Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on Jim's expectation of 9 8% sales growth and payout ratio of 81 48% of net income next year. Jim developed the pro

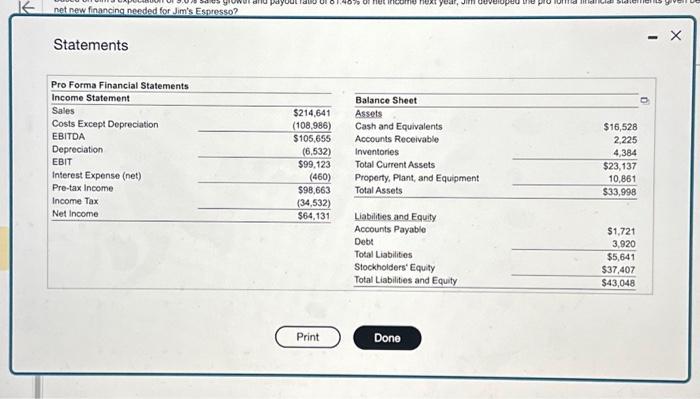

Based on Jim's expectation of 9 8% sales growth and payout ratio of 81 48% of net income next year. Jim developed the pro forma financial statements given below. What will be the amount of net new financing needed for Jim's Espresso? Click the icon to view the pro forma financial statements (Select from the drop-down menu) The total new financing will be $(Round to the nearest dollar) K net new financing needed for Jim's Espresso? Statements Pro Forma Financial Statements Income Statement Sales Costs Except Depreciation EBITDA Depreciation wwer and payout ratio of 1:46% of net income next year, Jim EBIT Interest Expense (net) Pre-tax Income Income Tax Net Income $214,641 (108,986) $105,655 (6,532) $99,123 (460) $98,663 (34,532) $64.131 Print Balance Sheet Assets Cash and Equivalents Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Total Assets Liabilities and Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity Done the pro ora inancial staten $16,528 2,225 4,384 $23,137 10,861 $33,998 $1, 3,920 $5,641 $37,407 $43,048 - X

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Net income is projected to be 98663 The payout ratio is 8148 of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started