Answered step by step

Verified Expert Solution

Question

1 Approved Answer

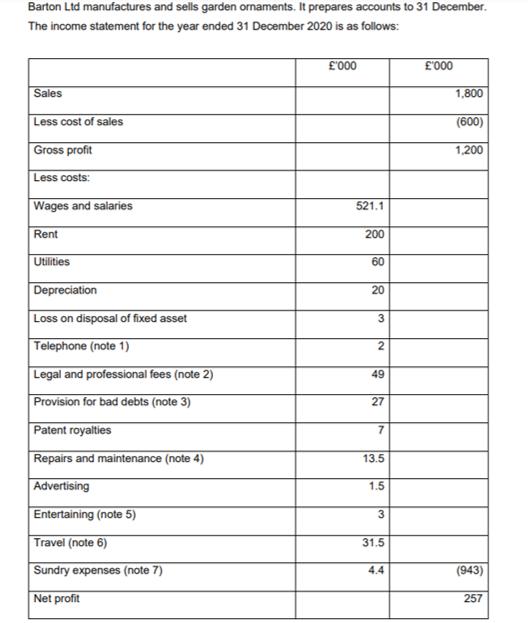

Barton Ltd manufactures and sells garden ornaments. It prepares accounts to 31 December. The income statement for the year ended 31 December 2020 is

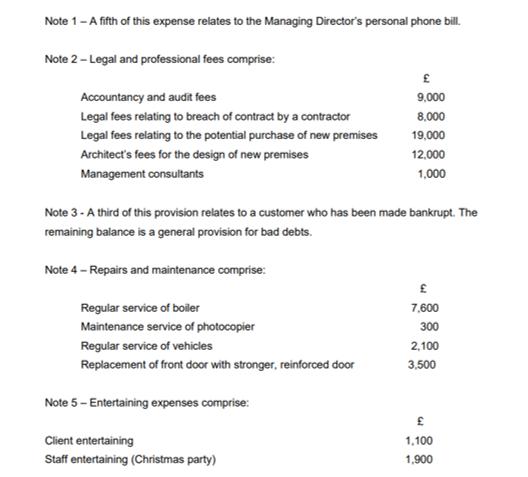

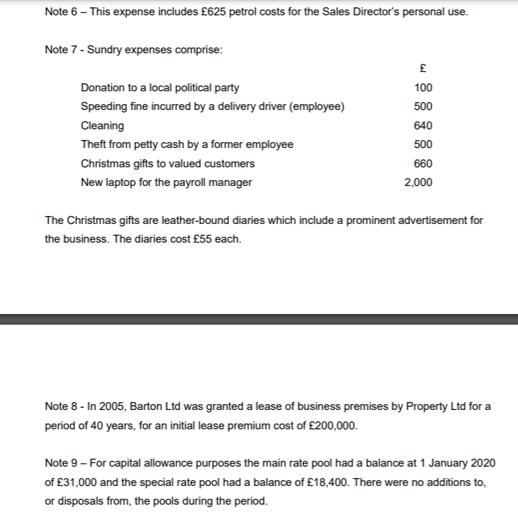

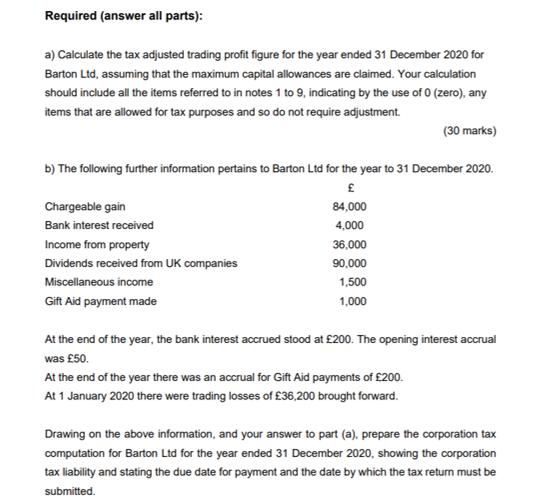

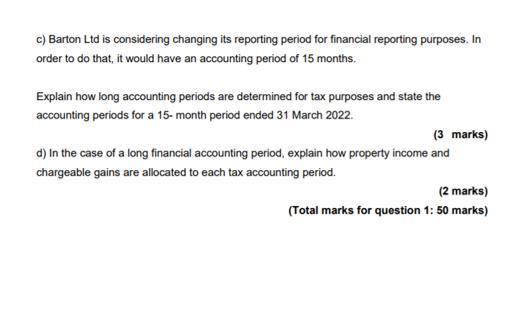

Barton Ltd manufactures and sells garden ornaments. It prepares accounts to 31 December. The income statement for the year ended 31 December 2020 is as follows: '000 '000 Sales 1,800 Less cost of sales (600) Gross profit 1,200 Less costs: Wages and salaries 521.1 Rent 200 Utilities 60 Depreciation Loss on disposal of fixed asset 3 Telephone (note 1) Legal and professional fees (note 2) 49 Provision for bad debts (note 3) Patent royalties Repairs and maintenance (note 4) 13.5 Advertising 1.5 Entertaining (note 5) Travel (note 6) 31.5 Sundry expenses (note 7) 4.4 (943) Net profit 257 20 2. 27 Note 1-A fifth of this expense relates to the Managing Director's personal phone bill. Note 2- Legal and professional fees comprise: Accountancy and audit fees 9,000 Legal fees relating to breach of contract by a contractor 8,000 Legal fees relating to the potential purchase of new premises Architect's fees for the design of new premises 19,000 12,000 Management consultants 1,000 Note 3 - A third of this provision relates to a customer who has been made bankrupt. The remaining balance is a general provision for bad debts. Note 4 - Repairs and maintenance comprise: Regular service of boiler 7,600 Maintenance service of photocopier 300 Regular service of vehicles 2,100 Replacement of front door with stronger, reinforced door 3.500 Note 5 - Entertaining expenses comprise: Client entertaining 1,100 Staff entertaining (Christmas party) 1,900 Required (answer all parts): a) Calculate the tax adjusted trading profit figure for the year ended 31 December 2020 for Barton Ltd, assuming that the maximum capital allowances are claimed. Your calculation should include all the items referred to in notes 1 to 9, indicating by the use of 0 (zero), any items that are allowed for tax purposes and so do not require adjustment. (30 marks) b) The following further information pertains to Barton Ltd for the year to 31 December 2020. Chargeable gain 84,000 Bank interest received 4,000 Income from property 36,000 Dividends received from UK companies 90,000 Miscellaneous income 1,500 Gift Aid payment made 1,000 At the end of the year, the bank interest accrued stood at 200. The opening interest accrual was 50. At the end of the year there was an accrual for Gift Aid payments of 200. At 1 January 2020 there were trading losses of 36,200 brought forward. Drawing on the above information, and your answer to part (a), prepare the corporation tax computation for Barton Ltd for the year ended 31 December 2020, showing the corporation tax liability and stating the due date for payment and the date by which the tax return must be submitted. c) Barton Ltd is considering changing its reporting period for financial reporting purposes. In order to do that, it would have an accounting period of 15 months. Explain how long accounting periods are determined for tax purposes and state the accounting periods for a 15- month period ended 31 March 2022. (3 marks) d) In the case of a long financial accounting period, explain how property income and chargeable gains are allocated to each tax accounting period. (2 marks) (Total marks for question 1: 50 marks)

Step by Step Solution

★★★★★

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Solution CALCULATION OF TAXABLE BUSINESS INCOME AND CORPORATION TAX THEREON OF BARTON LTD AS ON 31 DECEMBER 2020 N et profit as per income statement 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started