Answered step by step

Verified Expert Solution

Question

1 Approved Answer

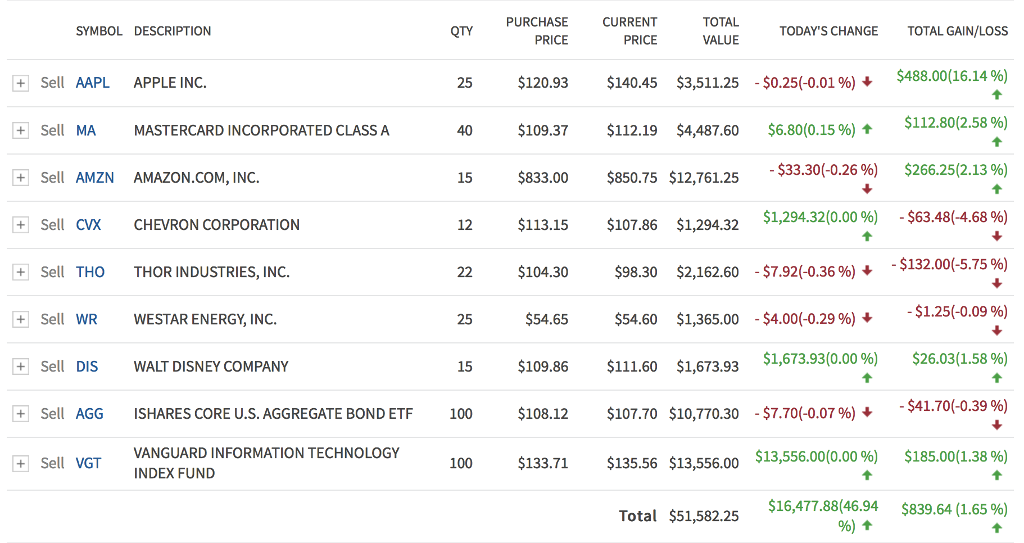

Based on a portfolio comprised entirely of only your investments in the two required ETFs, calculate the weight of each, the return of each, and

Based on a portfolio comprised entirely of only your investments in the two required ETFs, calculate the weight of each, the return of each, and the weighted return for the imagined portfolio. What would your return have been if you had invested 60% in the equity ETF and 40% in the bond ETF? How do these calculated returns compare with the return you actually earned?

Account Value (USD) $100,743.62 Buying Power $49,104.70 Cash $49,104.70 Annual Return 5.92 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started