Answered step by step

Verified Expert Solution

Question

1 Approved Answer

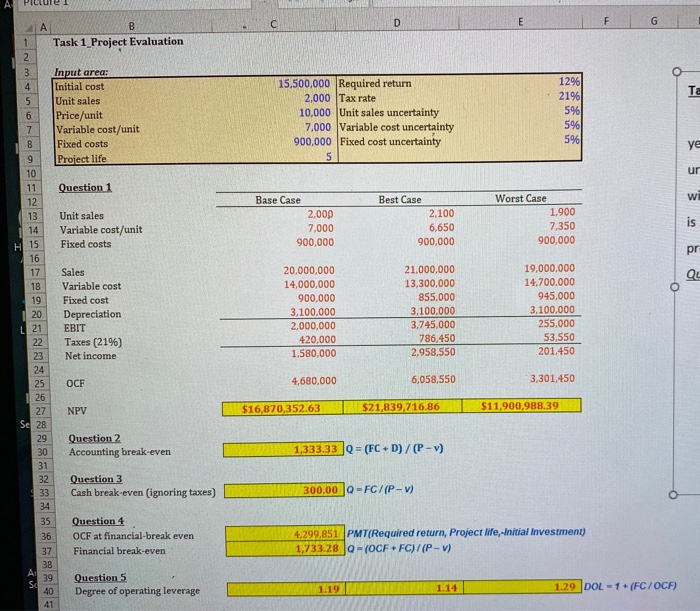

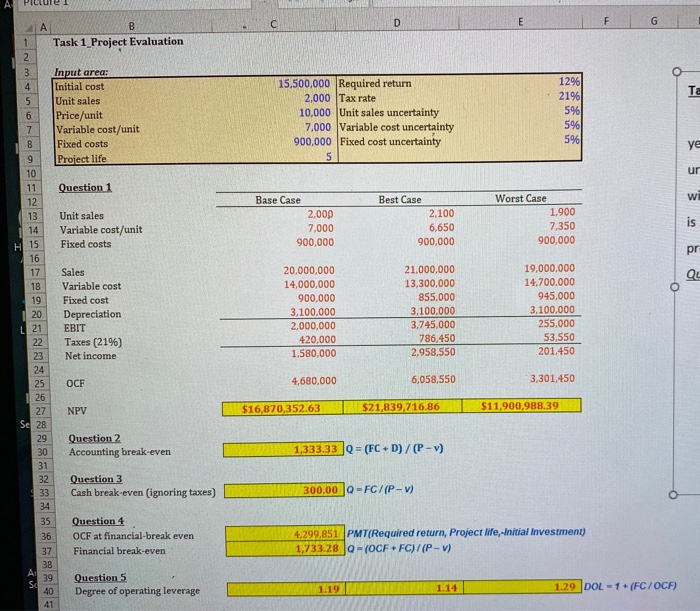

Based on my answers from question #1, can you please check my answers for questions 2-5? The formulas I used to calculate each of them

Based on my answers from question #1, can you please check my answers for questions 2-5? The formulas I used to calculate each of them are listed. Thank you.

1 Task 1 Project Evaluation T 3 4 1296 2196 Input area: Initial cost Unit sales Price/unit Variable cost/unit Fixed costs Project life 15.500,000 Required return 2.000 Tax rate 10,000 Unit sales uncertainty 7,000 Variable cost uncertainty 900,000 Fixed cost uncertainty 10 Question 1 Base Case 2.000 Unit sales Variable cost/unit Fixed costs Best Case 2.100 6,650 900.000 Worst Case 1.900 7,350 900.000 7.000 900.000 P5 & 19 20 Sales Variable cost Fixed cost Depreciation EBIT Taxes (2196) Net income 20,000,000 14,000,000 900,000 3,100,000 2,000,000 420,000 1.580,000 21,000,000 13,300,000 855,000 3.100.000 3.745,000 786.450 2,958.550 19.000.000 14.700.000 945,000 3,100,000 255,000 53.550 201.450 OCF 4,680,000 6,058,550 3,301.450 NPV $16,870,352.63 $21,839,716.86 $11,900,988.39 Question 2 Accounting break-even 1,333.33Q = (FC + D)/(P-v) Question 3 Cash break-even (ignoring taxes) 300.00 Q-FC/(P-V) Question 4 OCF at financial-break even Financial break-even 4.299.851 PMT(Required return, Project life, Initial Investment) 1,733.28 - (OCFFC)/(P-V) A 39 40 Question 5 Degree of operating leverage 1.19 1.14 1.29 DOL - 1 + (FC/OCF)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started