Based on the balance sheet, income statement, and cash flow:

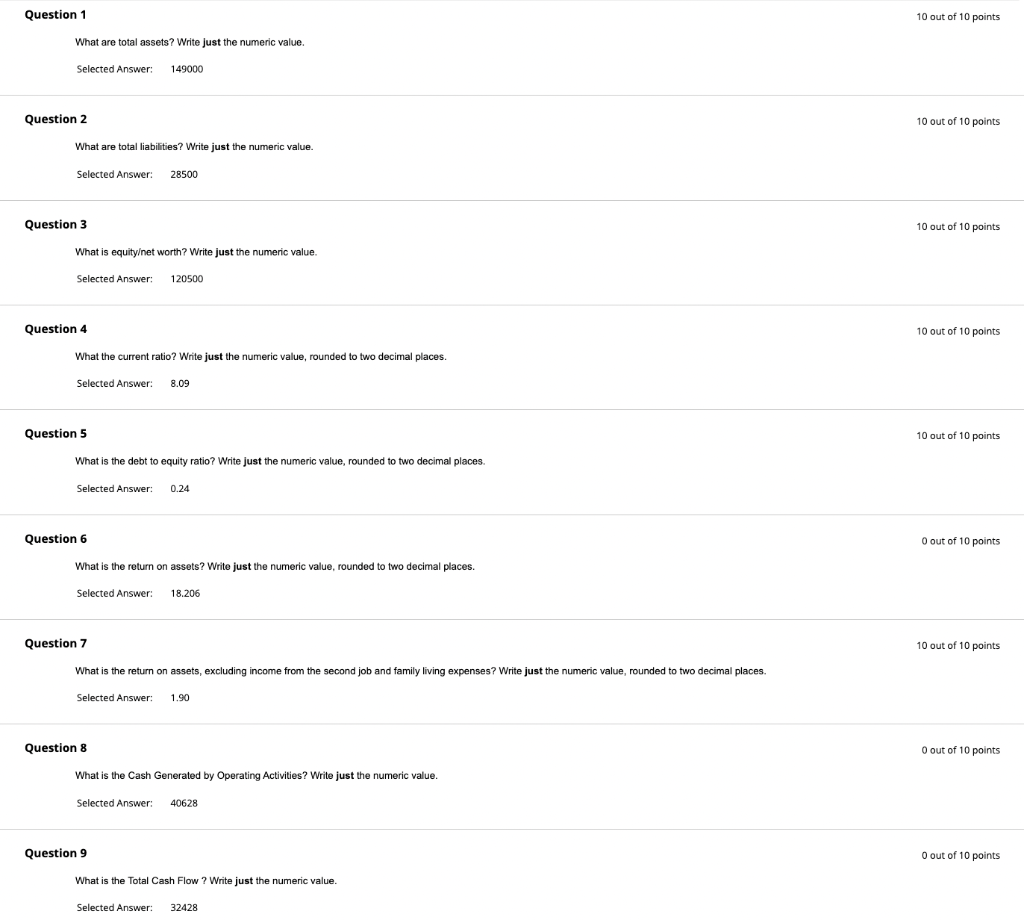

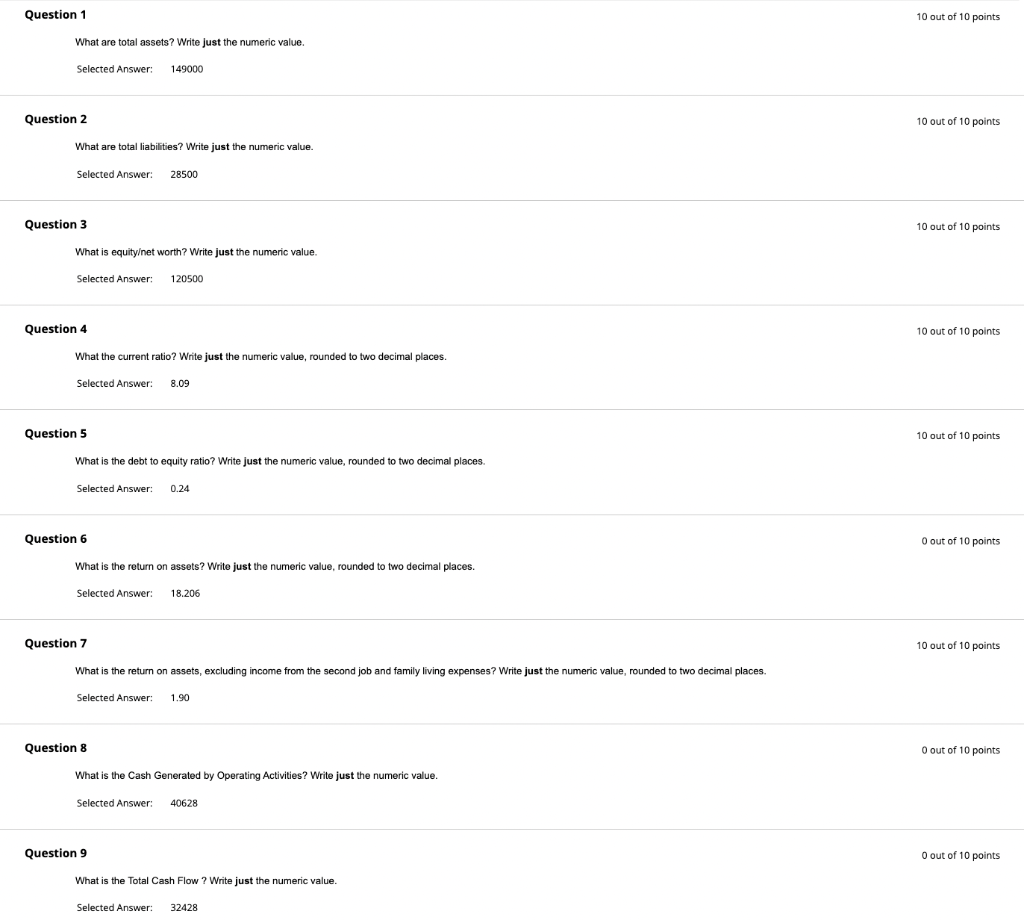

#6 What is the return on assets? (Rounded to two decimal places)

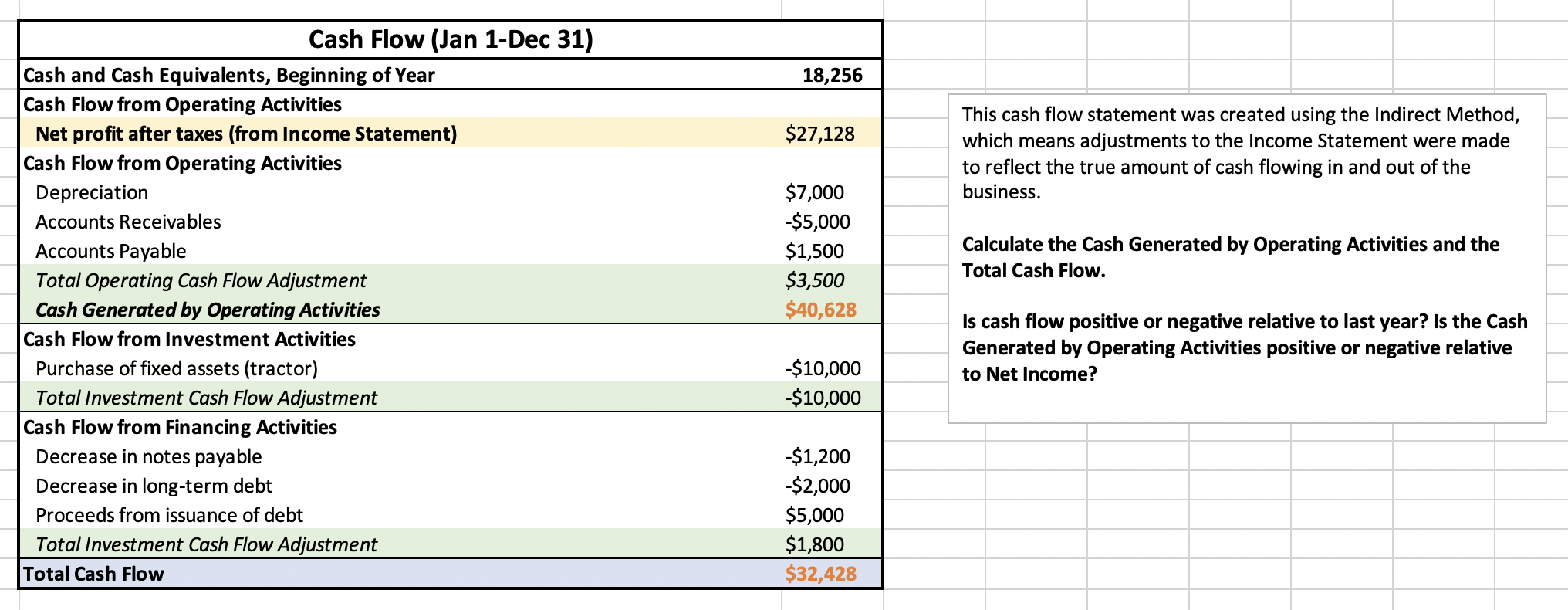

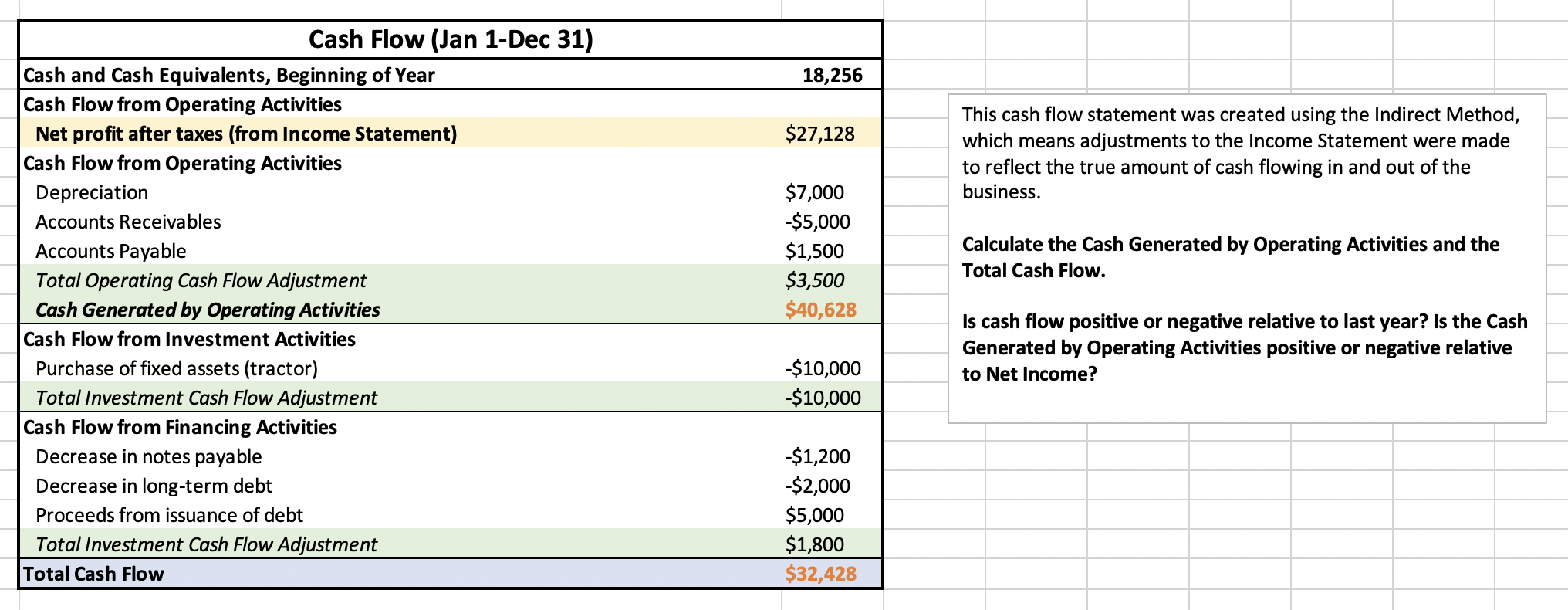

#8 What is the Cash Generated by Operating Activities?

#9 What is the Total Cash Flow?

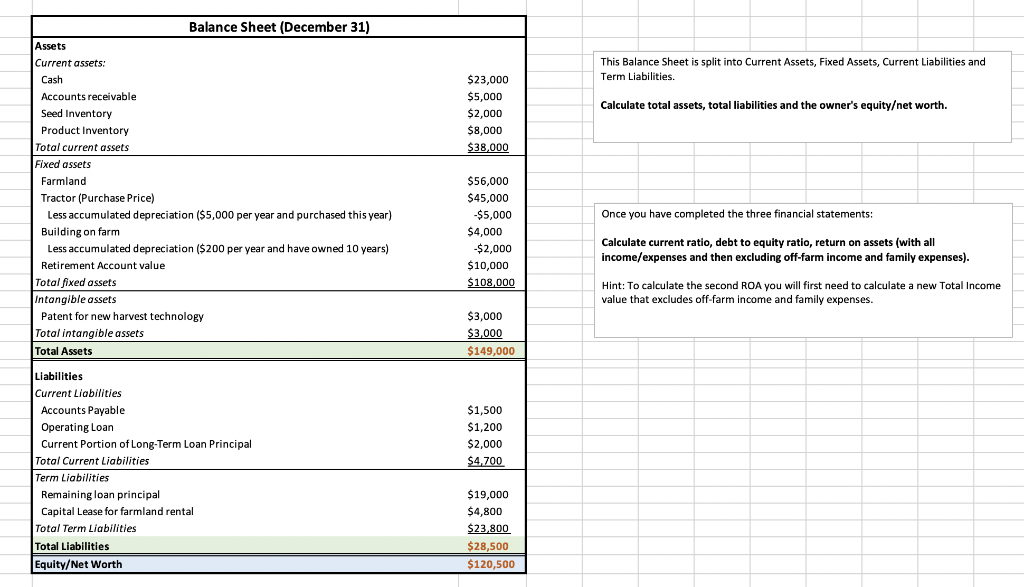

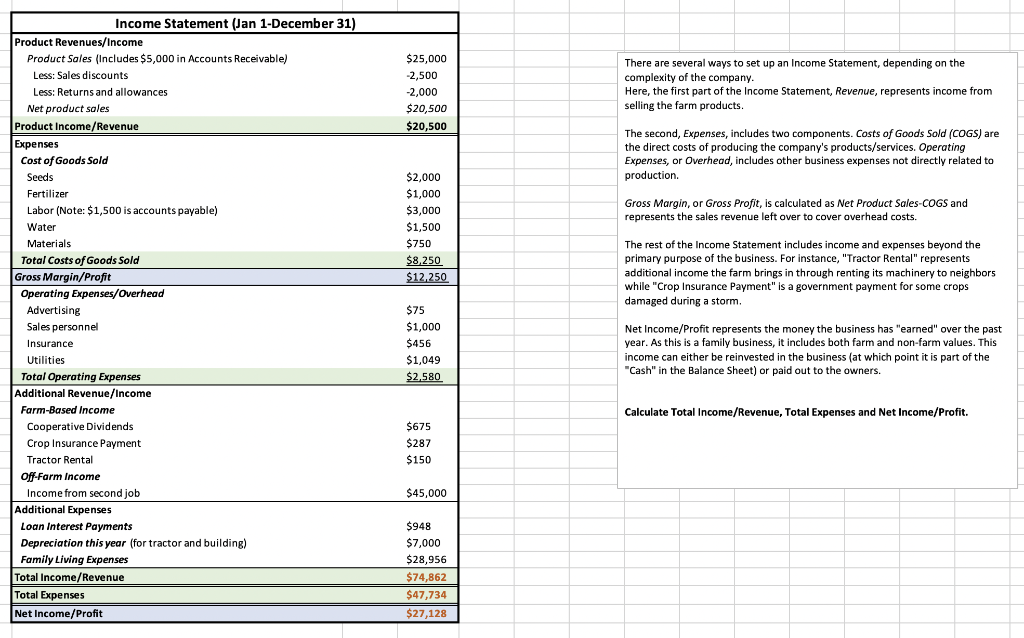

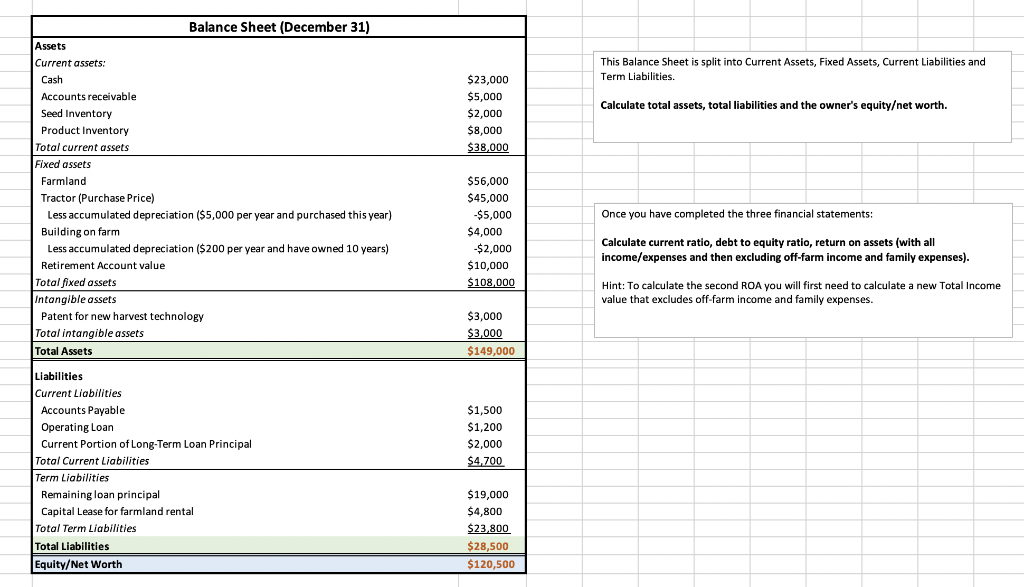

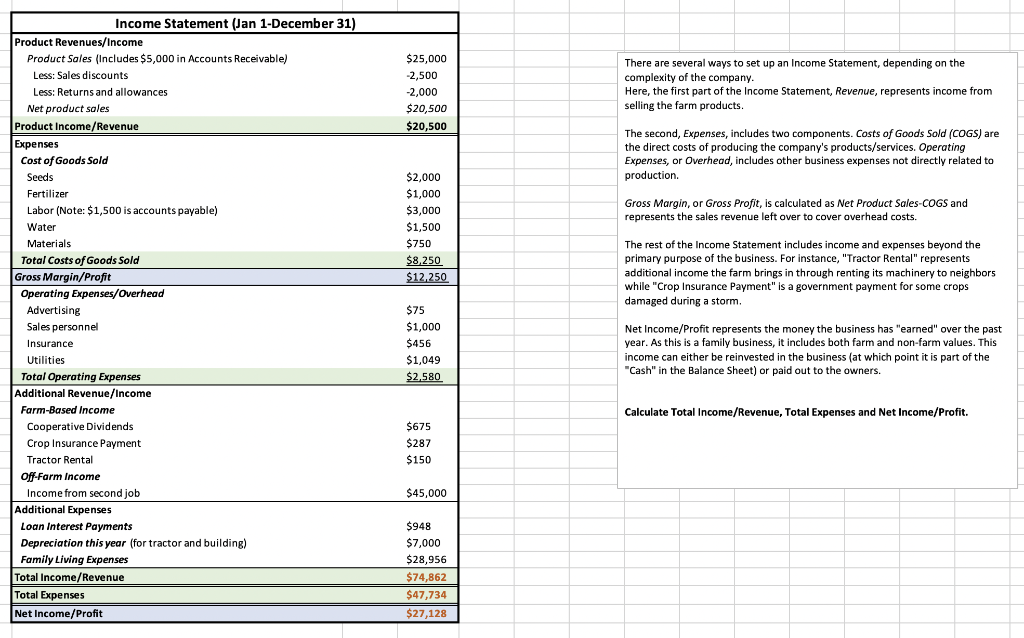

Once you have completed the three financial statements: Calculate current ratio, debt to equity ratio, return on assets (with all income/expenses and then excluding off-farm income and family expenses). Hint: To calculate the second ROA you will first need to calculate a new Total Income value that excludes off-farm income and family expenses. There are several ways to set up an Income Statement, depending on the complexity of the company. Here, the first part of the Income Statement, Revenue, represents income from selling the farm products. The second, Expenses, includes two components. Costs of Goods Sold (COGS) are the direct costs of producing the company's products/services. Operating Expenses, or Overhead, includes other business expenses not directly related to production. Gross Margin, or Gross Profit, is calculated as Net Product Sales-COGS and represents the sales revenue left over to cover overhead costs. The rest of the Income Statement includes income and expenses beyond the primary purpose of the business. For instance, "Tractor Rental" represents additional income the farm brings in through renting its machinery to neighbors while "Crop Insurance Payment" is a government payment for some crops damaged during a storm. Net Income/Profit represents the money the business has "earned" over the past year. As this is a family business, it includes both farm and non-farm values. This income can either be reinvested in the business (at which point it is part of the "Cash" in the Balance Sheet) or paid out to the owners. Calculate Total Income/Revenue, Total Expenses and Net Income/Profit. This cash flow statement was created using the Indirect Method, which means adjustments to the Income Statement were made to reflect the true amount of cash flowing in and out of the business. Calculate the Cash Generated by Operating Activities and the Total Cash Flow. Is cash flow positive or negative relative to last year? Is the Cash Generated by Operating Activities positive or negative relative to Net Income? Question 2 10 out of 10 points What are total liabilities? Write just the numeric value. 28500 Question 3 10 out of 10 points What is equityet worth? Write just the numeric value. 120500 Question 4 10 out of 10 points What the current ratio? Write just the numeric value, rounded to two decimal places. 8.09 Question 5 10 out of 10 points What is the debt to equity ratio? Write just the numeric value, rounded to two decimal places. 0.24 Question 6 0 out of 10 points What is the return on assets? Write just the numeric value, rounded to two decimal places. 18.206 Question 7 10 out of 10 points What is the return on assets, excluding income from the second job and family living expenses? Write just the numeric value, rounded to two decimal places. 1.90 Question 8 0 out of 10 points What is the Cash Generated by Operating Activities? Write just the numeric value. 40628 Question 9 0 out of 10 points What is the Total Cash Flow ? Write just the numeric value. Once you have completed the three financial statements: Calculate current ratio, debt to equity ratio, return on assets (with all income/expenses and then excluding off-farm income and family expenses). Hint: To calculate the second ROA you will first need to calculate a new Total Income value that excludes off-farm income and family expenses. There are several ways to set up an Income Statement, depending on the complexity of the company. Here, the first part of the Income Statement, Revenue, represents income from selling the farm products. The second, Expenses, includes two components. Costs of Goods Sold (COGS) are the direct costs of producing the company's products/services. Operating Expenses, or Overhead, includes other business expenses not directly related to production. Gross Margin, or Gross Profit, is calculated as Net Product Sales-COGS and represents the sales revenue left over to cover overhead costs. The rest of the Income Statement includes income and expenses beyond the primary purpose of the business. For instance, "Tractor Rental" represents additional income the farm brings in through renting its machinery to neighbors while "Crop Insurance Payment" is a government payment for some crops damaged during a storm. Net Income/Profit represents the money the business has "earned" over the past year. As this is a family business, it includes both farm and non-farm values. This income can either be reinvested in the business (at which point it is part of the "Cash" in the Balance Sheet) or paid out to the owners. Calculate Total Income/Revenue, Total Expenses and Net Income/Profit. This cash flow statement was created using the Indirect Method, which means adjustments to the Income Statement were made to reflect the true amount of cash flowing in and out of the business. Calculate the Cash Generated by Operating Activities and the Total Cash Flow. Is cash flow positive or negative relative to last year? Is the Cash Generated by Operating Activities positive or negative relative to Net Income? Question 2 10 out of 10 points What are total liabilities? Write just the numeric value. 28500 Question 3 10 out of 10 points What is equityet worth? Write just the numeric value. 120500 Question 4 10 out of 10 points What the current ratio? Write just the numeric value, rounded to two decimal places. 8.09 Question 5 10 out of 10 points What is the debt to equity ratio? Write just the numeric value, rounded to two decimal places. 0.24 Question 6 0 out of 10 points What is the return on assets? Write just the numeric value, rounded to two decimal places. 18.206 Question 7 10 out of 10 points What is the return on assets, excluding income from the second job and family living expenses? Write just the numeric value, rounded to two decimal places. 1.90 Question 8 0 out of 10 points What is the Cash Generated by Operating Activities? Write just the numeric value. 40628 Question 9 0 out of 10 points What is the Total Cash Flow ? Write just the numeric value