Answered step by step

Verified Expert Solution

Question

1 Approved Answer

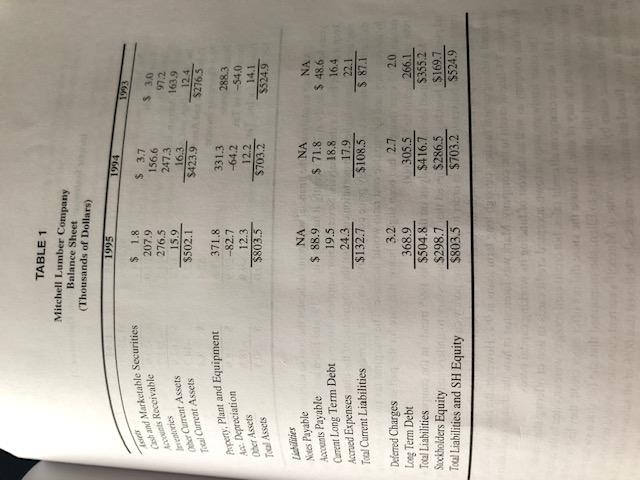

Based on the Balance sheet, how is the company funding its working capital position? is this considered an aggressive or conservative policy? Explain? TABLE 1

Based on the Balance sheet, how is the company funding its working capital position? is this considered an aggressive or conservative policy? Explain?

TABLE 1 Mitchell Lumber Company Balance Sheet (Thousands of Dollars) 1995 Grand Marketable Securities as Receivate $ 1.8 207.9 276.5 15.9 $502.1 $ 3.7 156,6 247.3 16.3 $423.9 her Current Assets ral Current Assets $ 3.0 97.2 1639 12.4 $276.5 Property, Plant and Equipment A. Depreciation her Assets Tal Assets 371.8 -82.7 12.3 $803.5 331.3 -64.2 12.2 $703.2 288.3 -54.0 14.1 $524.9 Listes Notes Payable Arants Payable Current Long Term Debt NA $ 88.9 19.5 24.3 $132.7 NA $ 71.8 18.8 17.9 $108.5 NA $48.6 16.4 22.1 $ 87.1 Accrued Expenses Toal Current Liabilities Deferred Charges Long Term Debt Total Liabilities Suckholders Equity Total Liabilities and SH Equity 3.2 368.9 $504.8 $298.7 $803,5 2.7 305.5 $416.7 $286.5 $703.2 2.0 266.1 $355,2 $169.7 $5249 TABLE 1 Mitchell Lumber Company Balance Sheet (Thousands of Dollars) 1995 Grand Marketable Securities as Receivate $ 1.8 207.9 276.5 15.9 $502.1 $ 3.7 156,6 247.3 16.3 $423.9 her Current Assets ral Current Assets $ 3.0 97.2 1639 12.4 $276.5 Property, Plant and Equipment A. Depreciation her Assets Tal Assets 371.8 -82.7 12.3 $803.5 331.3 -64.2 12.2 $703.2 288.3 -54.0 14.1 $524.9 Listes Notes Payable Arants Payable Current Long Term Debt NA $ 88.9 19.5 24.3 $132.7 NA $ 71.8 18.8 17.9 $108.5 NA $48.6 16.4 22.1 $ 87.1 Accrued Expenses Toal Current Liabilities Deferred Charges Long Term Debt Total Liabilities Suckholders Equity Total Liabilities and SH Equity 3.2 368.9 $504.8 $298.7 $803,5 2.7 305.5 $416.7 $286.5 $703.2 2.0 266.1 $355,2 $169.7 $5249Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started