Answered step by step

Verified Expert Solution

Question

1 Approved Answer

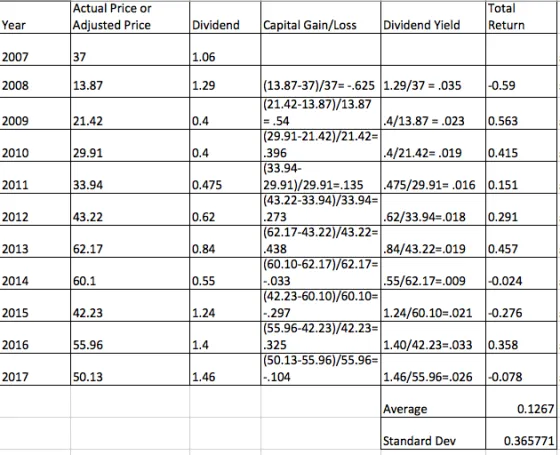

Based on the below chart, what is the total risk of this company? The average return and standard deviation for the S&P500 are around 10%

Based on the below chart, what is the total risk of this company? The average return and standard deviation for the S&P500 are around 10% and 18% respectively for the same period. Did your company outperform or underperform the S&P 500 index? Isyour company's stock riskier than the S&P 500 index?

Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Actual Price or Adjusted Price 37 13.87 21.42 29.91 33.94 43.22 62.17 60.1 42.23 55.96 50.13 Dividend Capital Gain/Loss 1.06 1.29 0.4 0.4 0.475 0.62 0.84 0.55 1.24 1.4 1.46 =.54 (13.87-37)/37=-.625 1.29/37 = .035 (21.42-13.87)/13.87 4/13.87 = .023 |(29.91-21.42)/21.42= 4/21.42= .019 29.91)/29.91-.135 475/29.91= .016 0.151 (43.22-33.94)/33.94= .62/33.94-.018 0.291 (62.17-43.22)/43.22= .84/43.22=.019 0.457 (60.10-62.17)/62.17= 55/62.17=.009 -0.024 (42.23-60.10)/60.10= 1.24/60.10=.021 -0.276 (55.96-42.23)/42.23= 1.40/42.23.033 0.358 (50.13-55.96)/55.96= 1.46/55.96-.026 -0.078 .396 (33.94- .273 .438 -.033 -.297 .325 Dividend Yield -.104 Total Return Average Standard Dev -0.59 0.563 0.415 0.1267 0.365771

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the total risk of the company you can use the standard deviation of the tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started