Answered step by step

Verified Expert Solution

Question

1 Approved Answer

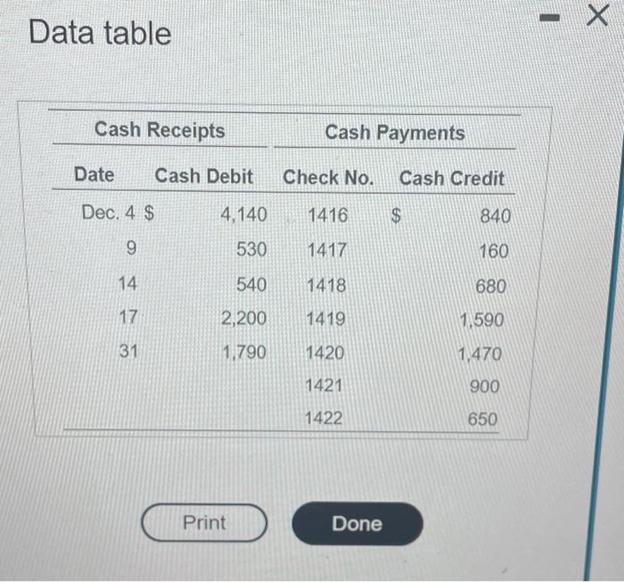

Data table Cash Receipts Cash Payments Date Cash Debit Check No. Cash Credit Dec. 4 $ 4,140 1416 $ 840 9 530 1417 160

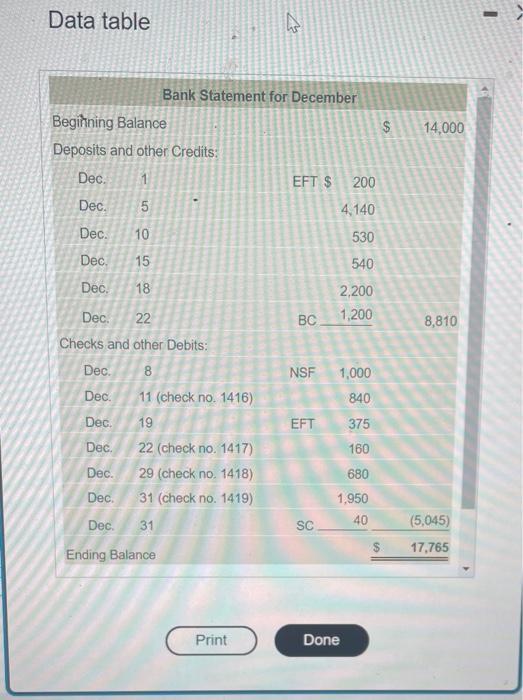

Data table Cash Receipts Cash Payments Date Cash Debit Check No. Cash Credit Dec. 4 $ 4,140 1416 $ 840 9 530 1417 160 540 1418 680 2,200 1419 1,590 1.790 1420 1,470 1421 900 1422 650 14 17 31 Print Done X Data table Beginning Balance Deposits and other Credits: Dec. Dec. Dec. Dec. Dec. Dec. 1 Dec. Dec. Dec. Dec. Dec. Dec. 5.10.15 16 18 22 Checks and other Debits: 8 Bank Statement for December 11 (check no. 1416) 19 22 (check no. 1417) 29 (check no. 1418) 31 (check no. 1419) Dec. 31 Ending Balance Print EFT $ BC NSF EFT SC 200 4,140 530 540 2,200 1,200 1,000 840 375 160 680 1,950 40 Done $ $ 14,000 8,810 (5,045) 17,765 Requirements 1. Prepare the bank reconciliation of Dickson Insurance at December 31, 2024. 2. Journalize any required entries from the bank reconciliation. Print Done - X Data table Cash Receipts Cash Payments Date Cash Debit Check No. Cash Credit Dec. 4 $ 4,140 1416 $ 840 9 530 1417 160 540 1418 680 2,200 1419 1,590 1.790 1420 1,470 1421 900 1422 650 14 17 31 Print Done X Data table Beginning Balance Deposits and other Credits: Dec. Dec. Dec. Dec. Dec. Dec. 1 Dec. Dec. Dec. Dec. Dec. Dec. 5.10.15 16 18 22 Checks and other Debits: 8 Bank Statement for December 11 (check no. 1416) 19 22 (check no. 1417) 29 (check no. 1418) 31 (check no. 1419) Dec. 31 Ending Balance Print EFT $ BC NSF EFT SC 200 4,140 530 540 2,200 1,200 1,000 840 375 160 680 1,950 40 Done $ $ 14,000 8,810 (5,045) 17,765 Requirements 1. Prepare the bank reconciliation of Dickson Insurance at December 31, 2024. 2. Journalize any required entries from the bank reconciliation. Print Done - X

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started