Answered step by step

Verified Expert Solution

Question

1 Approved Answer

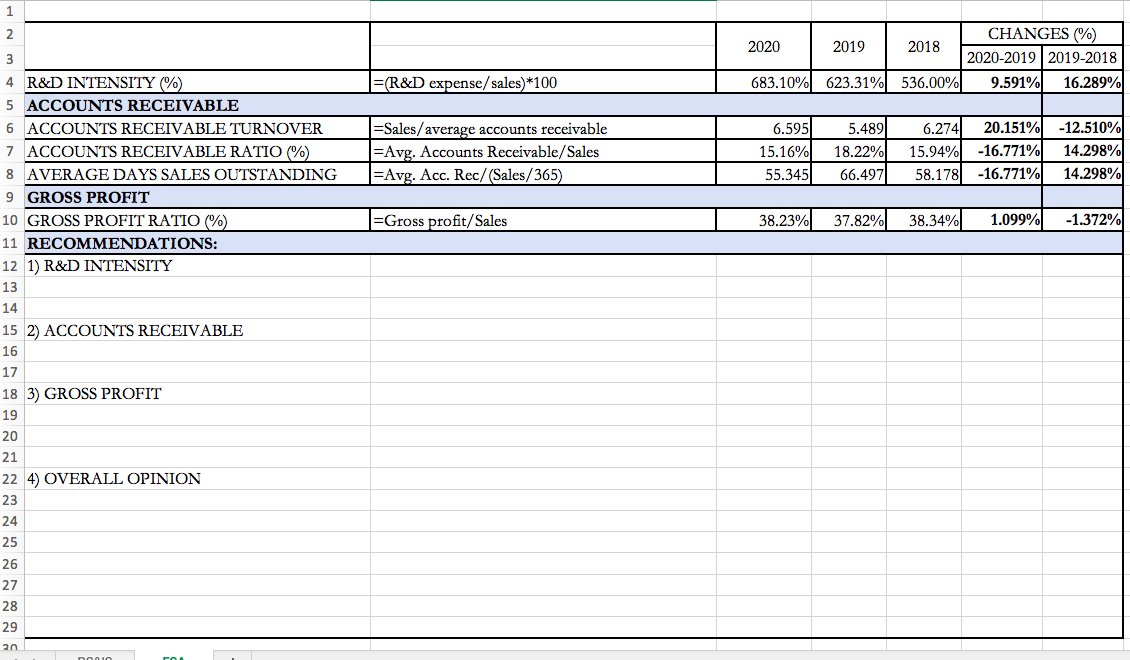

Base on the chart, comment on R&D INTENSITY, ACCOUNTS RECEIVABLE, GROSS PROFIT and give an OVERALL OPINION 1 2020 2019 2018 CHANGES (%) 2020-2019 2019-2018

Base on the chart, comment on R&D INTENSITY, ACCOUNTS RECEIVABLE, GROSS PROFIT

on R&D INTENSITY, ACCOUNTS RECEIVABLE, GROSS PROFIT

and give an OVERALL OPINION

1 2020 2019 2018 CHANGES (%) 2020-2019 2019-2018 9.591% 16.289% =(R&D expense/ sales)*100 683.10% 623.31% 536.00% I=Sales/average accounts receivable |=Avg. Accounts Receivable/Sales =Avg. Acc. Rec/(Sales/365) 6.595 15.16% 55.345 5.489 18.22% 66.497 6.2741 20.151% 15.94% -16.771% 58.1781 -16.771% -12.510% 14.298% 14.298% =Gross profit/Sales 38.23% 37.82% 38.34% 1.099% -1.372% 3 4 R&D INTENSITY (%) 5 ACCOUNTS RECEIVABLE 6 ACCOUNTS RECEIVABLE TURNOVER 7 ACCOUNTS RECEIVABLE RATIO (%) 8 AVERAGE DAYS SALES OUTSTANDING 9 GROSS PROFIT 10 GROSS PROFIT RATIO (%) 11 RECOMMENDATIONS: 12 1) R&D INTENSITY 13 14 15 2) ACCOUNTS RECEIVABLE 16 17 18 3) GROSS PROFIT 19 20 21 22 4) OVERALL OPINION 23 24 25 26 27 28 29 20 non 1 2020 2019 2018 CHANGES (%) 2020-2019 2019-2018 9.591% 16.289% =(R&D expense/ sales)*100 683.10% 623.31% 536.00% I=Sales/average accounts receivable |=Avg. Accounts Receivable/Sales =Avg. Acc. Rec/(Sales/365) 6.595 15.16% 55.345 5.489 18.22% 66.497 6.2741 20.151% 15.94% -16.771% 58.1781 -16.771% -12.510% 14.298% 14.298% =Gross profit/Sales 38.23% 37.82% 38.34% 1.099% -1.372% 3 4 R&D INTENSITY (%) 5 ACCOUNTS RECEIVABLE 6 ACCOUNTS RECEIVABLE TURNOVER 7 ACCOUNTS RECEIVABLE RATIO (%) 8 AVERAGE DAYS SALES OUTSTANDING 9 GROSS PROFIT 10 GROSS PROFIT RATIO (%) 11 RECOMMENDATIONS: 12 1) R&D INTENSITY 13 14 15 2) ACCOUNTS RECEIVABLE 16 17 18 3) GROSS PROFIT 19 20 21 22 4) OVERALL OPINION 23 24 25 26 27 28 29 20 nonStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started