Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on pages 776-785 in your textbook, calculate one ratio from each of the following groups (three ratios total) for 2018 for Smart Touch Learning:

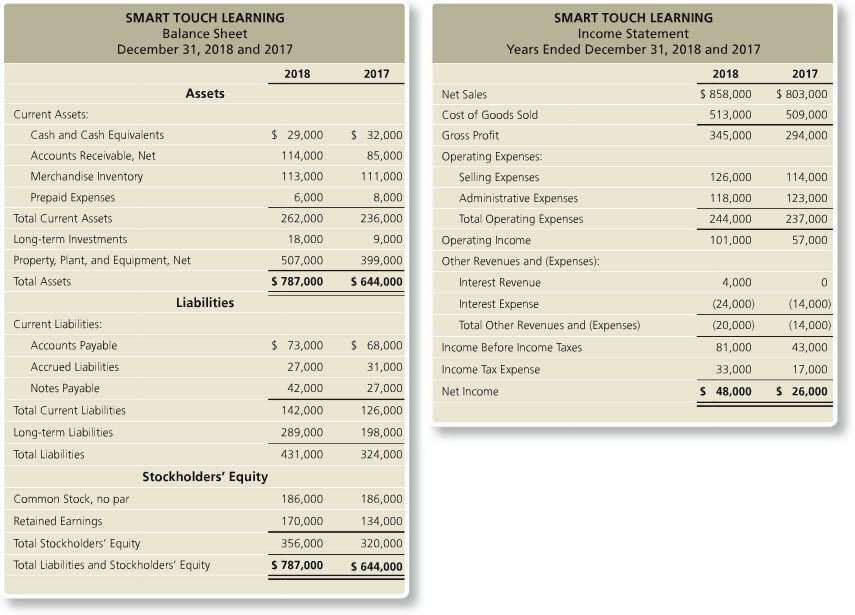

Based on pages 776-785 in your textbook, calculate one ratio from each of the following groups (three ratios total) for 2018 for Smart Touch Learning: Ability to Pay Current Liabilities Current Ratio Cash Ratio Ability to Pay Long-Term Debt Debt Ratio Debt-to-Equity Ratio Profitability Profit Margin Ratio Rate of Return on Total Assets What do these results tell you? How will you use this information in planning and decision making? Refer to these comparative financial statements to help you work through this discussion.

Based on pages 776-785 in your textbook, calculate one ratio from each of the following groups (three ratios total) for 2018 for Smart Touch Learning: Ability to Pay Current Liabilities Current Ratio Cash Ratio Ability to Pay Long-Term Debt Debt Ratio Debt-to-Equity Ratio Profitability Profit Margin Ratio Rate of Return on Total Assets What do these results tell you? How will you use this information in planning and decision making? Refer to these comparative financial statements to help you work through this discussion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started