Based off the Tables. What information can be taken away regarding Financial Distress, if any.

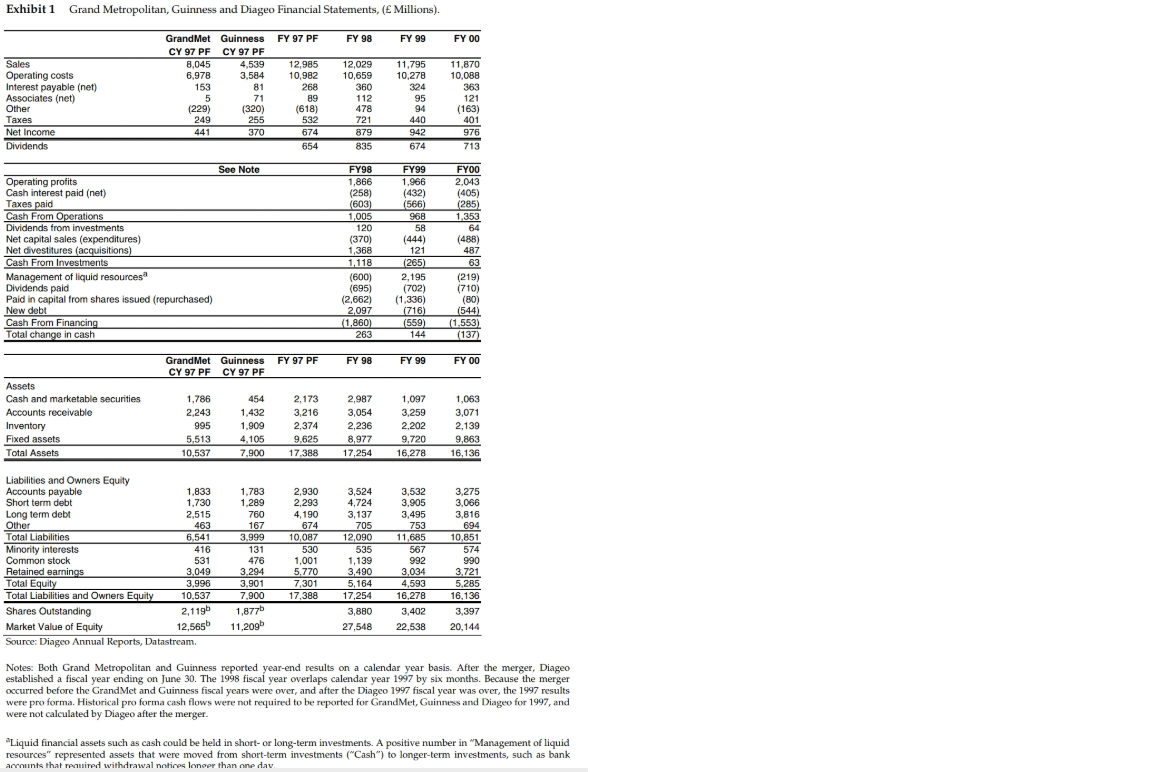

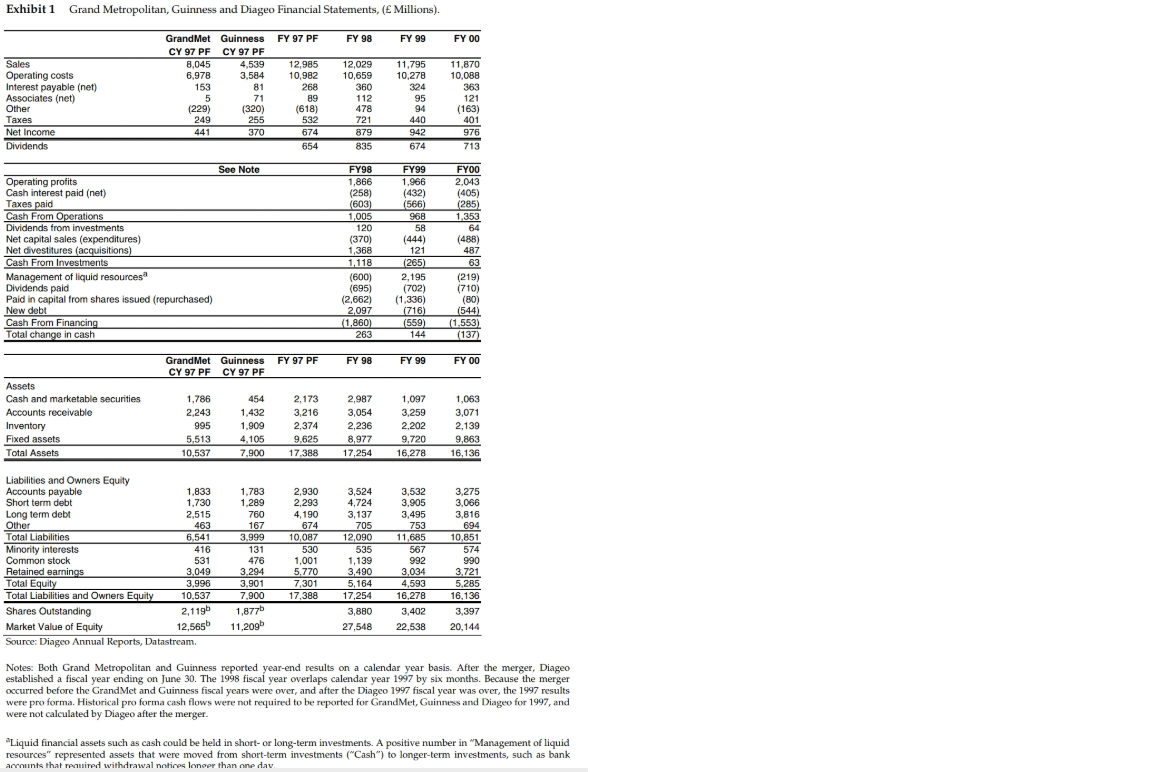

Exhibit 1 Grand Metropolitan, Guinness and Diageo Financial Statements, ( Millions). FY 98 FY 99 FY 00 Grand Met Guinness FY 97 PF CY 97 PF CY 97 PF 8,045 4,539 12,985 6,978 3,584 10,982 153 11,870 10,088 363 81 268 89 71 360 112 121 Sales Operating costs Interest payable (net) Associates (net) Other Taxes Net Income Dividends (229) 249 (320) 255 370 (618) 532 674 654 12,029 11,795 10,659 10,278 324 95 478 94 721 440 879942 835 674 (163) 401 976 713 FY99 1,966 (432) (566) 968 58 FYOO 2.043 (405) (285) 1.353 64 (488) 487 See Note Operating profits Cash interest paid (net) Taxes paid Cash From Operations Dividends from investments Net capital sales (expenditures) Net divestitures (acquisitions) Cash From Investments Management of liquid resources Dividends paid Paid in capital from shares issued (repurchased) New debt Cash From Financing Total change in cash (444) FY98 1.866 (258) (603) 1,005 120 (370) 1,368 1,118 (600) (695) (2,662) 2.097 1.860) 263 121 (265) 2,195 (702) (1.336) (716) (559) 144 (219) (710) (80) (544) (1.553) (137) Grand Met Guinness CY 97 PF CY 97 PF FY 97 PF FY 98 FY 99 FY 00 3 Assets Cash and marketable securities Accounts receivable Inventory Fixed assets Total Assets 1,786 2,243 995 5,513 10,537 454 1.432 1.909 4,105 7,900 2,173 ,216 2,374 9,625 17,388 2,987 3,054 3,054 2,236 8,977 17,254 1,097 3.259 3,259 3,071 2,202 2,139 9.7209 ,863 16,278 16,136 1.783 1.289 3,524 4,724 3,137 705 12.090 3,532 3,905 3.495 760 753 Liabilities and Owners Equity Accounts payable 1,833 Short term debt 1,730 Long term debt 2,515 Other 463 Total Liabilities 6.541 Minority interests 416 Common stock 531 Retained earnings 3049 Total Equity 3,996 Total Liabilities and Owners Equity 10.537 Shares Outstanding 2,1196 Market Value of Equity 12,565 Source: Diageo Annual Reports, Datastream. 535 2,930 2.293 4,190 674 10.087 530 1,001 5.770 7,301 17,388 167 3.999 131 476 3294 3,901 7.900 1,8776 11,209 1,139 3.490 5,164 17,254 3,880 27,548 11.685 567 992 3.034 4,593 16,278 3,402 22,538 3,275 3,066 3.816 694 10.851 574 990 3.721 5,285 16,136 3,397 20,144 Notes: Both Grand Metropolitan and Guinness reported year-end results on a calendar year basis. After the merger, Diageo established a fiscal year ending on June 30. The 1998 fiscal year overlaps calendar year 1997 by six months. Because the merger occurred before the Grand Met and Guinness fiscal years were over, and after the Diageo 1997 fiscal year was over, the 1997 results were pro forma. Historical pro forma cash flows were not required to be reported for Grand Met, Guinness and Diageo for 1997, and were not calculated by Diageo after the merger. Liquid financial assets such as cash could be held in short- or long-term investments. A positive number in "Management of liquid resources" represented assets that were moved from short-term investments ("Cash") to longer-term investments, such as bank accounts that aired withdrawal notices longer than one dav Exhibit 1 Grand Metropolitan, Guinness and Diageo Financial Statements, ( Millions). FY 98 FY 99 FY 00 Grand Met Guinness FY 97 PF CY 97 PF CY 97 PF 8,045 4,539 12,985 6,978 3,584 10,982 153 11,870 10,088 363 81 268 89 71 360 112 121 Sales Operating costs Interest payable (net) Associates (net) Other Taxes Net Income Dividends (229) 249 (320) 255 370 (618) 532 674 654 12,029 11,795 10,659 10,278 324 95 478 94 721 440 879942 835 674 (163) 401 976 713 FY99 1,966 (432) (566) 968 58 FYOO 2.043 (405) (285) 1.353 64 (488) 487 See Note Operating profits Cash interest paid (net) Taxes paid Cash From Operations Dividends from investments Net capital sales (expenditures) Net divestitures (acquisitions) Cash From Investments Management of liquid resources Dividends paid Paid in capital from shares issued (repurchased) New debt Cash From Financing Total change in cash (444) FY98 1.866 (258) (603) 1,005 120 (370) 1,368 1,118 (600) (695) (2,662) 2.097 1.860) 263 121 (265) 2,195 (702) (1.336) (716) (559) 144 (219) (710) (80) (544) (1.553) (137) Grand Met Guinness CY 97 PF CY 97 PF FY 97 PF FY 98 FY 99 FY 00 3 Assets Cash and marketable securities Accounts receivable Inventory Fixed assets Total Assets 1,786 2,243 995 5,513 10,537 454 1.432 1.909 4,105 7,900 2,173 ,216 2,374 9,625 17,388 2,987 3,054 3,054 2,236 8,977 17,254 1,097 3.259 3,259 3,071 2,202 2,139 9.7209 ,863 16,278 16,136 1.783 1.289 3,524 4,724 3,137 705 12.090 3,532 3,905 3.495 760 753 Liabilities and Owners Equity Accounts payable 1,833 Short term debt 1,730 Long term debt 2,515 Other 463 Total Liabilities 6.541 Minority interests 416 Common stock 531 Retained earnings 3049 Total Equity 3,996 Total Liabilities and Owners Equity 10.537 Shares Outstanding 2,1196 Market Value of Equity 12,565 Source: Diageo Annual Reports, Datastream. 535 2,930 2.293 4,190 674 10.087 530 1,001 5.770 7,301 17,388 167 3.999 131 476 3294 3,901 7.900 1,8776 11,209 1,139 3.490 5,164 17,254 3,880 27,548 11.685 567 992 3.034 4,593 16,278 3,402 22,538 3,275 3,066 3.816 694 10.851 574 990 3.721 5,285 16,136 3,397 20,144 Notes: Both Grand Metropolitan and Guinness reported year-end results on a calendar year basis. After the merger, Diageo established a fiscal year ending on June 30. The 1998 fiscal year overlaps calendar year 1997 by six months. Because the merger occurred before the Grand Met and Guinness fiscal years were over, and after the Diageo 1997 fiscal year was over, the 1997 results were pro forma. Historical pro forma cash flows were not required to be reported for Grand Met, Guinness and Diageo for 1997, and were not calculated by Diageo after the merger. Liquid financial assets such as cash could be held in short- or long-term investments. A positive number in "Management of liquid resources" represented assets that were moved from short-term investments ("Cash") to longer-term investments, such as bank accounts that aired withdrawal notices longer than one dav