Question: Based on Nike Inc case ( screenshot attached) - Reach out for more details. Discussion Questions What are the most relevant issues that is identified

- Based on Nike Inc case ( screenshot attached) - Reach out for more details.

Discussion Questions

- What are the most relevant issues that is identified in the case?

- Conduct a 5 C's analysis to evaluate the environment in which Nike operates, to include the Context, Competition, Collaborators (Value Chain), Customers and Company. Within the Company Analysis, include Nike's vision/mission statement, description and core competencies of the firm, revenue and profitability, positioning statements for the primary and secondary target markets, marketing mix and balanced scorecard.

- What advances in mobile technology and the development of the Internet of Things (IoT) could potentially change the industry and what innovation and technology strategies Nike should develop to gain a greater competitive advantage as the industry changes? Should Nike go it alone or form partnerships? If Nike forms partnerships, what are the risks that Nike's partners will move into Nike's turf? How to mitigate those risks?

- Develop an Expanded SWOT Analysis for Nike regarding the company and the Surface product, to include the strengths, weaknesses, opportunities and threats as well as the strategies to maximize the strengths and opportunities and mitigate the weaknesses and threats.

- What are the recommendations to best address the issues raised in the case (attached), the risks associated with each recommendation and propose to mitigate the risks?

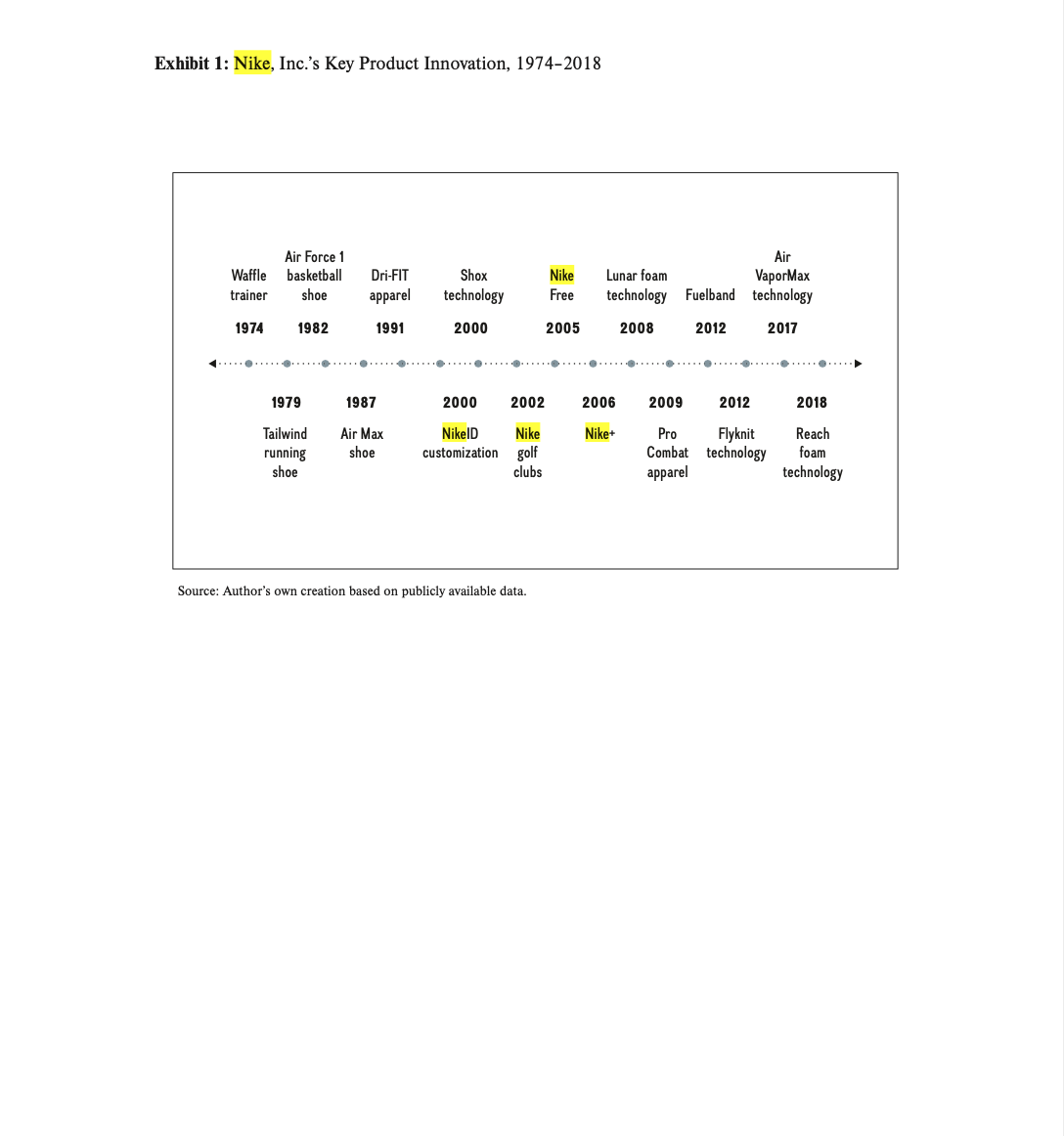

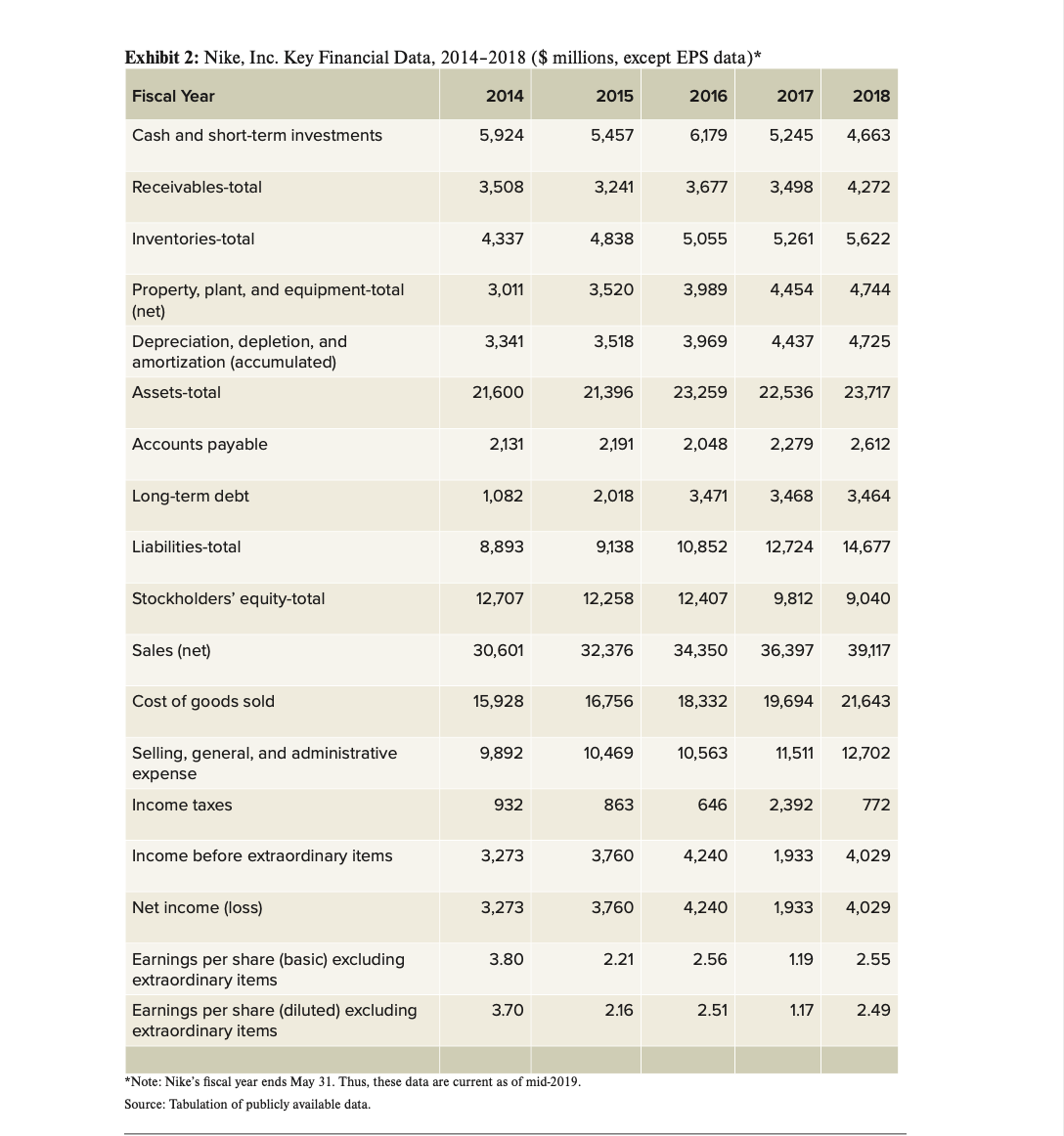

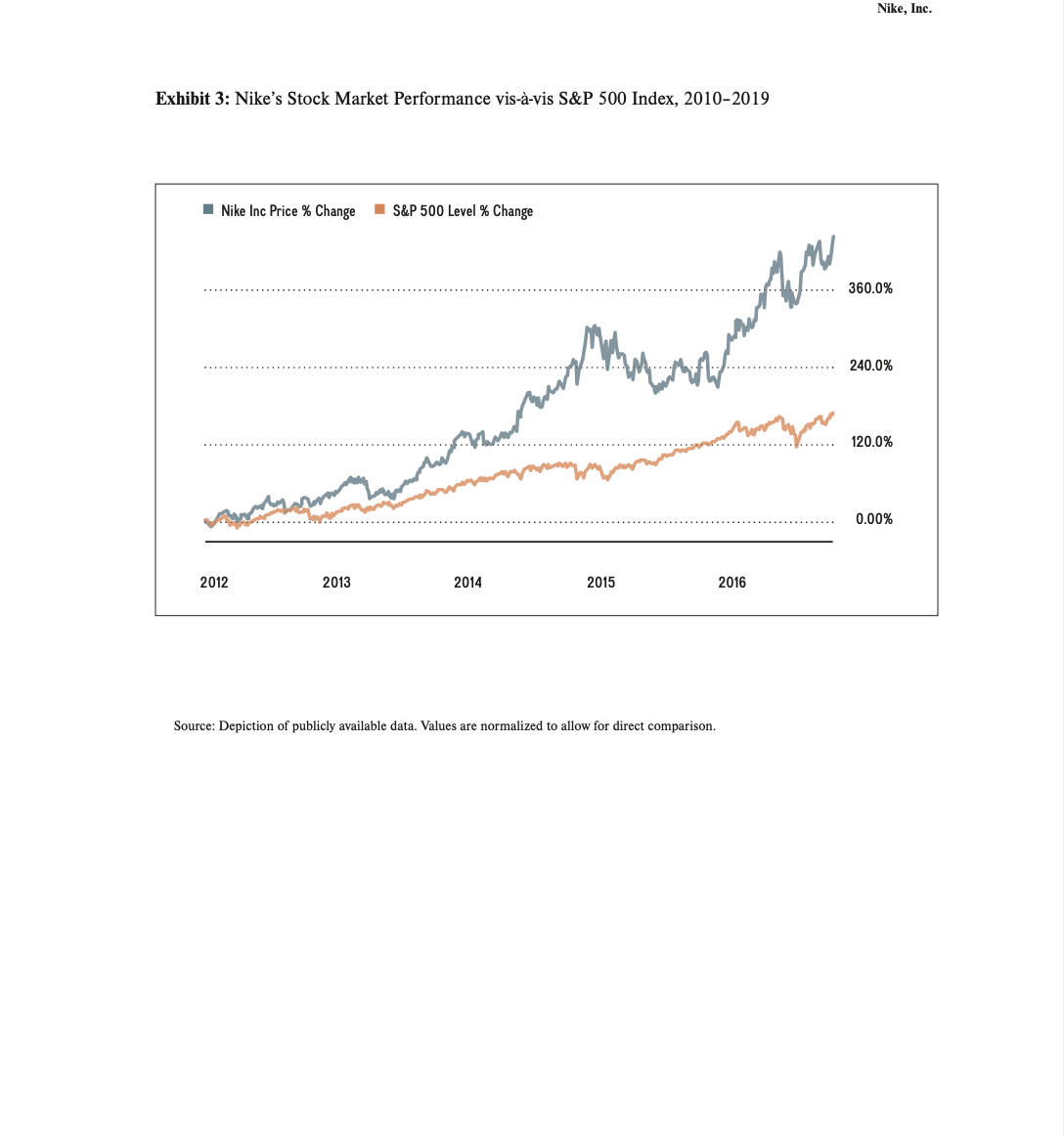

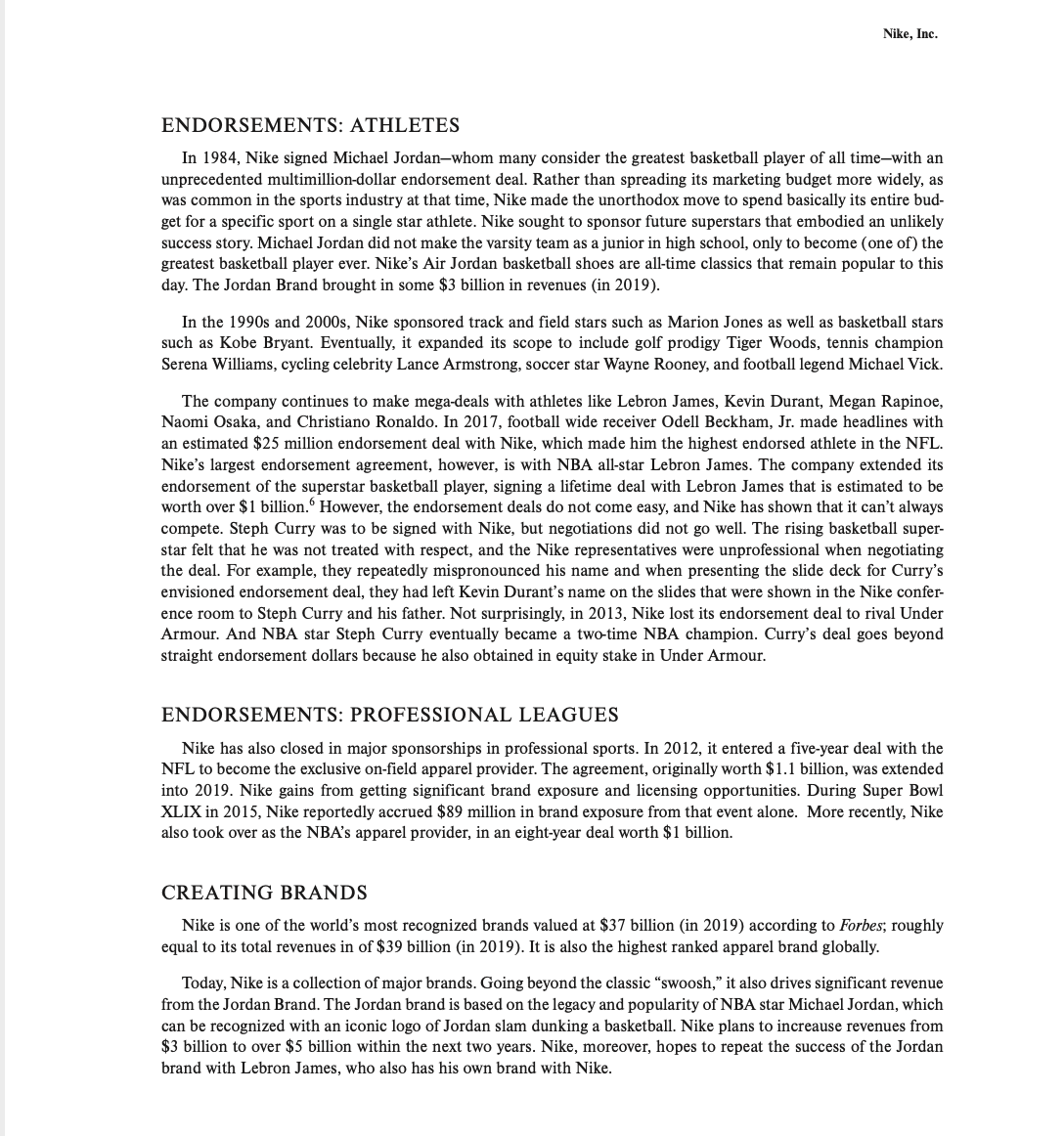

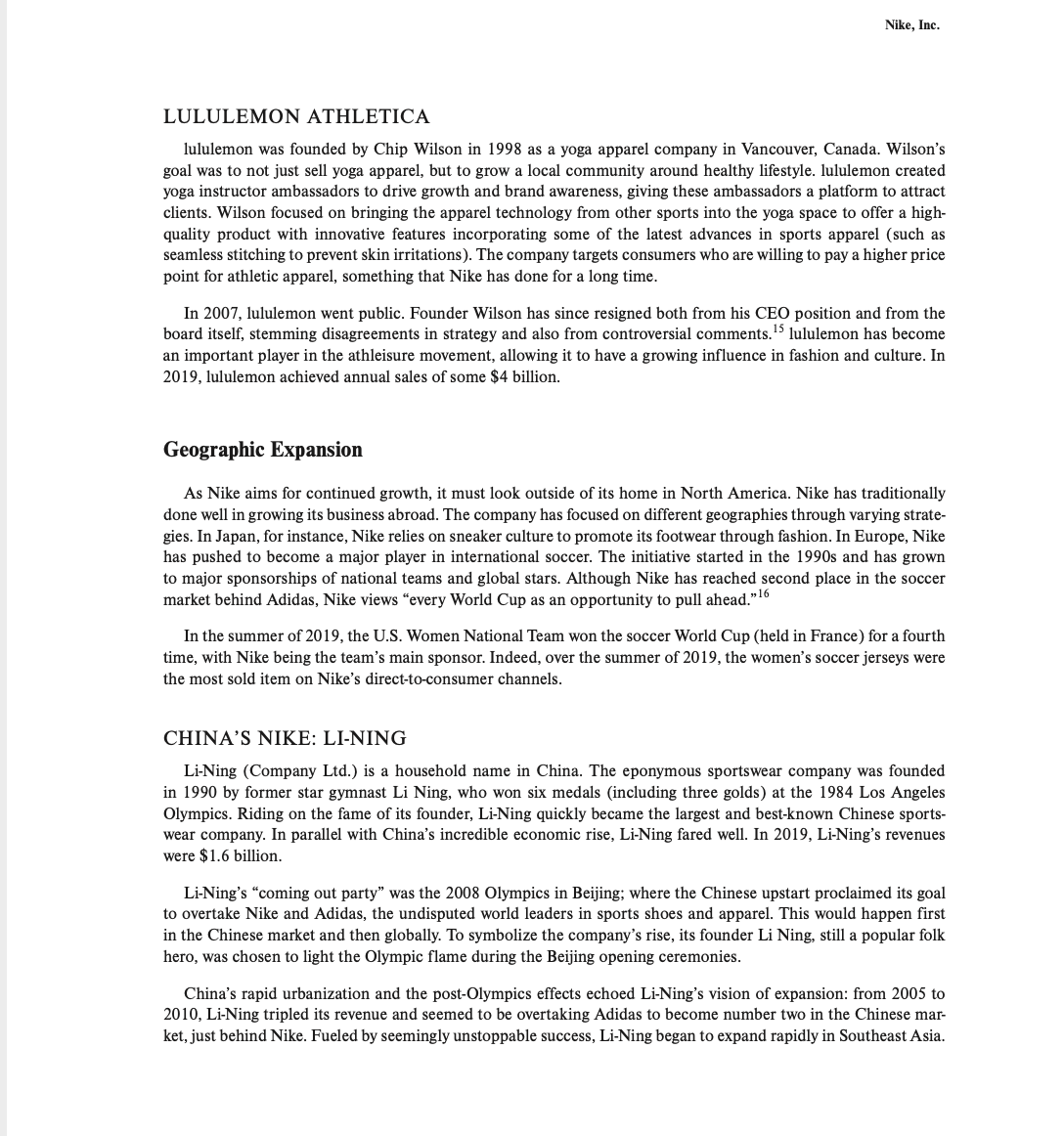

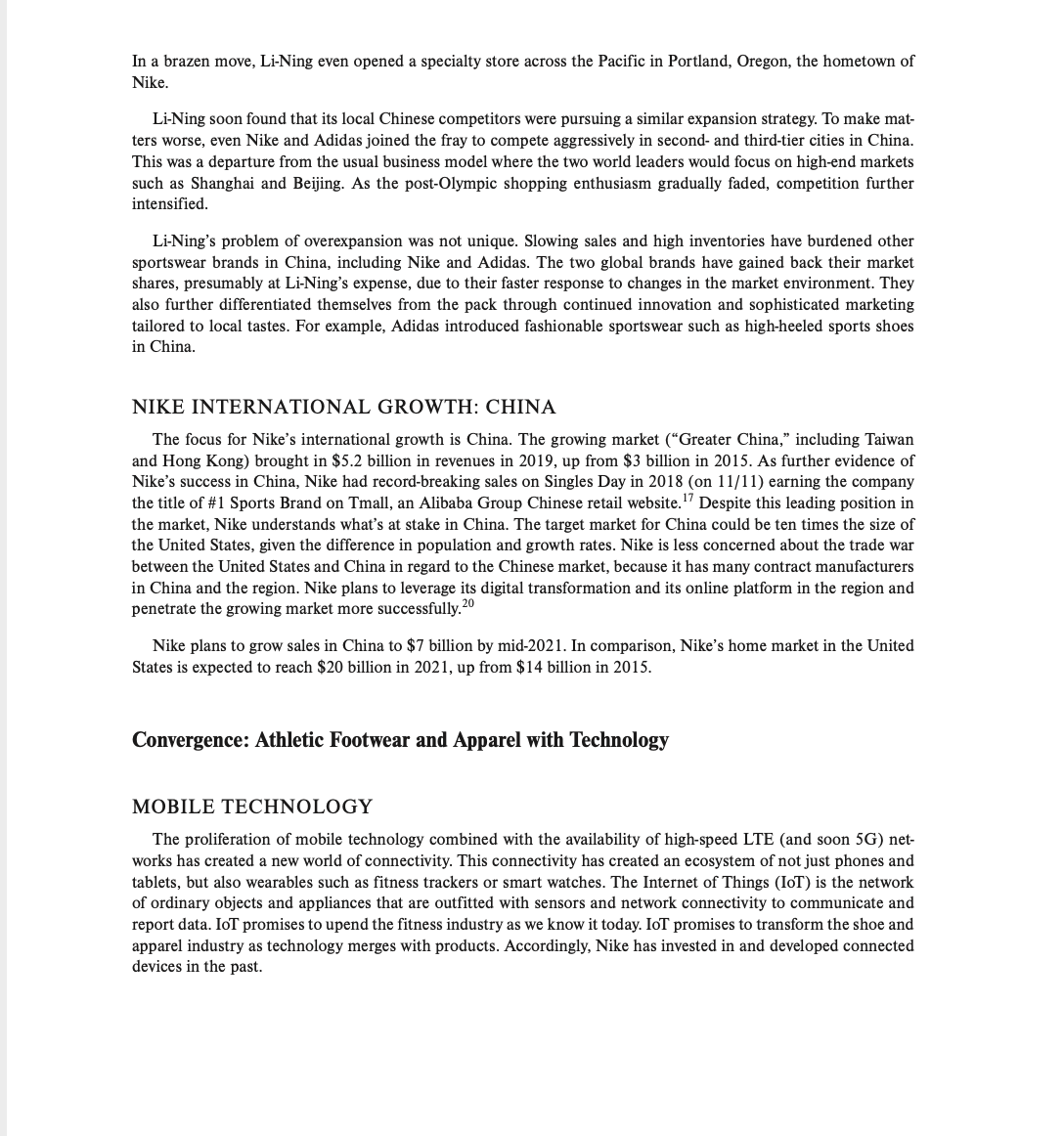

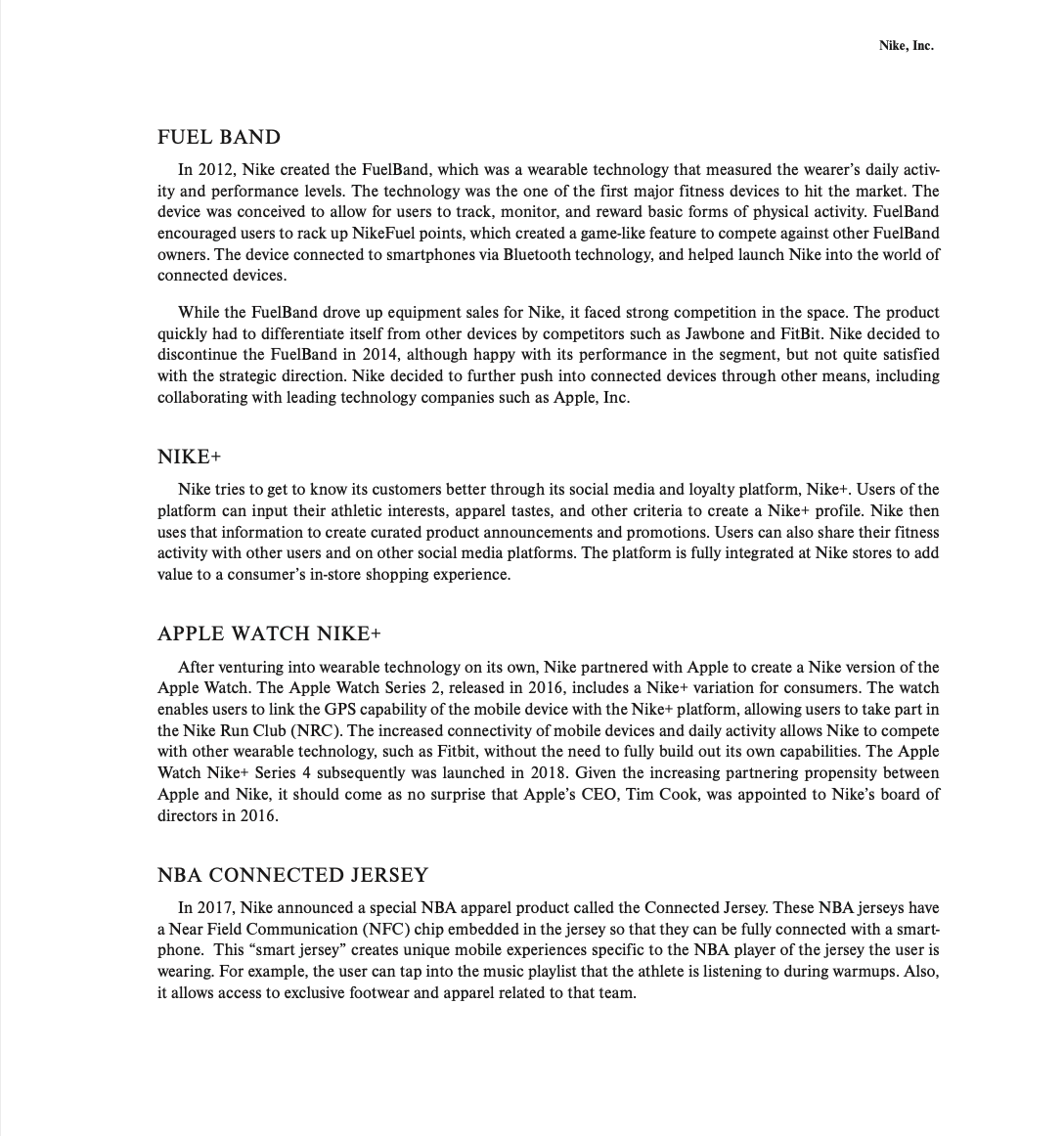

Nike, Inc. "Like most companies, we had role models. Sony, for instance. Sony was the Apple of its day. Profitable, innovative, efficient-and it treated its workers well. . . . I wanted to be like Sony . . . [but] still aimed and hoped for something bigger . . . I would search my mind and heart and the only thing I could come up with was this word 'winning.' It wasn't much, but it was far, far better than the alternative. Whatever happened, I just didn't want to lose. Losing was death." - Phil Knight, 1976 Wednesday, January 1, 2020, 5:28 am. On a cold and rainy winter morning in Beaverton, Oregon, John Donahoe moves along on his first pre-work run as Nike's new CEO. He was pacing through the almost empty Nike campus, which features state of the art running tracks, walking trails, and practice fields for its employees and athlete visi- tors. He can see the expansion of the Nike campus coming before him, with two new buildings named after tennis superstar Serena Williams and famed Duke basketball coach Mike Krzyzewski. The presence of cranes and machin- ery remind Donahue of how important growth is to Nike, and how it needs to execute on its vision. In 2015, former CEO Mark Parker laid out an ambitious plan to investors: Nike was going to grow to from $30 billion in annual revenues to $50 billion by mid-2021. By end-2019, Nike's revenues stood at $40 billion. The $50 billion goal would require Nike to grow by 25 percent-certainly, a stretch goal And, the new CEO is worrying about both internal and external challenges. Donahoe was appointed CEO at a time when the Oregon sports and apparel company faces a number of controversies including when Nike-sponsored athletes were caught up in scandals; the ban of Alberto Salazar, Nike's top running coach amid doping allegations; as well as continued concerns about Nike's workplace culture after an internal employee survey leaked describing the company as run by a boys-club that is hostile towards women. CEO Donahoe wonders: How can he deal with Nike's seemingly neverending public relations crises? How could Nike achieve the growth he had promised? Will Nike's strategy and business model have to fundamentally change? How can Nike take advantage of the digital transformation of devices as well as advances in artificial intelligence (AI)? How should Nike deal with intensify- ing competition? Should Nike build, borrow, or buy a growth strategy for the company? As he kept jogging, CEO Parker looked at his Apple Watch Nike+, which indicated that he needed to pick up the pace . . .Nike's Internal Challenges REPUTATION, BRAND IMAGE, AND FALLEN HEROES Today, Nike is one of the world's most recognized brands. Although Nike's marketing strategy of creating heroes has contributed to the company's sustained success, it has also raised some scandals, putting the brand at risk. Over the years, some of Nike's \"heroes\" were unmasked as cheaters, frauds, and criminals; others have been committed for serious felonies. But as long-time CEO and Chairman Phil Knight declared long ago, scandals are \"part of the game.\"3 With that statement, it appears that Nike is tolerant of such risksat least in some cases. In others, it simply is not. Moreover, Nike may view any publicity as free PR, helping it increase its \"cool\" factor, and letting people know that Nike stands for something meaningful. When NBA star Kobe Bryant was accused of rape, Nike continued to sponsor him (Bryant was later cleared of all charges). When Tiger Woods found himself engulfed in a sex scandal in 2009, Nike also continued to sponsor hima decision for which Nike felt vindicated after his Masters victory in 2019 (his first major championship since 2008). But, when NFL quarterback Michael Vick was charged with felony conviction of running a dog-ghting ring and engaging in animal cruelty in 2007, causing a public outcry, Nike ended his endorsement contract. However, in 2011, after serving a prison sentence and restarting his career at the Philadelphia Eagles, Nike signed a new endorsement deal with Vick. In 2012, Nike terminated its long-term relationship with disgraced cyclist Lance Armstrong. Just before Armstrong's public admission to doping during an interview with Oprah Winfrey, Knight was asked whether Nike would ever sponsor Armstrong again, to which Knight replied, \"Never say never.\"4 In 2013, Nike removed its ads with Oscar Pistorius and the unfortunate tagline, \"I am the bullet in the chamber,\" after the South African track and field athlete (\"the plate runner\") was charged with homicide, and later convicted. In 2014, Nike got entangled in the FIFA (the world governing body of soccer) bribery scandal that began 20 years earlier. After the United States hosted the 1994 World Cup, Nike decided it wanted to gain a stronger pres- ence in soccer. So, in 1996, it signed a long-term sponsorship agreement worth hundreds of millions of dollars the Brazilian national team. This was a huge win for Nike because soccer has been the basis of Adidas' success, much like running and basketball have been for Nike. Moreover, at the time, Brazil had already won the tournament ve times (more than any other nation) and was the only team to have played in every tournament thus far, which is only held every four years. Nike is alleged to have paid some $30 million to a middleman, who used that money for bribing soccer ofcials and politicians in Brazil. This middlemanJose Hawillahas admitted to a number of crimes including fraud, money laundering, and extortion related to the FIFA soccer investigation by U.S. prosecutors. COLIN KAEPERNICK CONTROVERSY In 2013, Nike ran an ad featuring Colin Kaepernick with the tag line \"Believe in something, even if it means sacricing everything. Just do it."[9 Some considered the ad inspirational and others controversial. Why? In 2016, NFL quarterback Colin Kaepernick (a free agent then playing for the San Francisco 49ers) \"took the knee\" during the national anthem as an act of protest against police brutality and racism in the United States. The anthem, which is always played before the start of any live professional sporting event, was televised and thus highly visible to millions of people. The action was supported by many (even inspiring other athletes to take the knee during the playing of the national anthem); it also catalyzed the Black Lives Matter movement. Yet, it enraged others, inciting accusations that Kaepernick was unpatriotic. Many demanded that he be blacklisted by his current and future NHL teams. After the 2016 season, Kaepernick was not signed by any NFL team, despite having been the starting quarter- back for the 49ers and having favorable performance statistics relative to other players that have since been signed. In 2017, Kaepernick filed a grievance, alleging that all 32 NFL teams colluded in not signing him, thus preventing him from working because of his protest action. In 2019, the NFL settled the matter by paying Kaepernick $10 mil- lion, even though Kaepernick's market value as an NFL quarterback is estimated to be about $15 million a season; by the time of the settlement, he had not played for two seasons. The marketing opportunity surrounding Kaepernick, was tailor-made for Nike, which has been trying to appeal to younger consumers with figures and campaigns that promote doing or standing for something meaningful. Adidas, which has recently become more popular with the under-18 crowd, now poses a significant threat to Nike. Thus, winning over this next generation of customers has become even more critical for the firm. In the wake of the Kaepernick ad, Nike and Kaepernick gained tremendous visibility. Kaepernick became the most mentioned athlete on Twitter, way ahead of sport greats such as Lionel Messi, Cristiano Ronaldo, Serena Williams, and Lebron James. Likewise, Nike also became the most mentioned company on Twitter, four times more than Apple, the next most-mentioned company. At the same time, the hashtag #NikeBoycott started trending. Nike and Colin Kaepernick took the spotlight again in the summer of 2019."Nike had planned to release a limited edition of a U.S.A.-themed sneaker (a version of the Air Max 1), featuring an early American flag that was flown during the Revolutionary War, with 13 white stars in a circle symbolizing the Thirteen American Colonies, commonly known the Betsy Ross flag after its designer. Nike did not consult Colin Kaepernick about the design of the shoe commemorating the July 4th Independence Day. Kaepernick saw photos of the shoe on Twitter shortly after its release. The former football quarterback turned social activist and celebrity endorser for Nike, vehemently objected to the sneaker design as he was concerned about associations of the Betsy Ross flag with an era of slavery and its adoption by some extremist groups. Following Colin Kaepernick's intervention, Nike decided to pull the shoe from all of its U.S. retailers. THE BOYS-CLUB In recent years Nike has been plagued by high-profile exits of female senior executives. Many speculated that the culture of Nike created a "boys-club," where there was limited opportunity for senior executives that did not play into the culture (not unlike that of Under Armour, discussed above). Women at the company also complained of a lack of promotion opportunities, gender pay differences, and inappropriate workplace behavior. In response to the exodus of female executives, a group of women created an anonymous survey shared with other women in the company. The survey eventually got the attention of former CEO Mark Parker, who knew he had to intervene. After investigating the allegations put forth against Nike, the then-CEO Mark Parker released a memo in 2018 to affirm that there were complaints of inappropriate behavior, and that Trevor Edwards, Nike president, had resigned effective immediately. Even though it was not explicitly stated, many believe he was released due to inappropriate conduct. Edwards had been long regarded as the future successor of Parker, after building a long and successful career at the company. This is not the first time Nike has had cultural issues affecting the company."In 2007, Nike hired David Ayre as the head of its human resources department, reporting directly to Parker. Ayre had many complaints filed against him, and eventually had to seek counseling to resolve issues to improve his behavior. Eventually, with more com- plaints, Nike had to relieve Ayre of his position and promoted company veteran Monique Matheson to the position. As of end-2019, Nike is trying to get ahead of the situation and make the necessary changes. The former CEO held a town hall with employees with panels to openly discuss the cultural issues and values of Nike. With more than doubling the number of its employees globally from 34,000 (in 2009) to 73,000 (in 2019), the challenge to change Nike's culture to value diversity and inclusion is ever present. Getting its own house in order is a pressingissue for Nike because the company now finds itself more in the public eye as it as it engages in more socially and politically conscious advertising. As such, Nike plans to further increase diversity, improve leadership training, and modify existing HR processes as a means to address culture concerns.27 DOPING ALLEGATIONS John Donahoe was appointed as Nike's new CEO after a detailed report by the U.S. Anti-Doping Agency revealed (in the fall of 2019) that then-CEO Mark Parker was briefed on numerous occasions by Nikesponsored star running coach Alberto Salazar on his experiments to use performance-enhancing drugs for track and eld athletes. The U.S. Anti-Doping Agency handed down a four-year ban for the star running coach for orchestrating and facilitating doping of athletes under his tutelage. In the wake of the doping verdict, Nike shut down its Oregon Running Project, in which it, for almost two decades, trained and sponsored a set of elite American runners to develop medal-winning athletes. Alberto Salazar led the Nike Oregon Running Project. The Road Ahead Alter John Donahoe completes his run, he's reminded that his day is just getting started. And his promise to investors to grow the company to $50 billion in annual sales comes back to his mind. One opportunity is to double revenues in the women's segment from $6 billion (in 2015) to $12 billion by 2021. But the challenges that lay ahead of Nike are ambiguous and monumental. Donahoe worries that a technology company that is ahead in [OT and artificial intelligence might have it much easier to move into the fashion indus- try than Nike moving into the technology age. He was worries Nike would end up like the Swiss watch makers; a fashion accessory from a bygone area. More short-term problems are also pressing. How should Nike grow its business to reach the $50 billion annual revenue goal? Where and how should it allocate its resources? Should it build new competencies in Io'I? Or, should it partner with or even acquire a tech company? Where should Nike play in the value chain? How should Nike deal with competitors that appear to get stronger and stronger? And, would he get a handle on Nike's neverending public relations crises? What role should Nike play in the public and political discussion concerning social issues, if any? Relatedly, how should Nike implement a culture suitable for a diverse and inclusive work environment in the 21st century? Thinking about all these issues in Nike's on-campus locker room, CEO Donahoe took a chilled bottle of Bodyarmour from the cooler and enjoyed a sip before getting ready to shower. . . Exhibit 1: Nike, Inc.'s Key Product Innovation, 1974-2018 Air Air Force 1 VaporMax Waffle basketball Dri-FIT Shox Nike Lunar foam trainer shoe apparel technology Free technology Fuelband technology 2005 2012 1974 1982 1991 2000 2008 2017 2012 2018 1979 1987 2000 2002 2006 2009 Nike+ Pro Flyknit Reach Tailwind Air Max Nike ID Nike foam golf Combat technology running shoe customization apparel technology shoe club Source: Author's own creation based on publicly available data.Exhibit 2: Nike, Inc. Key Financial Data, 2014-2018 ($ millions, except EPS data)* Fiscal Year 2014 2015 2016 2017 2018 Cash and short-term investments 5,924 5,457 6,179 5,245 4,663 Receivables-total 3,508 3,241 3,677 3,498 4,272 Inventories-total 4,337 4.838 5,055 5,261 5,622 Property, plant, and equipment-total 3,011 3,520 3,989 4,454 4,744 net) Depreciation, depletion, and 3,341 3,518 3,969 4,437 4,725 amortization (accumulated) Assets-total 21,600 21,396 23,259 22,536 23,717 Accounts payable 2,131 2,191 2,048 2,279 2,612 Long-term debt 1,082 2,018 3,471 3,468 3,464 Liabilities-total 8,893 9,138 10,852 12,724 14,677 Stockholders' equity-total 12,707 12,258 12,407 9,812 9,040 Sales (net) 30,601 32,376 34,350 36,397 39,117 Cost of goods sold 15,928 16,756 18,332 19,694 21,643 Selling, general, and administrative 9,892 10,469 10,563 11,511 12,702 expense Income taxes 932 863 646 2,392 772 Income before extraordinary items 3,273 3,760 4,240 1,933 4,029 Net income (loss) 3,273 3,760 4,240 1,933 4,029 Earnings per share (basic) excluding 3.80 2.21 2.56 1.19 2.55 extraordinary items Earnings per share (diluted) excluding 3.70 2.16 2.51 1.17 2.49 extraordinary items *Note: Nike's fiscal year ends May 31. Thus, these data are current as of mid-2019. Source: Tabulation of publicly available dataNike, Inc. Exhibit 3: Nike's Stock Market Performance vis-a-vis S&P 500 Index, 2010-2019 Nike Inc Price % Change S&P 500 Level % Change . . . . 360.0% J....MUSIC. 240.0% ........ 120.0% 0.00% 2012 2013 2014 2015 2016 Source: Depiction of publicly available data. Values are normalized to allow for direct comparison.Brief History of Nike MISSION, VISION, AND VALUES Nike's mission is to bring inspiration and innovation to every athlete in the world (and if you have a body, you are an athlete). Nike's vision is to remain the most authentic, connected, and distinctive brand globally; and its core values are performance, authenticity, innovation, and sustainability. INNOVATION The Beaverton, Oregon, company has come a long way from its humble beginnings. It was founded by University of Oregon track and eld coach Bill Bowerman and middle-distance runner Phil Knight in 1964 and was first called Blue Ribbon Sports. In 1971, the company changed its name to Nike (after the goddess of victory in Greek mythology) and called upon a Portland State University graphic design student to design its now iconic \"swoosh.\" Knight, who was teaching at the university at the time, paid the student $35 for it. By the summer of that year, Nike's swoosh logo was registered at the US. Patent and Trademark office. Coach Bowerman was a true innovator because he constantly sought ways to give his athletes a competitive edge. He experimented with many factors affecting running performance, from different track surfaces to rehydra- tion drinks. Bowerman's biggest focus, however, was on providing a better running shoe for his athletes. While sitting at the breakfast table one Sunday morning and absentmindedly looking at his waffle iron, Bowerman had an epiphany. He poured hot, liquid urethane into the waffle ironruining it inthe process but coming up with the now famous waffle-type sole that not only provided better traction but was also lighter than traditional running shoes. DISRUPTION After completing his undergraduate degree at the University of Oregon and serving in the US. Army, Phil Knight entered the MBA program at Stanford. For one entrepreneurship class that required him to propose a busi- ness idea, he wrote a term paper on how to disrupt the leading athletic shoemaker, Adidas. The research question he came up with was, \"Can Japanese sports shoes do to German sports shoes what Japanese cameras have done to German cameras?\" At that time, Adidas athletic shoes were the gold standard. They were also expensive and hard to nd in the United States. After several failed attempts to interest Japanese sneaker makers, Knight struck a distribution agreement with Tiger Shoes (a forerunner of today's ASICS footwear company, which is known for high-quality athletic shoes that fall in the higher price range). After his rst shipment arrived in the United States, Phil Knight sent some of the running shoes to his former coach Bill Bowerman, hoping to make a sale. To his surprise, Bowerman replied that he was interested in becoming a business partner and contributing his innovative ideas on how to improve running shoes, including the waffle design. With an investment of $500 each and a handshake, the venture commenced. Based on a highly successful string of innovations including Nike Air, by 1979 the company had captured more than a 50 percent market share for running shoes in the United States. A year later, Nike went public. Exhibit 1 depicts Nike's key product innovations over time. Nike diversied into apparel and equipment, representing over a quarter (or $10 billion) of its business (in 2019). These products include, training apparel, outerwear, jerseys, sporting equipment, and various other items. Not all growth in these segments has proven to be successful. In 2016, Nike discontinued its golf product lines, including clubs, balls, and bags.5 Nike, Inc. ENDORSEMENTS: ATHLETES In 1984, Nike signed Michael Jordan-whom many consider the greatest basketball player of all time-with an unprecedented multimillion-dollar endorsement deal. Rather than spreading its marketing budget more widely, as was common in the sports industry at that time, Nike made the unorthodox move to spend basically its entire bud- get for a specific sport on a single star athlete. Nike sought to sponsor future superstars that embodied an unlikely success story. Michael Jordan did not make the varsity team as a junior in high school, only to become (one of) the greatest basketball player ever. Nike's Air Jordan basketball shoes are all-time classics that remain popular to this day. The Jordan Brand brought in some $3 billion in revenues (in 2019). In the 1990s and 2000s, Nike sponsored track and field stars such as Marion Jones as well as basketball stars such as Kobe Bryant. Eventually, it expanded its scope to include golf prodigy Tiger Woods, tennis champion Serena Williams, cycling celebrity Lance Armstrong, soccer star Wayne Rooney, and football legend Michael Vick. The company continues to make mega-deals with athletes like Lebron James, Kevin Durant, Megan Rapinoe, Naomi Osaka, and Christiano Ronaldo. In 2017, football wide receiver Odell Beckham, Jr. made headlines with an estimated $25 million endorsement deal with Nike, which made him the highest endorsed athlete in the NFL. Nike's largest endorsement agreement, however, is with NBA all-star Lebron James. The company extended its endorsement of the superstar basketball player, signing a lifetime deal with Lebron James that is estimated to be worth over $1 billion. However, the endorsement deals do not come easy, and Nike has shown that it can't always compete. Steph Curry was to be signed with Nike, but negotiations did not go well. The rising basketball super- star felt that he was not treated with respect, and the Nike representatives were unprofessional when negotiating the deal. For example, they repeatedly mispronounced his name and when presenting the slide deck for Curry's envisioned endorsement deal, they had left Kevin Durant's name on the slides that were shown in the Nike confer- ence room to Steph Curry and his father. Not surprisingly, in 2013, Nike lost its endorsement deal to rival Under Armour. And NBA star Steph Curry eventually became a two-time NBA champion. Curry's deal goes beyond straight endorsement dollars because he also obtained in equity stake in Under Armour. ENDORSEMENTS: PROFESSIONAL LEAGUES Nike has also closed in major sponsorships in professional sports. In 2012, it entered a five-year deal with the NFL to become the exclusive on-field apparel provider. The agreement, originally worth $1.1 billion, was extended into 2019. Nike gains from getting significant brand exposure and licensing opportunities. During Super Bowl XLIX in 2015, Nike reportedly accrued $89 million in brand exposure from that event alone. More recently, Nike also took over as the NBA's apparel provider, in an eight-year deal worth $1 billion. CREATING BRANDS Nike is one of the world's most recognized brands valued at $37 billion (in 2019) according to Forbes; roughly equal to its total revenues in of $39 billion (in 2019). It is also the highest ranked apparel brand globally. Today, Nike is a collection of major brands. Going beyond the classic "swoosh," it also drives significant revenue from the Jordan Brand. The Jordan brand is based on the legacy and popularity of NBA star Michael Jordan, which can be recognized with an iconic logo of Jordan slam dunking a basketball. Nike plans to increase revenues from $3 billion to over $5 billion within the next two years. Nike, moreover, hopes to repeat the success of the Jordan brand with Lebron James, who also has his own brand with Nike.Nike, Inc. Nike also has wholly owned subsidiaries Hurley and Converse, which diversifies its pure athletic apparel to swim and fashion respectively. In regard to the Converse brand, Nike plans to double sales from $2 billion (in 2015) to $4 billion (in 2021). Nike also sold off some brands. In 2012, it divested its Cole Haan brand by selling it for $520 million to a private equity firm. Taken together, Nike has been tremendously successful, holding close to a 60-percent market share in running shoes and nearly a 90-percent market share in basketball shoes and apparel. In the spring of 2019 (which marks the end of its scal year), Nike recorded $39 billion in revenues. Sportswear is Nike's biggest segment in terms of revenues {$10 billion), followed by running ($5.2 billion), training ($3.1 billion), the Jordan brand ($3 billion), and soccer ($2.1 billion), among several other sources of revenues. Exhibit 2 shows Nike, Inc.'s key f'mancial data between 2014 and 2018. Nike outperformed the S&P 500 index, a common benchmark to proxy the broader stock market, by a wide margin over the past decade, wherein its annual revenues doubled (Exhibit 3). The Industry Nike competes in the athletic footwear, apparel, and equipment markets. In the United States alone, the athletic footwear market alone was some $17 billion in 2019, and is expected to grow to $23 billion by 2023, or almost 10 percent per year. In athletic footwear, Nike is leading with $22 billion in sales globally (2018), followed by Adidas ($15 billion), Asics ($3 billion), Puma ($2.5 billion), and Under Armour ($1.1 billion). In terms of athletic apparel, the global market is expected to grow from $181 billion in 2019 to $220 billion by 2024, or some 4 percent per year. These two markets are driven by many fragmented brands with a few larger players such as Nike with $39 billion in total revenues and Adidas with total revenues of $26 billion (in 201111).1r NIKE'S VALUE CHAIN Nike focuses its business around the design, marketing, licensing, and selling of athletic footwear, apparel, equip- ment, accessories and services worldwide. In terms of design, the company prides itself on being an innovator in its footwear, apparel, and equipment, which stems from the founder imprinting by Bowerman and Knight. Nike holds a number of patents and trademarks for key technologies that advance the materials and performance of its products. To enhance innovation, a cross-functional team of \"athletes, coaches, trainers, equipment managers, orthopedists, podiatrists and other experts consult with Nike and review designs, materials, concepts for product and manufacturing.\" This has led to technologies such as Air, Flyknit, Dri-Fit, and React that define the com- pany's products today (Exhibit 1). Approximately 130 footwear factories and 365 apparel factories independently manufacture Nike's products around the globe. The company was infamous in the 1990s for the allegations that it was using manufacturers that were sweatshops, and of using child labor. Since then, Nike has cleaned up its corporate social responsibility image and uses a number of renewable materials for its footwear products and ensures that all of its suppliers adhere to standards of ethical manufacturing. The retail industry has gone through massive changes with the proliferation of onljne and mobile commerce. The traditional retail model for Nike consisted of a mix of footwear stores, sporting goods stores, athletic specialty stores, department stores, skate, tennis and golf shops and other retail outlets. In 2017, Nike announced a major shift in its retail strategy. Nike now focuses on major partnerships with approximately 40 retailers, and slowly eliminates the thousands of retail accounts that it currently manages. Nike's brand president (at the time), Trevor Edwards, stated that \"undifferentiated, mediocre retail won't survive."9 The shift in retailing is due to the \"Amazon effect.\" For many years, Nike did not sell its products directly on Amazon. As Nike moves to a more digital form of commerce, Amazon has emerged as a legitimate partner in its new strategy. The company is also leveraging ecommerce through social media such as Instagram and Twitter. Nike is betting on its direct-to-consumer model as well as direct-to-consumer endorsements by its celebrities on social media to be the fuel for its next leg of growth. To take advantage of the shifting retail landscape, Nike plans to grow its direct sales via \"Nike Direct\" from $? billion in 2015 to $16 billion and other ecommerce from $1 billion in 2015 to $7 billion by mid-2021. \"Nike Direct\" collectively includes the company's digital marketplace (via its mobile app and nike.com) as well as its company owned retail stores. Competition ADIDAS Adidas was founded in 1924 in Gerwmany. It began its life in the laundry room of a small apartment. Two brothers focused on one product: athletic shoes. The big breakthrough for the company came in 1954 when the underdog West Germany won the soccer Woild Cup in Adidas cleats. What running shoes are for Nike, soccer cleats are for Adidas. As the world markets globalized and became more competitive in the decades after World War 11, Adidas not only vertically disintegrated to focus mainly on the design of athletic shoes but also diversified into sports apparel. Adidas' annual revenues were $26 billion (in 2019), with a diverse of activities across the globe in sports shoes (40 percent of revenues), sports apparel {50 percent of revenues), and sports equipment (10 percent of revenues). The longtime rival of Nike has continued to grow and found its own spot in the athletic apparel industry. In par- ticular, the German company seems to have found a new outlet and growth segment in the teenage market. Adidas has shifted from focusing on performance-based footwear and apparel to a fashion-centric approach, capitalizing on the athleisure movement. The company has experienced recent success with the new approach. In 2018, Adidas posted a 15-percent (currency neutral) increase in sales in North America.\" Despite the spike in sales, Adidas is still behind Nike in the United States, yet achieving close to 15 percent of sports apparel market share. Adidas has built on its strong legacy in soccer and morphed into a fashion apparel company. Adidas achieved this pivot in part through mega endorsement deals with athletes and pop culture icons such as Kanye West to bring a design-centric approach and cool factor to its products. UNDER ARMOUR Under Armour was started by walk-on college football player Kevin Plank in 1996; the same year he graduated with a degree in business administration from the University of Maryland. Plank created the compression t-shirt, which wicked away moisture better than traditional t-shirts. This became Under Armour's agship product that catapulted the company to become a household name in football apparel. Nike, Inc. Since then, the Baltimore, Maryland company has experienced rapid growth. Under Armour established spon- sorships with a number of collegiate football programs, and then quickly entered adjacent markets. In 2005, the company went public and ended the year with $281 million in revenues. By 2010, Under Armour aggressively entered the footwear market and surpassed $1 billion in revenue.\" Like Nike, Under Armour relies heavily on endorsements of athletes to promote its brand. Under Armour successfully signed a string of high-profile athletes such as Jordan Spieth, Tom Brady, Michael Phelps, and Steph Curry. Under Armour, however, has not been able to retain its rapid growth from the previous decade.12 The company has been troubled by supply chain issues, pricing confusion, and a fragmented retail strategy. Under Armour reported its rst-ever quarterly loss in 2017, and continues to shake up its executive team. In 2018, the company also had to deal with internal challenges such as allegations of a workplace culture that was hostile to women and where male executives frequently used company funds for lavish entertainment at various strip clubs.13 In 2019, Under Armour revenues stood at $5.2 billion. NEW BALANCE New Balance Athletics, Inc. is a Boston-based manufacturer of athletic footwear and apparel. The company was founded in 1906 and is privately held. Unlike other competitors in the industry that rely on low-cost manufacturers in Southeast Asia, New Balance exclusively manufacturers its products in the United States, United Kingdom, and Europe; it also owns its manufacturing facilities. Because of higher labor costs, New Balance products tend to be priced at a premium. The company argues, however, that the comparatively higher prices are justied given that its products are of higher quality and incorporate more innovative and cutting-edge features as well as offer a greater selection of sizes. In 2019, New Balance's revenues were about $5 billion; and the company employed about 8,000 people. In the same year, New Balance appointed company veteran Joe Preston as new CEO, following the successful tenure of Rob DeMartini, who led the company for 12 years. During this time period, DeMartini grew New Balance almost threefold by more than doubling the company's international sales among other strategic initiatives. Overall, New Balances achieved double-digit growth in each of the last few years. The company is also the sole supplier of athletic footwear for the U.S. military, benetting from legislation requiring the Department of Defense to source from U.S. companies that manufacture domestically. '4 Fashion 'Ikends As a major player in sports apparel, Nike is tied to industry and fashion trends both on an athletic level, but also on a larger scale. For instance, Nike is falling behind with the under-13 crowd, where Adidas boasts some major endorsements from such pop superstars and fashion trend setters such as Kanye West and Pharrell Williams. Moreover, lululemon has become a major force in the fast-growing athleisure segment. Nike, Inc. LULULEMON ATHLETICA lululemon was founded by Chip Wilson in 1998 as a yoga apparel company in Vancouver, Canada. Wilson's goal was to not just sell yoga apparel, but to grow a local community around healthy lifestyle. lululemon created yoga instructor ambassadors to drive growth and brand awareness, giving these ambassadors a platform to attract clients. Wilson focused on bringing the apparel technology from other sports into the yoga space to offer a high- quality product with innovative features incorporating some of the latest advances in sports apparel (such as seamless stitching to prevent skin irritations). The company targets consumers who are willing to pay a higher price point for athletic apparel, something that Nike has done for a long time. In 2007, lululemon went public. Founder Wilson has since resigned both from his CEO position and from the board itself, stemming disagreements in strategy and also from controversial comments." lululemon has become an important player in the athleisure movement, allowing it to have a growing influence in fashion and culture. In 2019, lululemon achieved annual sales of some $4 billion. Geographic Expansion As Nike aims for continued growth, it must look outside of its home in North America. Nike has traditionally done well in growing its business abroad. The company has focused on different geographies through varying strate- gies. In Japan, for instance, Nike relies on sneaker culture to promote its footwear through fashion. In Europe, Nike has pushed to become a major player in international soccer. The initiative started in the 1990s and has grown to major sponsorships of national teams and global stars. Although Nike has reached second place in the soccer market behind Adidas, Nike views "every World Cup as an opportunity to pull ahead." In the summer of 2019, the U.S. Women National Team won the soccer World Cup (held in France) for a fourth time, with Nike being the team's main sponsor. Indeed, over the summer of 2019, the women's soccer jerseys were the most sold item on Nike's direct-to-consumer channels. CHINA'S NIKE: LI-NING Li-Ning (Company Ltd.) is a household name in China. The eponymous sportswear company was founded in 1990 by former star gymnast Li Ning, who won six medals (including three golds) at the 1984 Los Angeles Olympics. Riding on the fame of its founder, Li-Ning quickly became the largest and best-known Chinese sports- wear company. In parallel with China's incredible economic rise, Li-Ning fared well. In 2019, Li-Ning's revenues were $1.6 billion. Li-Ning's "coming out party" was the 2008 Olympics in Beijing; where the Chinese upstart proclaimed its goal to overtake Nike and Adidas, the undisputed world leaders in sports shoes and apparel. This would happen first in the Chinese market and then globally. To symbolize the company's rise, its founder Li Ning, still a popular folk hero, was chosen to light the Olympic flame during the Beijing opening ceremonies. China's rapid urbanization and the post-Olympics effects echoed Li-Ning's vision of expansion: from 2005 to 2010, Li-Ning tripled its revenue and seemed to be overtaking Adidas to become number two in the Chinese mar- ket, just behind Nike. Fueled by seemingly unstoppable success, Li-Ning began to expand rapidly in Southeast Asia.In a brazen move, Li-Ning even opened a specialty store across the Pacic in Portland, Oregon, the hometown of Nike. Li-Ning soon found that its local Chinese competitors were pursuing a similar expansion strategy. To make mat- ters worse, even Nike and Adidas joined the fray to compete aggressively in second- and third-tier cities in China. This was a departure from the usual business model where the two world leaders would focus on high-end markets such as Shanghai and Beijing. As the post-Olympic shopping enthusiasm gradually faded, competition further intensied. Li-Ning's problem of overexpansion was not unique. Slowing sales and high inventories have burdened other sportswear brands in China, including Nike and Adidas. The two global brands have gained back their market shares, presumably at Li-Ning's expense, due to their faster response to changes in the market environment. They also further differentiated themselves from the pack through continued innovation and sophisticated marketing tailored to local tastes. For example, Adidas introduced fashionable sportswear such as high-heeled sports shoes in China. NIKE INTERNATIONAL GROWTH: CHINA The focus for Nike's international growth is China. The growing market (\"Greater China,\" including Taiwan and Hong Kong) brought in $5.2 billion in revenues in 2019, up from $3 billion in 2015. As further evidence of Nike's success in China, Nike had record-breaking sales on Singles Day in 2018 (on 11,-'1 1) earning the company the title of #1 Sports Brand on Tmall, an Alibaba Group Chinese retail website.\" Despite this leading position in the market, Nike understands what's at stake in China. The target market for China could be ten times the size of the United States, given the difference in population and growth rates. Nike is less concerned about the trade war between the United States and China in regard to the Chinese market, because it has many contract manufacturers in China and the region. Nike plans to leverage its digital transformation and its online platform in the region and penetrate the growing market more successfully.\" Nike plans to grow sales in China to $1 billion by mid-2021. In comparison, Nike's home market in the United States is expected to reach $20 billion in 2021, up from $14 billion in 2015. Convergence: Athletic Footwear and Apparel with Technology MOBILE TECHNOLOGY The proliferation of mobile technology combined with the availability of high-speed LTE (and soon 5G) net- works has created a new world of connectivity. This connectivity has created an ecosystem of not just phones and tablets, but also wearables such as tness trackers or smart watches. The Internet of Things (101') is the network of ordinary objects and appliances that are outfitted with sensors and network connectivity to communicate and report data. IoT promises to upend the fitness industry as we know it today. IoT promises to transform the shoe and apparel industry as technology merges with products. Accordingly, Nike has invested in and developed connected devices in the past. Nike, Inc. FUEL BAND In 2012, N'Lke created the FuelBand, which was a wearable technology that measured the wearer's daily activ- ity and performance levels. The technology was the one of the rst major tness devices to hit the market. The device was conceived to allow for users to track, monitor, and reward basic forms of physical activity. FuelBand encouraged users to rack up NikeFuel points, which created a game-like feature to compete against other FuelBand owners. The device connected to smartphones via Bluetooth technology, and helped launch Nike into the world of connected devices. While the FuelBand drove up equipment sales for Nike, it faced strong competition in the space. The product quickly had to differentiate itself from other devices by competitors such as Jawbone and FitBit. Nike decided to discontinue the FuelBand in 2014, although happy with its performance in the segment, but not quite satised with the strategic direction. Nike decided to further push into connected devices through other means, including collaborating with leading technology companies such as Apple, Inc. NI KE+ Nike tries to get to know its customers better through its social media and loyalty platform, Nike+. Users of the platform can input their athletic interests, apparel tastes, and other criteria to create a Nike+ prole. Nike then uses that information to create curated product announcements and promotions. Users can also share their fitness activity with other users and on other social media platforms. The platform is fully integrated at Nike stores to add value to a consumer's in-store shopping experience. APPLE WATCH NIKE+ After venturing into wearable technology on its own, Nike partnered with Apple to create a Nike version of the Apple Watch. The Apple Watch Series 2, released in 2016, includes a Nike+ variation for consumers. The watch enables users to link the GPS capability of the mobile device with the Nike+ platform, allowing users to take part in the Nike Run Club (NRC). The increased connectivity of mobile devices and daily activity allows Nike to compete with other wearable technology, such as Fitbit, without the need to fully build out its own capabilities. The Apple Watch Nike+ Series 4 subsequently was launched in 2018. Given the increasing partnering propensity between Apple and Nike, it should come as no surprise that Apple's CEO, Tim Cook, was appointed to Nike's board of directors in 2016. NBA CONNECTED JERSEY In 201?, Nike announced a special NBA apparel product called the Connected Jersey. These NBA jerseys have aNear Field Communication (NFC) chip embedded inthe jersey so that they can be fully connected with a smart- phone. This \"smart jersey\" creates unique mobile experiences specific to the NBA player of the jersey the user is wearing. For example, the user can tap into the music playlist that the athlete is listening to during warmups. Also, it allows access to exclusive footwear and apparel related to that team

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts