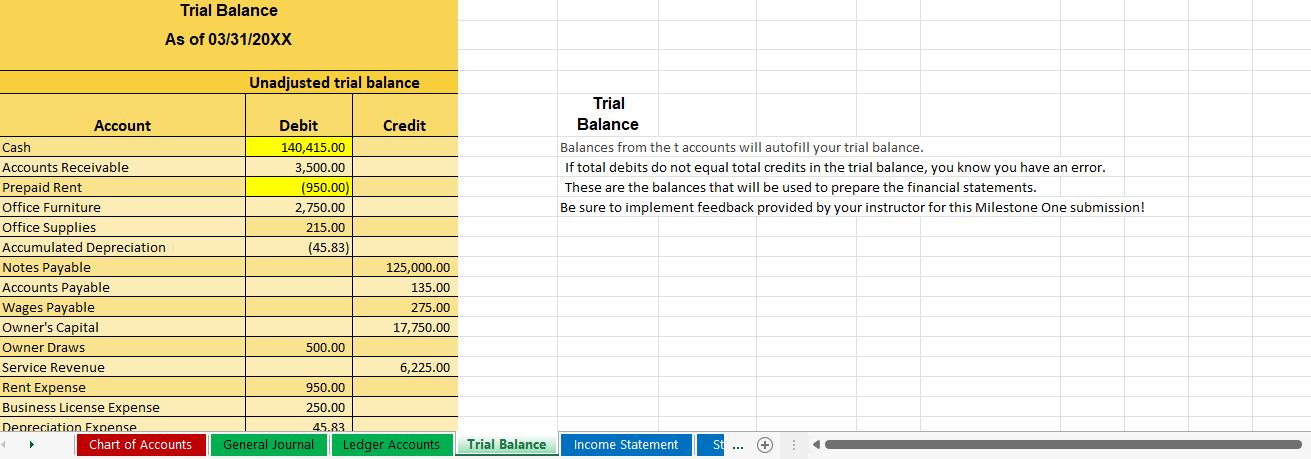

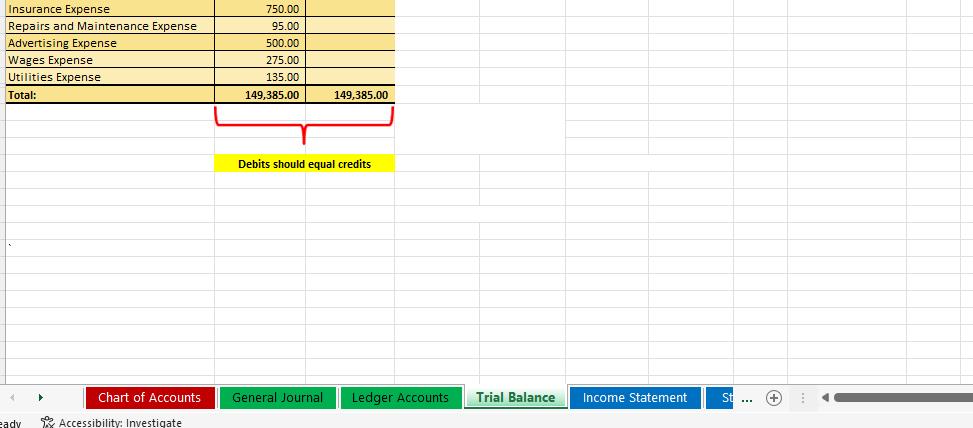

Based on the below, identify on the Ledger Accounts and Trial Balance HIGHLIGHTED YELLOW information which identified to be inaccurate? correct the inaccurate figures The

Based on the below, identify on the "Ledger Accounts" and "Trial Balance" HIGHLIGHTED YELLOW information which identified to be inaccurate? correct the inaccurate figures

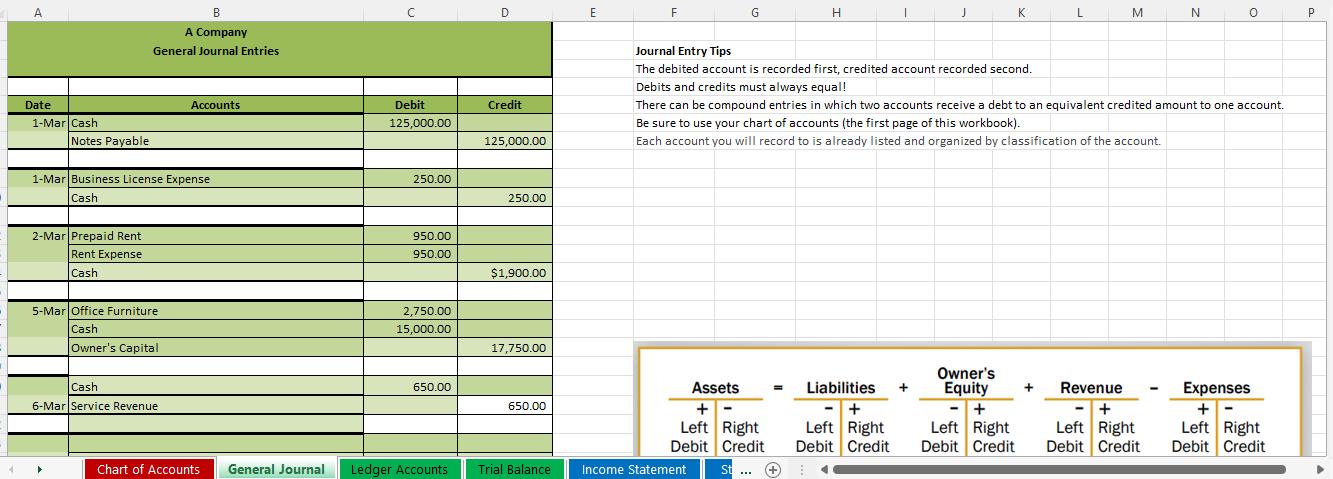

The following events occurred in March:

March 1: Owner borrowed $125,000 to fund/start the business. The loan term is 5 years.

March 1: Owner paid $250 to the county for a business license.

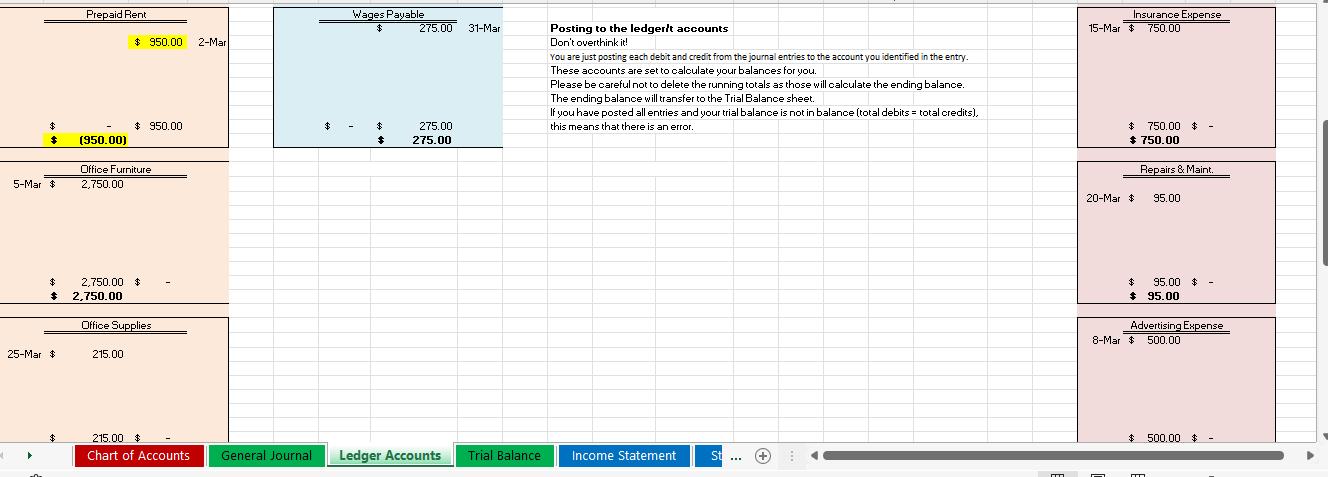

March 2: Owner signed lease on office space; paying first (March 20XX) and last month’s rent of $950 per month.

March 5: Owner contributed office furniture valued at $2,750 and cash in the amount of $15,000 to the business.

March 6: Owner performed service for client in the amount of $650. Customer paid in cash.

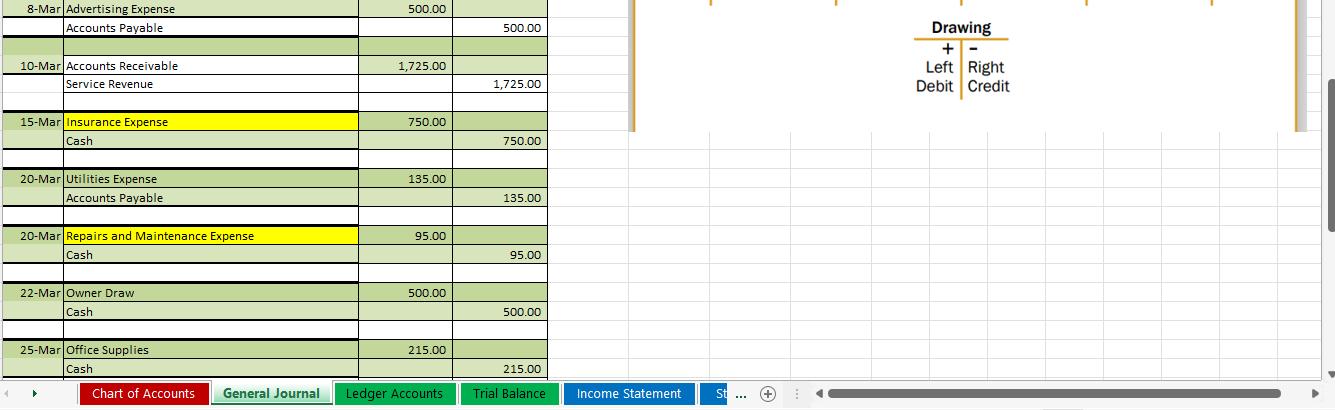

March 8: Owner purchased advertising services on account in the amount of $500.

March 10: Owner provided services to client on account, in the amount of $1,725.

March 15: Owner paid business insurance in the amount of $750.

March 20: The owner received first utility bill in the amount of $135, due in April.

March 20: Office copier required maintenance; owner paid $95.00 for copier servicing.

March 22: Owner withdrew $500 cash for personal use.

March 25: Owner paid $215 for office supplies.

March 25: Owner provided service to client in the amount of $350. Client paid at time of service.

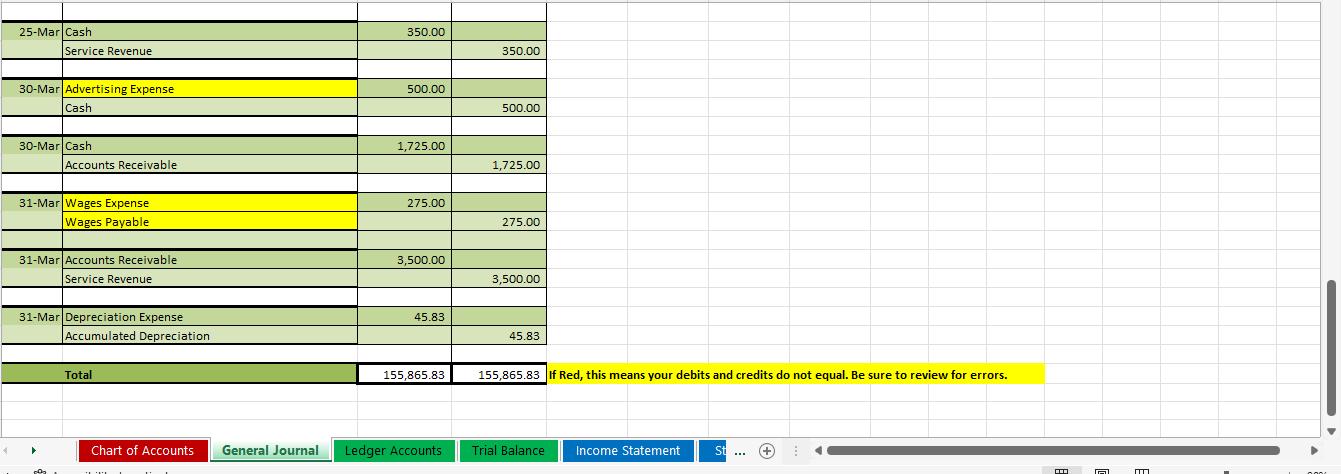

March 30: Owner paid balance due for advertising expense purchase on March 8.

March 30: Received payment from customer for March 10 invoice in the amount of $1,725.

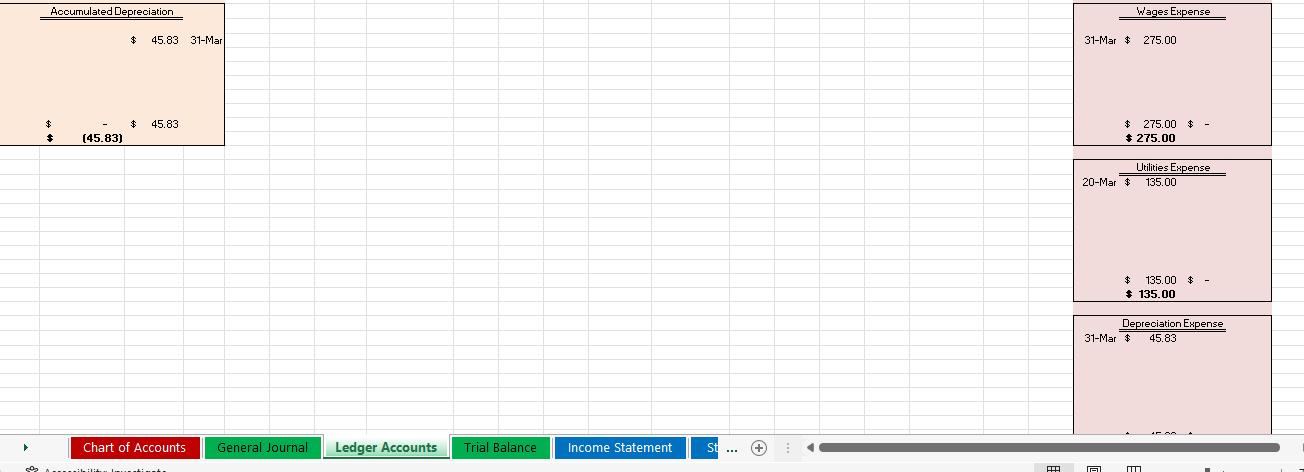

March 31: Last day of pay period; owner owes part-time worker $275 for the March 16 through March 31 pay period. This will be paid on April 5.

March 31: Provided service for client on account in the amount of $3,500.

March 31: Record depreciation of the office furniture at $45.83.

4 A Date 1-Mar Cash Notes Payable 2-Mar Prepaid Rent Rent Expense Cash B A Company General Journal Entries 1-Mar Business License Expense Cash 5-Mar Office Furniture Cash Owner's Capital Cash 6-Mar Service Revenue Accounts Chart of Accounts Debit 125,000.00 250.00 950.00 950.00 2,750.00 15,000.00 650.00 D Credit 125,000.00 250.00 $1,900.00 17,750.00 650.00 General Journal Ledger Accounts Trial Balance E F G Assets + Left Right Debit Credit St... Income Statement H = Liabilities + Left Right Debit Credit J + Journal Entry Tips The debited account is recorded first, credited account recorded second. Debits and credits must always equal! There can be compound entries in which two accounts receive a debt to an equivalent credited amount to one account. Be sure to use your chart of accounts (the first page of this workbook). Each account you will record to is already listed and organized by classification of the account. K Owner's Equity + + Left Right Debit Credit L M N Revenue + Left Right Debit Credit 0 Expenses + Left Right Debit Credit P

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

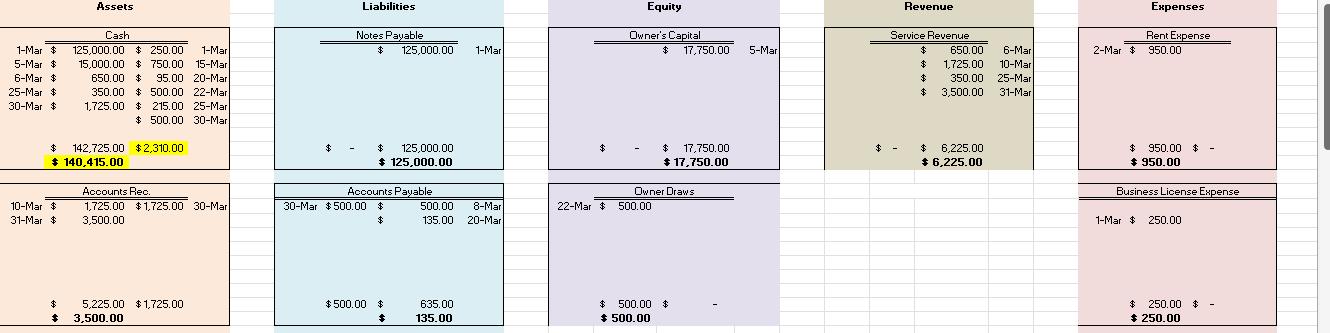

SOLUTIONS Ledger Accounts 1Loan Payable Inaccurate amount The owner borrowed 125000 on March 1 but the amount is not reflected in the ledger A new account should be opened for the loan payable with a ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started