Question: Based on the attached case details address the following in at least 1. External environment (threats and opportunities) 2. Internal capabilities 3. Recommended business-level strategy

Based on the attached case details address the following in at least

1. External environment (threats and opportunities)

2. Internal capabilities

3. Recommended business-level strategy to follow

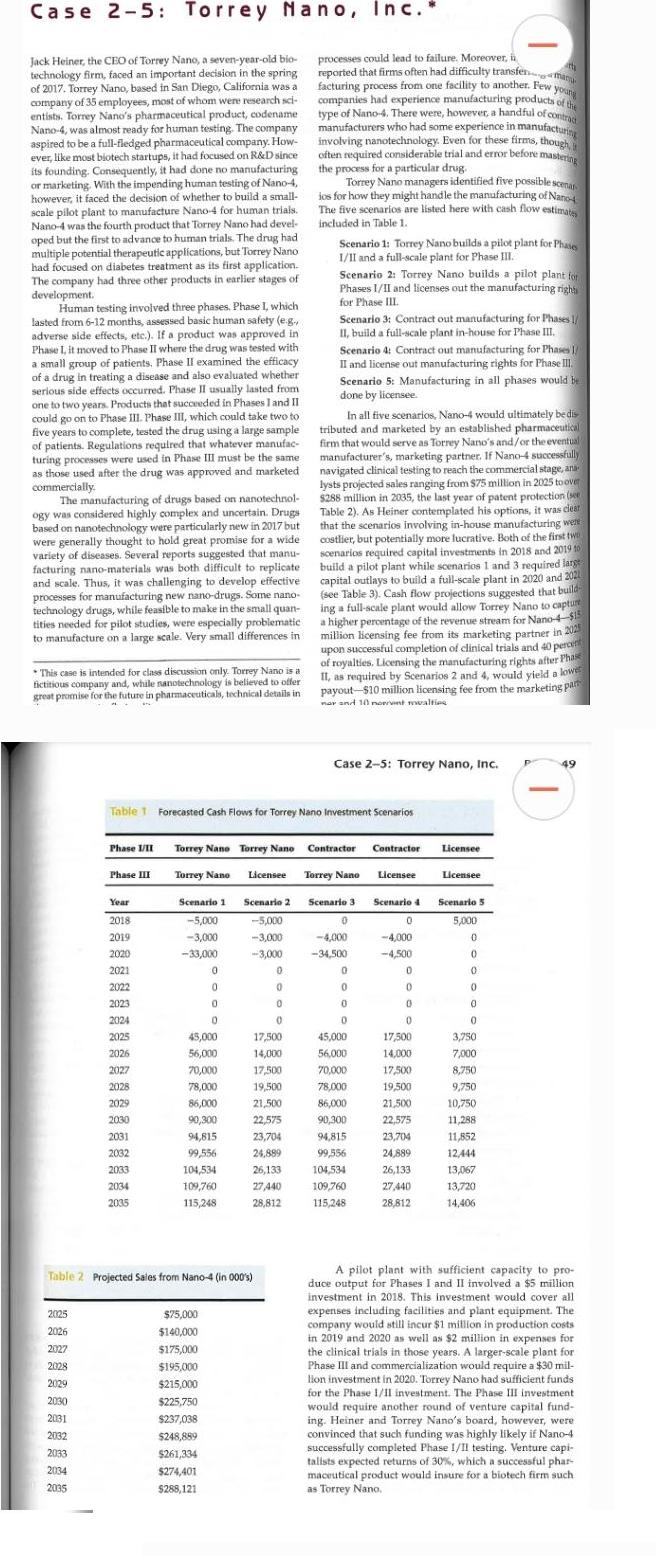

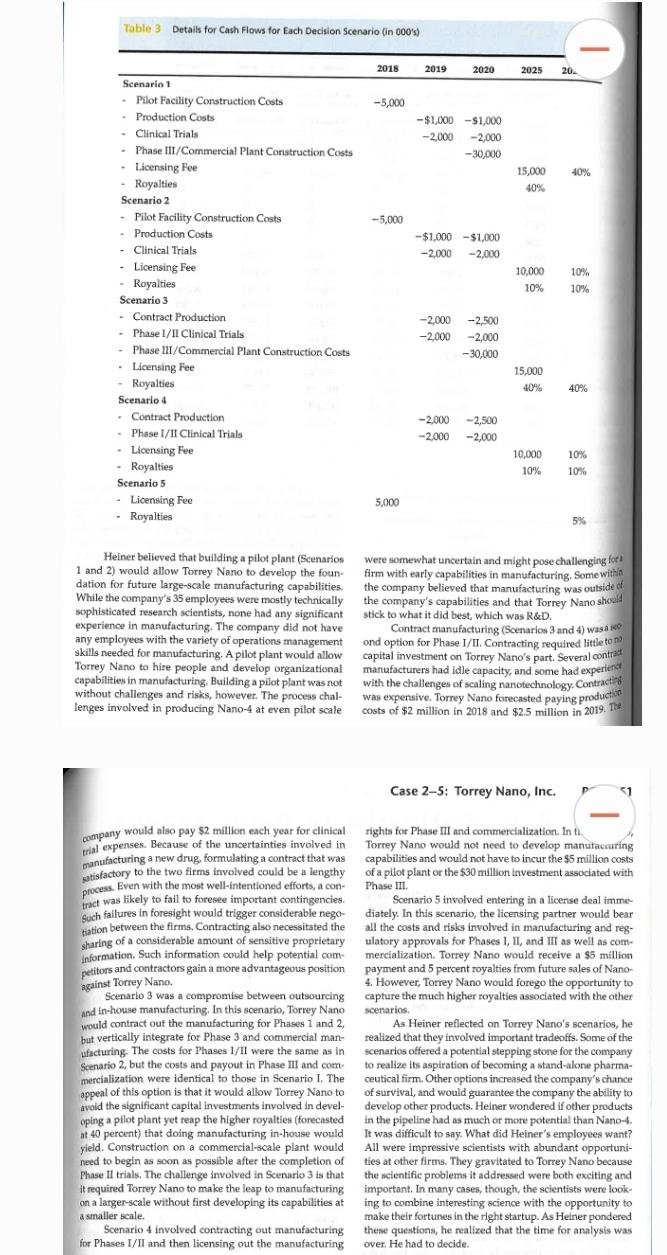

Case 2-5: Torrey Nano, Inc. processes could lead to failure. Moreover, i Jack Heiner, the CEO of Torrey Nano, a seven-year-old bio- technology firm, faced an important decision in the spring reported that firms often had difficulty transfen.m of 2017. Torrey Nano, based in San Diego, California was a facturing process from one facility to another. Few company of 35 employees, most of whom were research sci- entists. Torrey Nano's pharmaceutical product, codename Nano-4, was almost ready for human testing. The company aspired to be a full-fledged pharmaceutical company. How- involving nanotechnology. Even for these firms, though ever, like most biotech startups, it had focused on R&D since often required considerable trial and error before maste its founding. Consequently, it had done no manufacturing or marketing. With the impending human testing of Nano-4, however, it faced the decision of whether to build a small- scale pilot plant to manufacture Nano-4 for human trials. Nano-4 was the fourth product that Torrey Nano had devel- oped but the first to advance to human trials. The drug had multiple potential therapeutic applications, but Torrey Nano had focused on diabetes treatment as its first application. The company had three other products in earlier stages of development. Human testing involved three phases. Phase I, which lasted from 6-12 months, assessed basic human safety (e.g., adverse side effects, etc.). If a product was approved in Phase I, it moved to Phase II where the drug was tested with a small group of patients. Phase II examined the efficacy of a drug in treating a disease and also evaluated whether serious side effects occurred. Phase II usually lasted from one to two years. Products that succeeded in Phases I and II could go on to Phase III. Phase III, which could take two to five years to complete, tested the drug using a large sample tributed and marketed by an established pharmaceutical of patients. Regulations required that whatever manufac- turing processes were used in Phase III must be the same as those used after the drug was approved and marketed commercially. The manufacturing of drugs based on nanotechnol- ogy was considered highly complex and uncertain. Drugs Table 2). As Heiner contemplated his options, it was dear based on nanotechnology were particularly new in 2017 but that the scenarios involving in-house manufacturing wert were generally thought to hold great promise for a wide costlier, but potentially more lucrative. Both of the first tw variety of diseases. Several reports suggested that manu- facturing nano-materials was both difficult to replicate build a pilot plant while scenarios 1 and 3 required large and scale. Thus, it was challenging to develop effective capital outlays to build a full-scale plant in 2020 and 202 processes for manufacturing new nano-drugs. Some nano- technology drugs, while feasible to make in the small quan- ing a full-scale plant would allow Torrey Nano to captu tities needed for pilot studies, were especially problematic a higher percentage of the revenue stream for Nano-$ to manufacture on a large scale. Very small differences in companies had experience manufacturing products of type of Nano-4. There were, however, a handful of cont manufacturers who had some experience in manufacturi the process for a particular drug. Torrey Nano managers identified five possible scena jos for how they might handle the manufacturing of Nano The five scenarios are listed here with cash flow estimate included in Table 1. Scenario 1: Torrey Nano builds a pilot plant for Phae 1/1I and a full-scale plant for Phase III. Scenario 2: Torrey Nano builds a pilot plant for Phases 1/II and licenses out the manufacturing righ for Phase III. Scenario 3: Contract out manufacturing for Phases ! II, build a full-scale plant in-house for Phase II. Scenario 4: Contract out manufacturing for Phases II and license out manufacturing rights for Phase I. Scenario 5: Manufacturing in all phases would be done by licensee. In all five scenarios, Nano-4 would ultimately be dis firm that would serve as Torrey Nano's and/or the eventual manufacturer's, marketing partner. If Nano-4 successfully navigated clinical testing to reach the commercial stage, ana lysts projected sales ranging from $75 million in 2025 to over $288 million in 2035, the last year of patent protection (se scenarios required capital investments in 2018 and 2019 t0 (see Table 3). Cash flow projections suggested that build * This case is intended for class discussion only. Torrey Nano is a fictitious company and, while nanotechnology is believed to offer great promise for the future in pharmaceuticals, technical details in million licensing fee from its marketing partner in 20 upon successful completion of clinical trials and 40 percent of royalties. Licensing the manufacturing rights after Pha II, as required by Scenarios 2 and 4, would yield a lowe payout-$10 million licensing fee from the marketing pa nar and 10 norrvnt walties Case 2-5: Torrey Nano, Inc. 49 Table 1 Forecasted Cash Flows for Torrey Nano Investment Scenarios Phase 1II Torrey Nano Torrey Nano Contractor Contractor Licensee Phase III Torrey Nano Licensee Torrey Nano Licensee Licensee Year Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 2018 -5,000 -5,000 5,000 -3,000 -33,000 -3,000 -3,000 2019 -4,000 -4,000 2020 -34,500 -4,500 2021 2022 2023 2024 2025 45,000 17,500 45,000 17,500 3,750 2026 56,000 14,000 56,000 14,000 7,000 2027 70,000 17,500 70,000 17,500 8,750 2028 78,000 19,500 78,000 19,500 9,750 2029 86,000 21,500 86,000 21,500 10,750 2030 90,300 22,575 90,300 22,575 11,288 2031 94,815 23,704 94,815 23,704 11,852 2032 99,556 24,889 99,556 24,889 12,444 104,534 109,760 115,248 2033 104,534 26,133 26,133 13,067 2034 109,760 27,440 27,440 13,720 2035 115,248 28,812 28,812 14,406 A pilot plant with sufficient capacity to pro- duce output for Phases I and II involved a $5 million investment in 2018. This investment would cover all expenses including facilities and plant equipment. The company would still incur $1 million in production costs in 2019 and 2020 as well as $2 million in expenses for the clinicai trials in those years. A larger-scale plant for Phase III and commercialization would require a $30 mil- lion investment in 2020. Torrey Nano had sufficient funds for the Phase 1/11 investment. The Phase II investment Table 2 Projected Sales from Nano-4 (in 000's) 2025 $75,000 2026 $140,000 2027 $175,000 2028 $195,000 2029 $215,000 2030 $225,750 would require another round of venture capital fund- ing. Heiner and Torrey Nano's board, however, were convinced that such funding was highly likely if Nano-4 successfully completed Phase 1/Il testing. Venture capi- talists expected returns of 30%, which a successful phar- maceutical product would insure for a biotech firm such as Torrey Nano, 2031 $237,038 2032 $248,889 2033 $261,334 2034 $274,401 2035 $288,121

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

SWOT Analysis SWOT analysis is the best parameter to identify and evaluat... View full answer

Get step-by-step solutions from verified subject matter experts