Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Barzetti had no investments prior to the current year. It had the following transactions during the year involving stock investments with insignificant influence and also

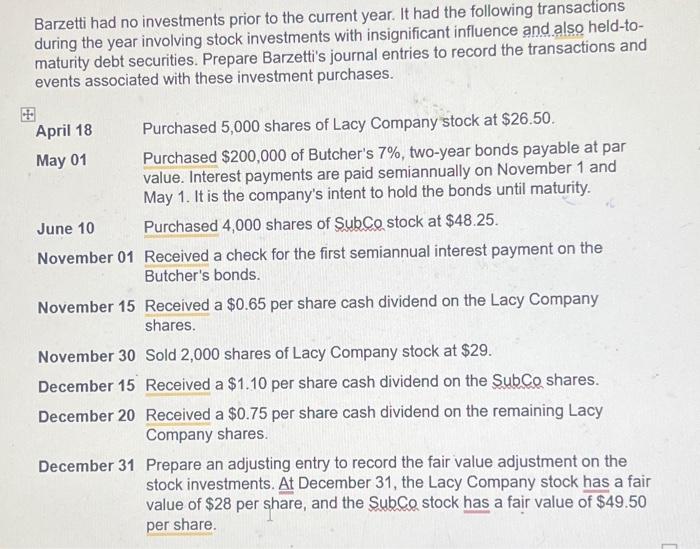

Barzetti had no investments prior to the current year. It had the following transactions during the year involving stock investments with insignificant influence and also held-to- maturity debt securities. Prepare Barzetti's journal entries to record the transactions and events associated with these investment purchases. Purchased 5,000 shares of Lacy Company stock at $26.50. Purchased $200,000 of Butcher's 7%, two-year bonds payable at par value. Interest payments are paid semiannually on November 1 and May 1. It is the company's intent to hold the bonds until maturity. June 10 Purchased 4,000 shares of SubCo stock at $48.25. November 01 Received a check for the first semiannual interest payment on the Butcher's bonds. April 18 May 01 November 15 Received a $0.65 per share cash dividend on the Lacy Company shares. November 30 Sold 2,000 shares of Lacy Company stock at $29. December 15 Received a $1.10 per share cash dividend on the SubCo shares. December 20 Received a $0.75 per share cash dividend on the remaining Lacy Company shares. December 31 Prepare an adjusting entry to record the fair value adjustment on the stock investments. At December 31, the Lacy Company stock has a fair value of $28 per share, and the SubCo stock has a fair value of $49.50 per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started