Question

Based on the accumulated debt at the end of 2017, a. Calculate the 2018 interest payment. Assume an interest rate of 8.2%. b. Calculate the

Based on the accumulated debt at the end of 2017,

a. Calculate the 2018 interest payment. Assume an interest rate of 8.2%.

b. Calculate the total outlays for 2018, the year-end surplus or deficit, and the year-end accumulated debt.

c. Based on the accumulated debt at the end of 2018, calculate the 2019 interest payment, again assuming an 8.2% interest rate.

d. Assume that in 2019 the company has receipts of $1,104,000, holds operating expenses and employee benefits to their 2018 levels, and spends no money on security. Calculate total outlays for 2019, the year-end surplus or deficit, and the year-end accumulated debt.

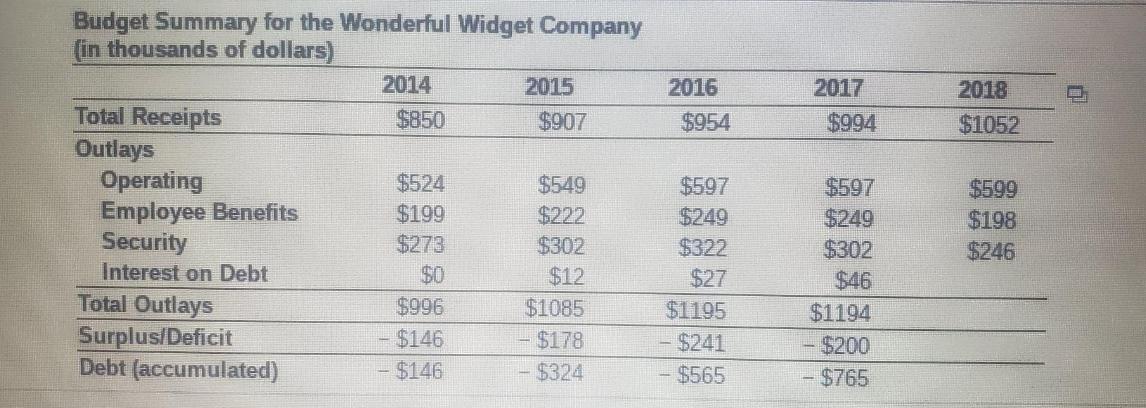

Budget Summary for the Wonderful Widget Company (in thousands of dollars) Total Receipts Outlays Operating Employee Benefits Security Interest on Debt Total Outlays Surplus/Deficit Debt (accumulated) 2014 $850 $524 $199 $273 $0 $996 - $146 - $146 2015 $907 $549 $222 $302 $12 $1085 - $178 - $324 2016 $954 $597 $249 $322 $27 $1195 - $241 $565 2017 F $994 $597 $249 $302 $46 $1194 - $200 $765 2018 $1052 $599 $198 $246

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Year Interest Payment Total Outlays SurplusDeficit Accumulated Debt 2018 62730 1602730 498730 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started