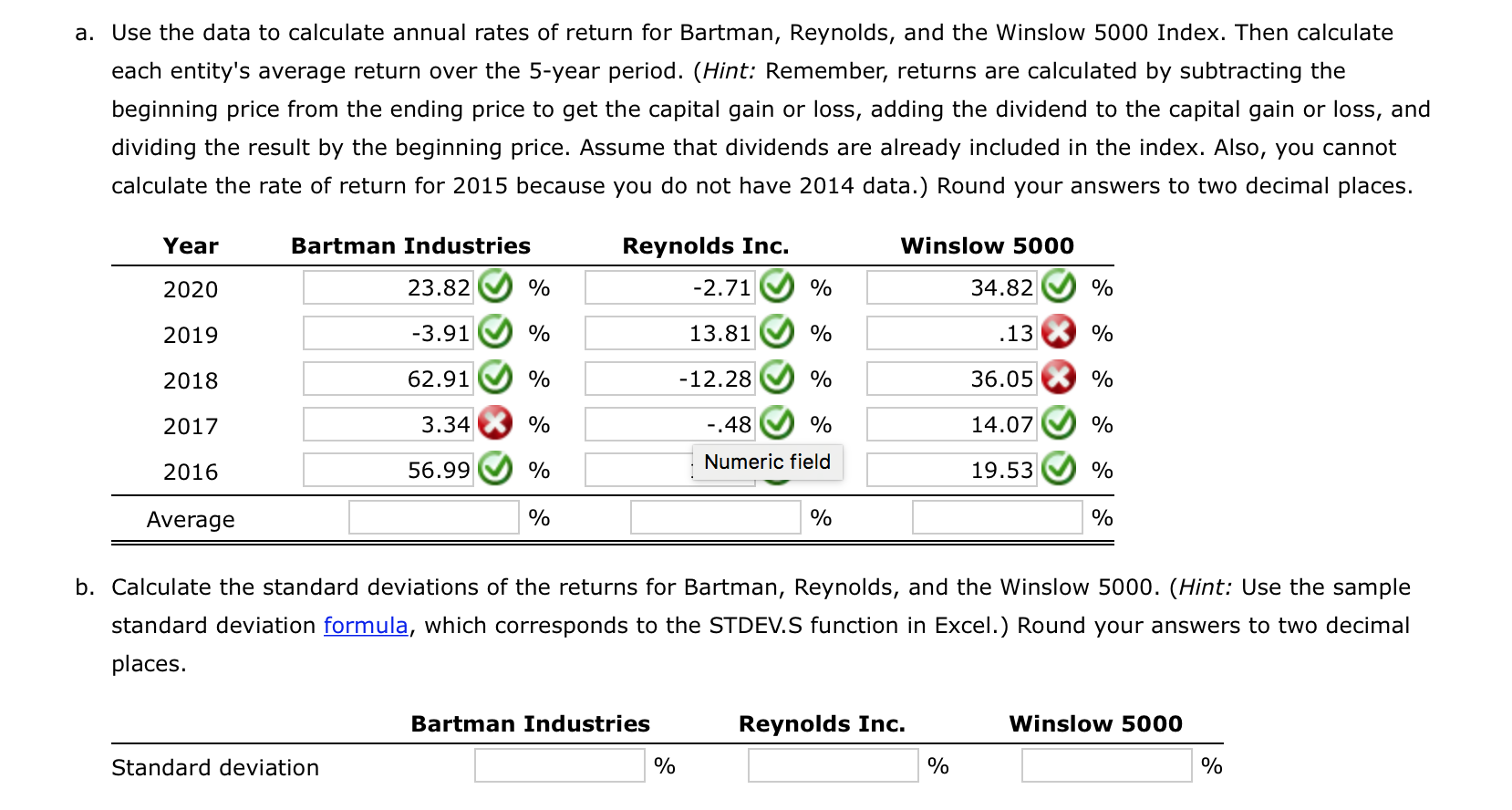

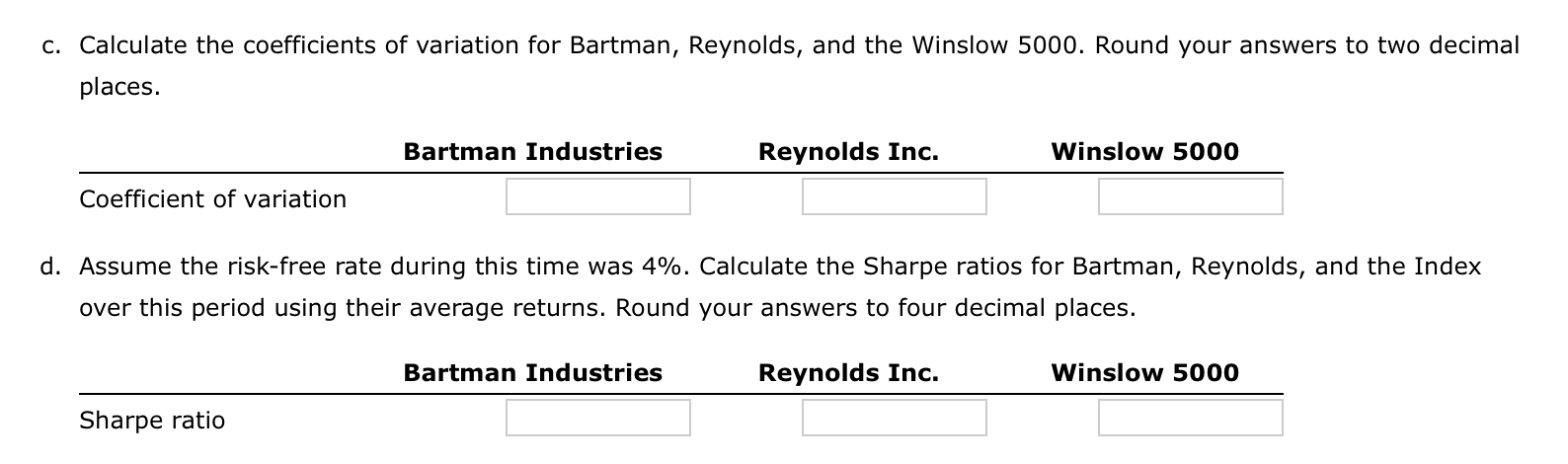

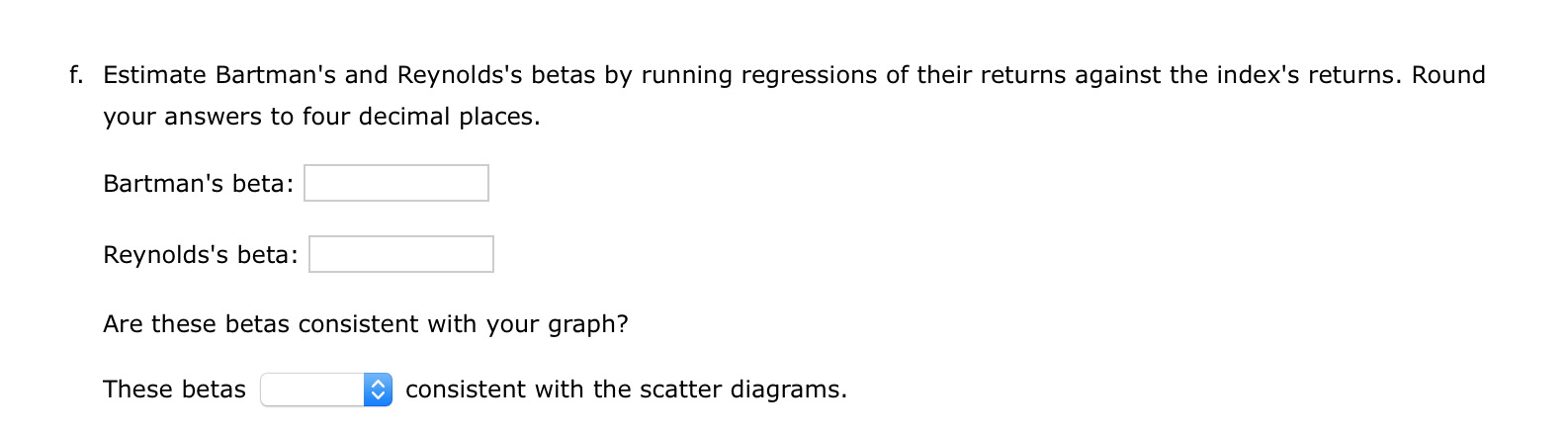

Bartman Industries's and Reynolds Inc.'s stock prices and dividends, along with the Winslow 5000 Index, are shown here for the period 2015-2020. The Winslow 5000 data are adjusted to include dividends. Bartman Industries Reynolds Inc. Winslow 5000 Year Stock Price Dividend Stock Price Dividend Includes Dividends 2020 $17.00 14.65 $1.14 1.06 $49.25 53.40 $2.70 2.65 2019 2018 16.35 1.00 49.25 2.55 $11,776.10 8,734.59 8,625.16 6,332.48 5,551.39 4,644.32 2017 10.65 0.95 59.05 2.25 2016 11.22 0.90 61.60 2.00 2015 7.72 0.85 57.15 1.85 a. Use the data to calculate annual rates of return for Bartman, Reynolds, and the Winslow 5000 Index. Then calculate each entity's average return over the 5-year period. (Hint: Remember, returns are calculated by subtracting the beginning price from the ending price to get the capital gain or loss, adding the dividend to the capital gain or loss, and dividing the result by the beginning price. Assume that dividends are already included in the index. Also, you cannot calculate the rate of return for 2015 because you do not have 2014 data.) Round your answers to two decimal places. Year Bartman Industries Reynolds Inc. Winslow 5000 2020 23.82 % -2.71 % 34.82 % 2019 -3.91 % 13.81 % .13 % 2018 62.91 % -12.28 % 36.05 % 2017 3.34 % -.48 % 14.07 % 2016 56.99 % Numeric field 19.53 % Average % % % b. Calculate the standard deviations of the returns for Bartman, Reynolds, and the Winslow 5000. (Hint: Use the sample standard deviation formula, which corresponds to the STDEV.S function in Excel.) Round your answers to two decimal places. Bartman Industries Reynolds Inc. Winslow 5000 Standard deviation % % % C. Calculate the coefficients of variation for Bartman, Reynolds, and the Winslow 5000. Round your answers to two decimal places. Bartman Industries Reynolds Inc. Winslow 5000 Coefficient of variation d. Assume the risk-free rate during this time was 4%. Calculate the Sharpe ratios for Bartman, Reynolds, and the Index over this period using their average returns. Round your answers to four decimal places. Bartman Industries Reynolds Inc. Winslow 5000 Sharpe ratio f. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's returns. Round your answers to four decimal places. Bartman's beta: Reynolds's beta: Are these betas consistent with your graph? These betas consistent with the scatter diagrams. Bartman Industries's and Reynolds Inc.'s stock prices and dividends, along with the Winslow 5000 Index, are shown here for the period 2015-2020. The Winslow 5000 data are adjusted to include dividends. Bartman Industries Reynolds Inc. Winslow 5000 Year Stock Price Dividend Stock Price Dividend Includes Dividends 2020 $17.00 14.65 $1.14 1.06 $49.25 53.40 $2.70 2.65 2019 2018 16.35 1.00 49.25 2.55 $11,776.10 8,734.59 8,625.16 6,332.48 5,551.39 4,644.32 2017 10.65 0.95 59.05 2.25 2016 11.22 0.90 61.60 2.00 2015 7.72 0.85 57.15 1.85 a. Use the data to calculate annual rates of return for Bartman, Reynolds, and the Winslow 5000 Index. Then calculate each entity's average return over the 5-year period. (Hint: Remember, returns are calculated by subtracting the beginning price from the ending price to get the capital gain or loss, adding the dividend to the capital gain or loss, and dividing the result by the beginning price. Assume that dividends are already included in the index. Also, you cannot calculate the rate of return for 2015 because you do not have 2014 data.) Round your answers to two decimal places. Year Bartman Industries Reynolds Inc. Winslow 5000 2020 23.82 % -2.71 % 34.82 % 2019 -3.91 % 13.81 % .13 % 2018 62.91 % -12.28 % 36.05 % 2017 3.34 % -.48 % 14.07 % 2016 56.99 % Numeric field 19.53 % Average % % % b. Calculate the standard deviations of the returns for Bartman, Reynolds, and the Winslow 5000. (Hint: Use the sample standard deviation formula, which corresponds to the STDEV.S function in Excel.) Round your answers to two decimal places. Bartman Industries Reynolds Inc. Winslow 5000 Standard deviation % % % C. Calculate the coefficients of variation for Bartman, Reynolds, and the Winslow 5000. Round your answers to two decimal places. Bartman Industries Reynolds Inc. Winslow 5000 Coefficient of variation d. Assume the risk-free rate during this time was 4%. Calculate the Sharpe ratios for Bartman, Reynolds, and the Index over this period using their average returns. Round your answers to four decimal places. Bartman Industries Reynolds Inc. Winslow 5000 Sharpe ratio f. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's returns. Round your answers to four decimal places. Bartman's beta: Reynolds's beta: Are these betas consistent with your graph? These betas consistent with the scatter diagrams