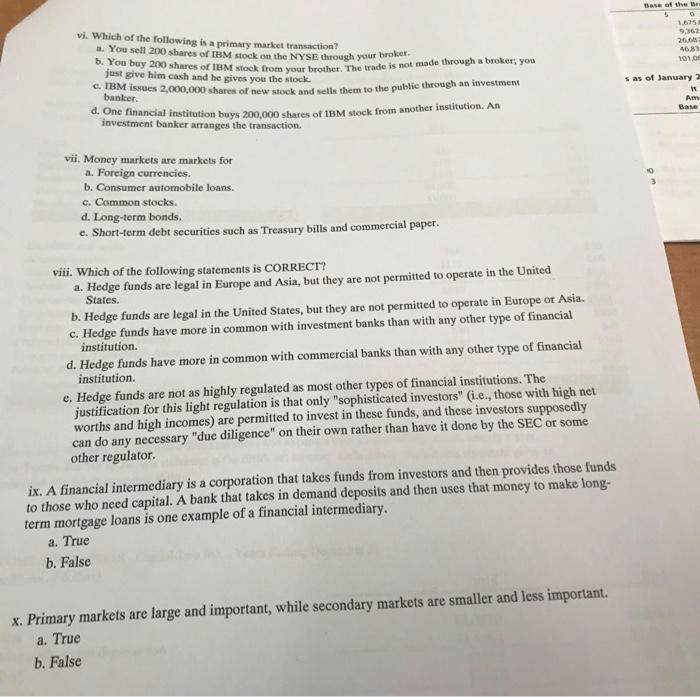

Base of the Br C vi. Which of the following is a primary market transaction? a. You sell 200 shares of IBM stock on the NYSE through your broker. b. You buy 200 shares of IBM stock from your brother. The trade is not made through a broker; you 1,6758 9,362 26087 46,83 101,08 just give him cash and he gives you the stock. c. IBM issues 2,000,000 shares of new stock and sells them to the public through an investment d. One financial institution buys 200,000 shares of IBM stock from another institution. An s as of January 2 banker. It Am investment banker arranges the transaction. Base vii. Money markets are markets for a. Foreign currencies. b. Consumer automobile loans. c. Common stocks. d. Long-term bonds. e. Short-term debt securities such as Treasury bills and commercial paper. viii. Which of the following statements is CORRECT? a. Hedge funds are legal in Europe and Asia, but they are not permitted States to operate in the United b. Hedge funds are legal in the United States, but they are not permitted to operate in Europe or Asia. c. Hedge funds have more in common with investment banks than with any other type of financial institution. d. Hedge funds have more in common with commercial banks than with any other type of financial institution. e. Hedge funds are not as highly regulated as most other types of financial institutions. The justification for this light regulation is that only "sophisticated investors" (i.e., those with high net worths and high incomes) are permitted to invest in these funds, and these investors supposedly can do any necessary "due diligence" on their own rather than have it done by the SEC or some other regulator. ix. A financial intermediary is a corporation that takes funds from investors and then provides those funds to those who need capital. A bank that takes in demand deposits and then uses that money to make long- term mortgage loans is one example of a financial intermediary. a. True b. False x.Primary markets are large and important, while secondary markets are smaller and less important. a. True b. False