Question

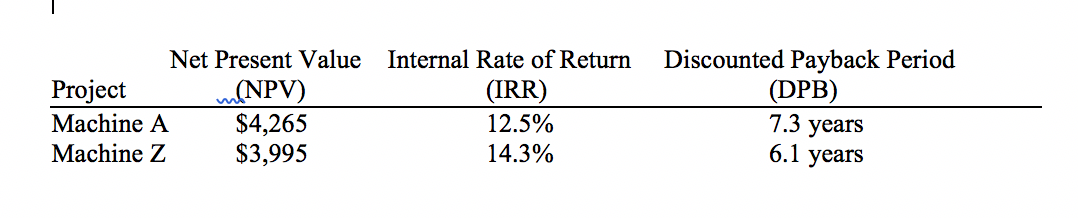

Based on the attached information about two mutually exclusive capital budgeting projects (milling machines) that the CFO of MaxLife has compiled, which project(s) should MaxLife

Based on the attached information about two mutually exclusive capital budgeting projects (milling machines) that the CFO of MaxLife has compiled, which project(s) should MaxLife purchase?  A. Machine Z only, because its IRR is higher than Machine As IRR and its DPB is less than Machines As DPB. B. To make a decision as to which machine should be purchased, we need to know MaxLifes required rate of return. C. Neither machine should be purchased because neither project is considered acceptable based on the results given in the table. D. Both machines should be purchased because they are both acceptable projects. E. Machine A only, because its NPV is greater than Machine Zs NPV.

A. Machine Z only, because its IRR is higher than Machine As IRR and its DPB is less than Machines As DPB. B. To make a decision as to which machine should be purchased, we need to know MaxLifes required rate of return. C. Neither machine should be purchased because neither project is considered acceptable based on the results given in the table. D. Both machines should be purchased because they are both acceptable projects. E. Machine A only, because its NPV is greater than Machine Zs NPV.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started