Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on results should the recommendation be to either build a new plant or buy an existing one? Explain will be $5,000 million for eltne

Based on results should the recommendation be to either build a new plant or buy an existing one? Explain

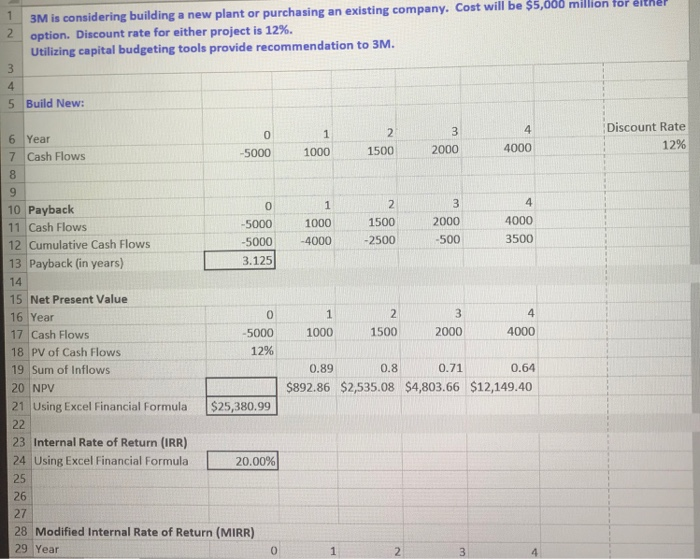

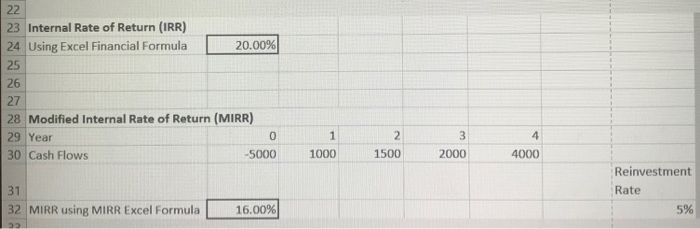

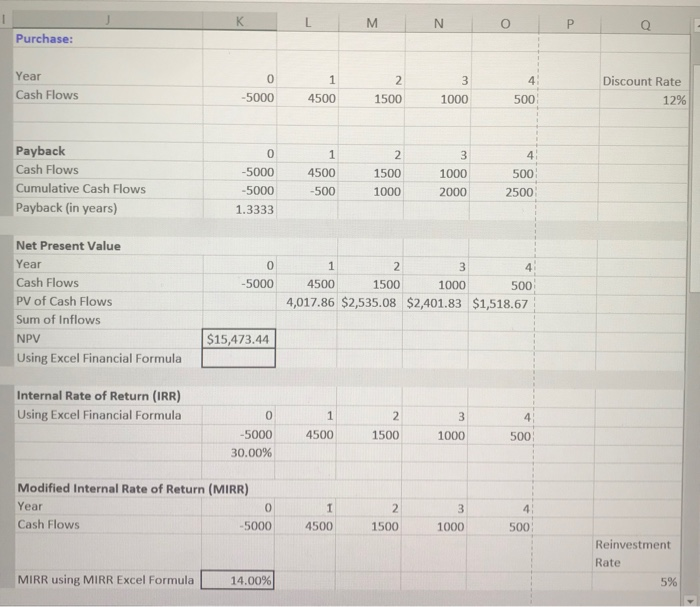

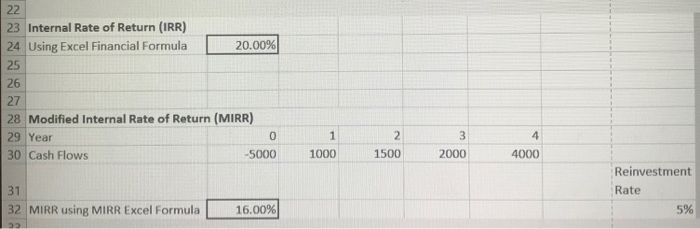

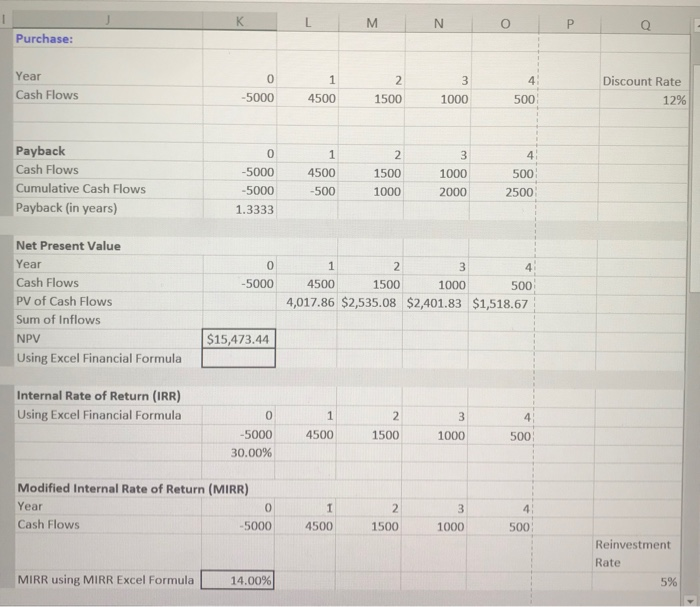

will be $5,000 million for eltne is considering building a new plant or purchasing an existing company. Cost option. Discount rate for either project is 12%. Utilizing capital budgeting tools provide recommendation to 3M. 5 Build New: Discount Rate 12% 0 6 Year 7 Cash Flows 4000 0001000 1500 2000 4 4000 3500 0 10 Payback 11 Cash Flows 12 Cumulative Cash Flows 13 Payback (in years) 14 15 Net Present Value 16 Year 17 Cash Flows 18 PV of Cash Flows 19 Sum of Inflows 20 NPV 21 Using Excel Financial Formula $25,380.99 500010001500 2000 5000 4000 2500 3.125 500 4 -5000 1000 1500 2000 4000 1296 0.89 0.8 0.71 0.64 $892.86 $2,535.08 $4,803.66 $12,149.40 23 Internal Rate of Return (IRR) 24 Using Excel Financial Formula 20.00% 26 27 28 Modified Internal Rate of Return (MIRR) 29 Year 23 Internal Rate of Return (IRR) 24|Using Excel Financial Formula 20.00%) 25 26 27 28 Modified Internal Rate of Return (MIRR) 29 Year 30 Cash Flows 0 3 4 -5000 1000 1500 2000 4000 Reinvestment 31 32 IMIRR using MIRR Excel Formula | Rate 16.00% 5% Purchase: Year Discount Rate 12% Cash Flows 500045001500 1000 500 Payback Cash Flows Cumulative Cash Flows Payback (in years) 0 500045001500 1000 5000 500 2500 -500 1000 2000 1.3333 Net Present Value Year Cash Flows PV of Cash Flows Sum of Inflows NPV Using Excel Financial Formula 5000 4500 500 4,017.86 $2,535.08 $2,401.83 $1,518.67 1500 1000 $15,473.44 Internal Rate of Return (IRR) Using Excel Financial Formula -5000 30.00% 4500 1500 1000 500 Modified Internal Rate of Return (MIRR Year Cash Flows 3 5000 4500 1500 1000 41 500 Reinvestment Rate MIRR using MIRR Excel Formula | 14.00% 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started