Answered step by step

Verified Expert Solution

Question

1 Approved Answer

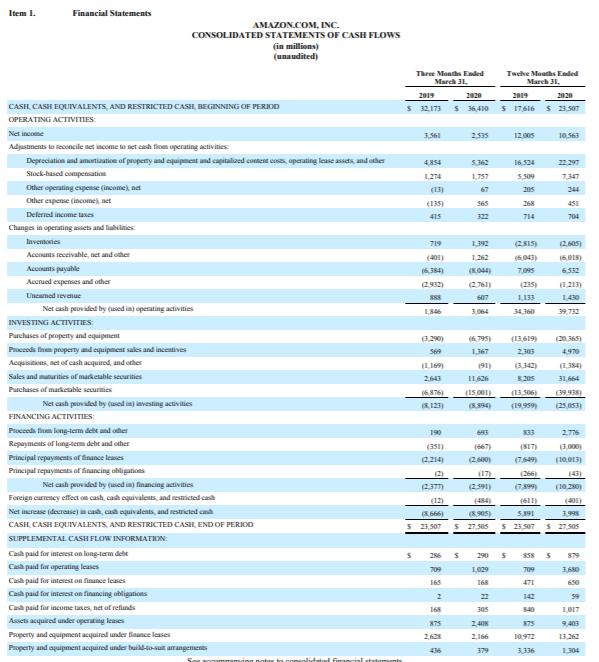

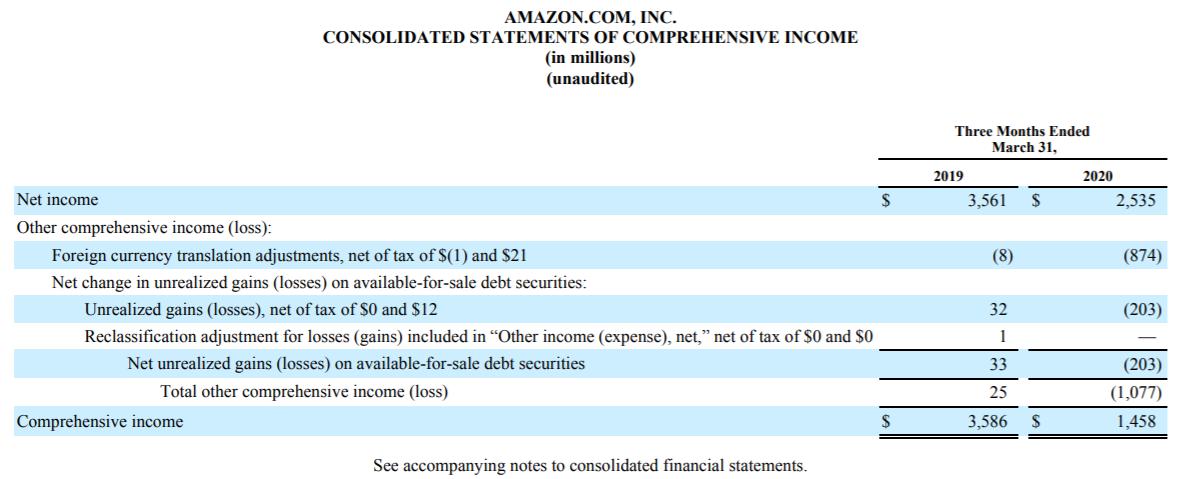

Based on Amazon's consolidated cash flow, consolidated statement of income and consolidated balance sheet for their 10-Q 2020 filing can you determine the company's following:

Based on Amazon's consolidated cash flow, consolidated statement of income and consolidated balance sheet for their 10-Q 2020 filing can you determine the company's following:

1. Long-Term Debt-paying Ability

Debt Ratio

Debt-equity Ratio

Times Interest Earned

2. Profitability

Net Income / Sales (Profit Margin)

Net Income / Assets (ROA)

Net Income / Shareholder Equity (ROE)

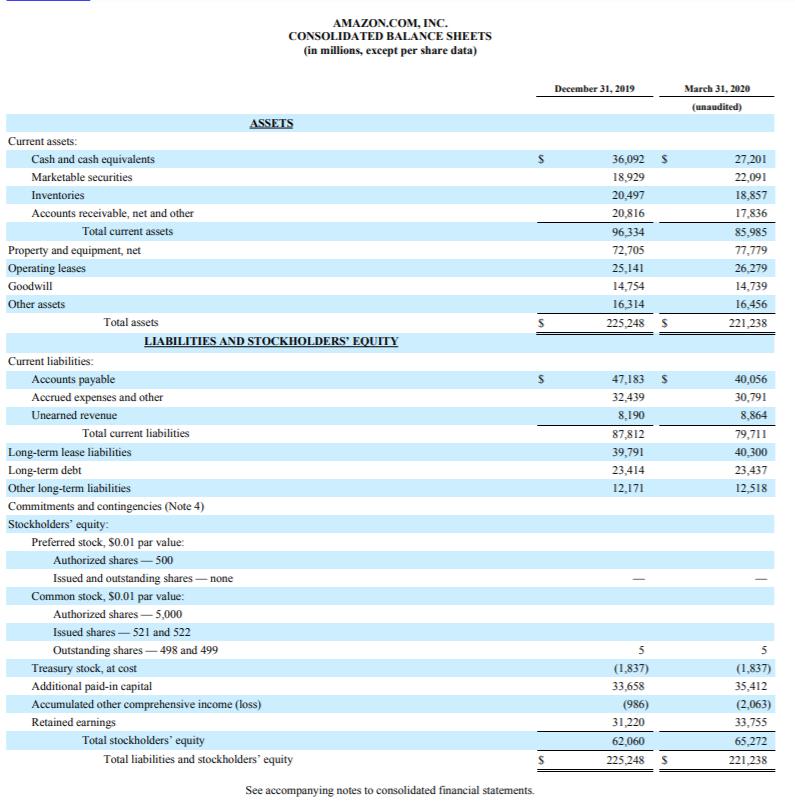

Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Current liabilities: Total assets Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities LIABILITIES AND STOCKHOLDERS' EQUITY Commitments and contingencies (Note 4) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares - 500 Issued and outstanding shares-none Common stock, $0.01 par value: Authorized shares-5,000 Issued shares - 521 and 522 Outstanding shares - 498 and 499 Retained earnings Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) ASSETS Total stockholders' equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. S S $ S December 31, 2019 36,092 18,929 20,497 20,816 96,334 72,705 25,141 14,754 16,314 225,248 47,183 32,439 8,190 87,812 39,791 23,414 12,171 5 (1,837) 33,658 (986) 31,220 62,060 225,248 S $ S $ March 31, 2020 (unaudited) 27,201 22,091 18,857 17,836 85,985 77,779 26,279 14,739 16,456 221,238 40,056 30,791 8,864 79,711 40,300 23,437 12,518 5 (1,837) 35,412 (2,063) 33,755 65,272 221,238

Step by Step Solution

★★★★★

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To determine the companys longterm debtpaying ability and profitabili...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started