Answered step by step

Verified Expert Solution

Question

1 Approved Answer

based on past experience, a bank believes 14% of the people who receive loans will not make payments. the bank has recently approved 100 loans,

based on past experience, a bank believes 14% of the people who receive loans will not make payments. the bank has recently approved 100 loans, which are a random representative sample.

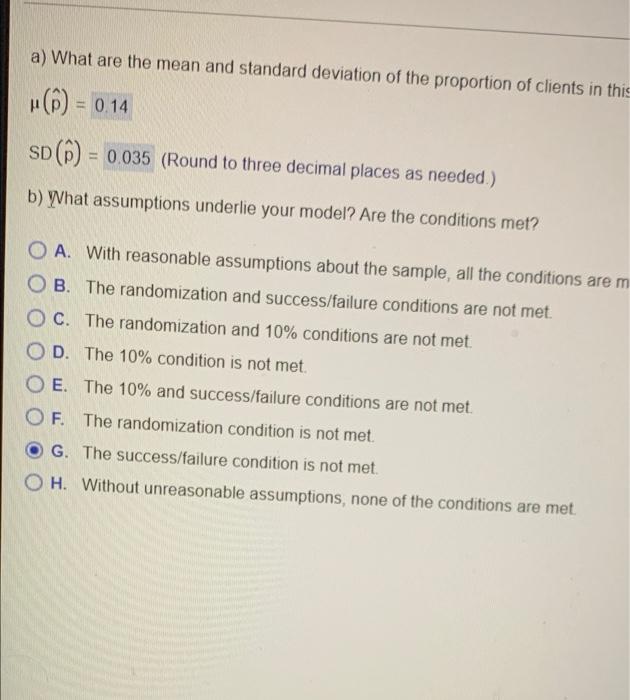

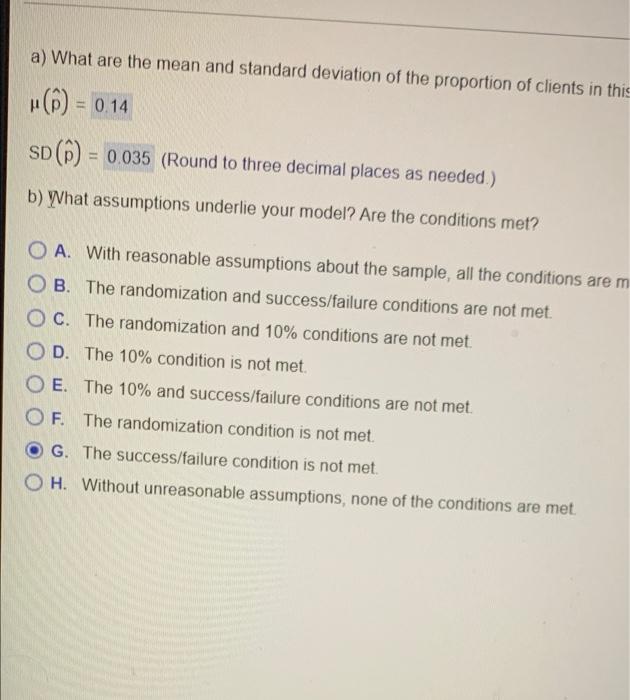

a) What are the mean and standard deviation of the proportion of clients in this = 0.14 SDC) = 0.035 (Round to three decimal places as needed.) b) What assumptions underlie your model? Are the conditions met? O A. With reasonable assumptions about the sample, all the conditions are m OB. The randomization and success/failure conditions are not met. OC. The randomization and 10% conditions are not met OD. The 10% condition is not met. O E. The 10% and success/failure conditions are not met. OF. The randomization condition is not met O G. The success/failure condition is not met. OH. Without unreasonable assumptions, none of the conditions are met what are the mean and standard deviation of the proportion of clients in this group who may not make timely payments?

what assumptions underlie your model?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started