Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on historical information, you have developed the following information. Gross Profit Margin 0.40 SG&A / Sales 0.15 Depreciation/Net Fixed Assets 0.10 Interest Rate

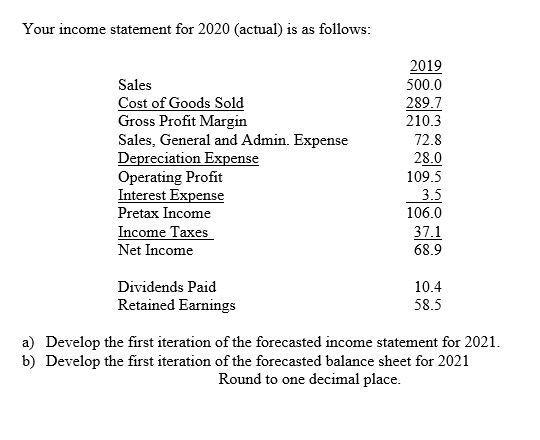

Based on historical information, you have developed the following information. Gross Profit Margin 0.40 SG&A / Sales 0.15 Depreciation/Net Fixed Assets 0.10 Interest Rate on Debt 0.04 Income Tax Rate 0.35 Cash / Sales 0.07 Accounts Receivable / Sales 0.15 Inventory/Sales 0.20 Net Fixed Assets / Sales 0.55 Accounts Payable / Sales 0.10 Bank Debt / Sales 0.18 Dividend Payout Ratio 0.15 Your sales forecast for 2021 is $650. Your balance sheet for 2020 (actual) is as follows: 2020 Cash 37 Accounts Receivable 75 Inventory 110 Net Fixed Assets 280 Total Assets 502 Accounts Payable 53 Bank Debt 87 Equity 362 Total Liab. and Equity 502 Your income statement for 2020 (actual) is as follows: Sales Cost of Goods Sold Gross Profit Margin Sales, General and Admin. Expense Depreciation Expense Operating Profit Interest Expense Pretax Income Income Taxes Net Income Dividends Paid Retained Earnings 2019 500.0 289.7 210.3 72.8 28.0 109.5 3.5 106.0 37.1 68.9 10.4 58.5 a) Develop the first iteration of the forecasted income statement for 2021. b) Develop the first iteration of the forecasted balance sheet for 2021 Round to one decimal place.

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Given the information provided I can calculate the projected financial statements ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started