Answered step by step

Verified Expert Solution

Question

1 Approved Answer

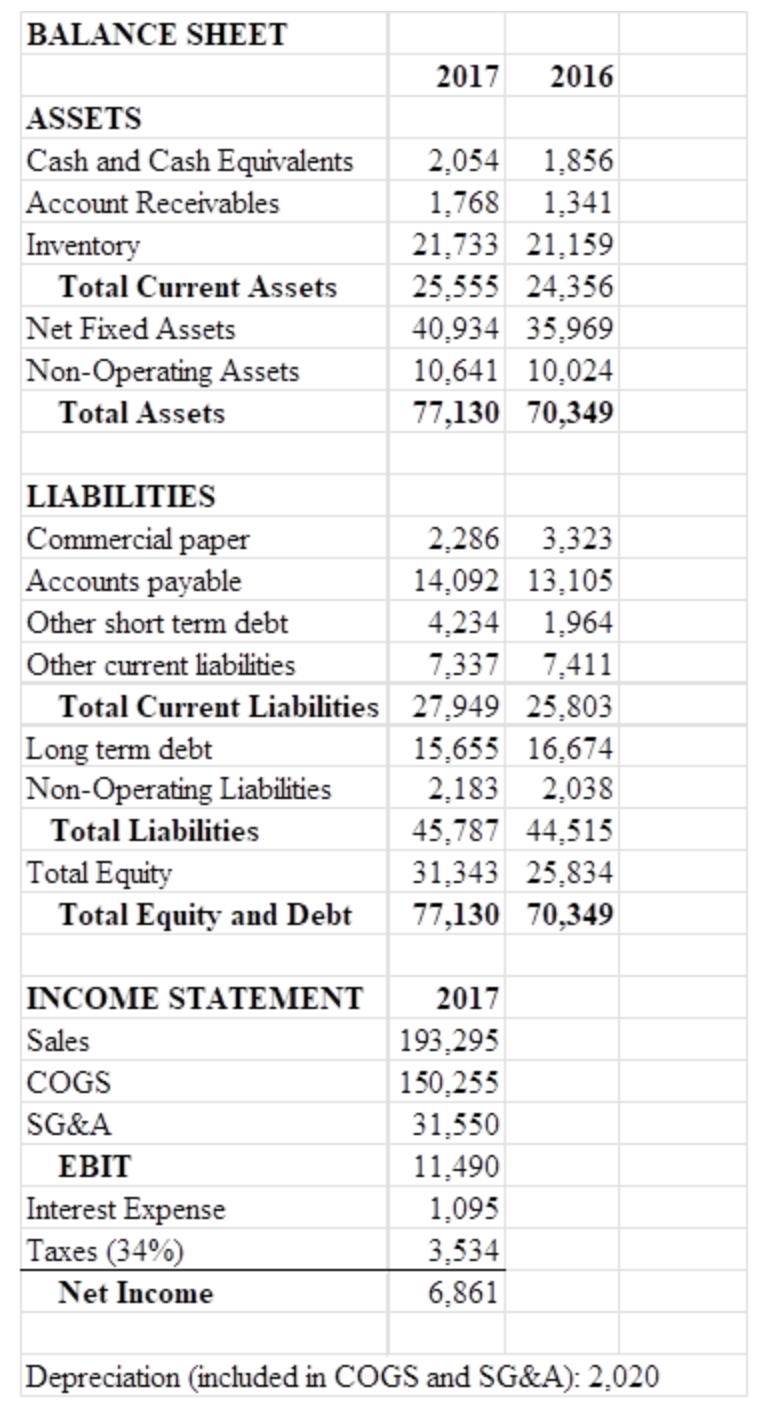

Based on the below information on the 2017 financial statements for XBM-Mart. Its effective tax rate is 34%. To calculate the firm's free cash flow,

Based on the below information on the 2017 financial statements for XBM-Mart. Its effective tax rate is 34%. To calculate the firm's free cash flow, we break it down into the following questions. For each question, round your answer to the nearest integer.

17: Calculate the After-tax Interest Expense.

18: Calculate Investment in Net Working Capital

19: Calculate Investment in Fixed Assets.

20: Finally, what is the Free Cash Flow?

BALANCE SHEET ASSETS Cash and Cash Equivalents Account Receivables Inventory Total Current Assets Net Fixed Assets Non-Operating Assets Total Assets LIABILITIES Commercial paper Accounts payable Other short term debt Other current liabilities Total Current Liabilities Long term debt Non-Operating Liabilities Total Liabilities Total Equity Total Equity and Debt INCOME STATEMENT Sales COGS SG&A EBIT Interest Expense Taxes (34%) Net Income 2017 2016 2,054 1,856 1,768 1,341 21,733 21,159 25,555 24,356 40,934 35,969 10,641 10,024 77,130 70,349 2,286 3,323 14,092 13,105 4,234 1,964 7,337 7,411 27,949 25,803 15,655 16,674 2,183 2,038 45,787 44,515 31,343 25,834 77,130 70,349 2017 193,295 150,255 31,550 11,490 1,095 3,534 6,861 Depreciation (included in COGS and SG&A): 2,020

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

17 Aftertax Interest Expense 1095 x 1 034 719 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started