Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the Bloomberg DDM screenshots below, which company is the most undervalued and which is the most overvalued on a percentage basis? AT&T

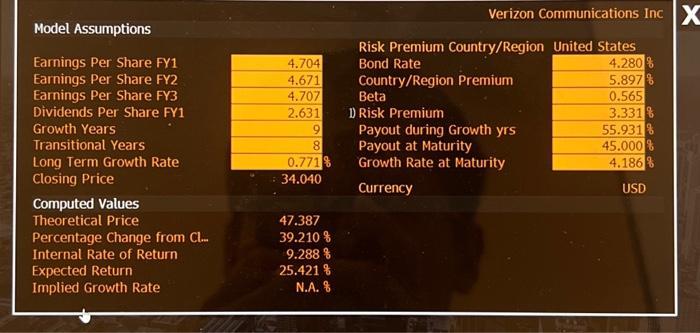

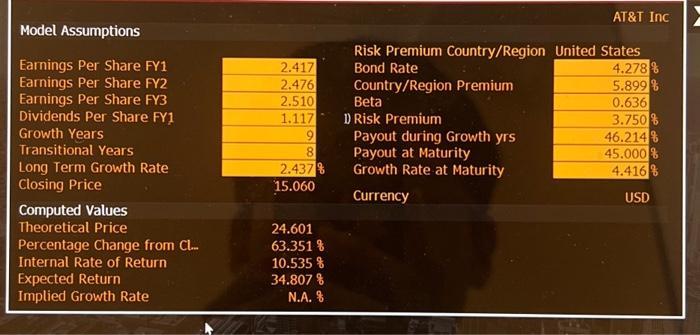

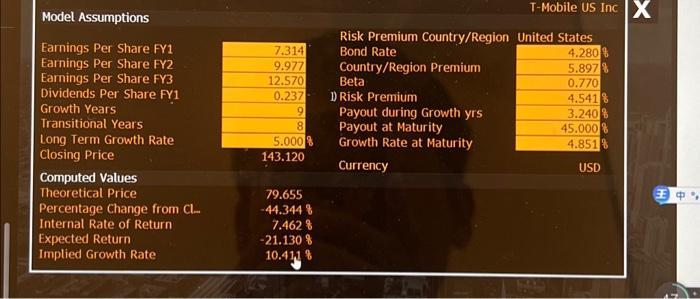

Based on the Bloomberg DDM screenshots below, which company is the most undervalued and which is the most overvalued on a percentage basis? AT&T is the most undervalued and T-Mobile is the most overvalued. AT&T is the most overvalued and T-Mobile is the most undervalued. Verizon is the most undervalued and AT&T is the most overvalued. Model Assumptions Earnings Per Share FY1 Earnings Per Share FY2 Earnings Per Share FY3 Dividends Per Share FY1 Growth Years Transitional Years Long Term Growth Rate Closing Price Computed Values Theoretical Price Percentage Change from Cl... Internal Rate of Return Expected Return Implied Growth Rate 4.704 4.671 4.707 2.631 9 8 0.771% 34.040 47.387 39.210 % 9.288% 25.421 % N.A. % Verizon Communications Inc X Risk Premium Country/Region United States Bond Rate 4.280 % Country/Region Premium Beta 1) Risk Premium Payout during Growth yrs Payout at Maturity Growth Rate at Maturity Currency 5.897% 0.565 3.331 55.931% 45.000% 4.186% USD Model Assumptions Earnings Per Share FY1 Earnings Per Share FY2 Earnings Per Share FY3 Dividends Per Share FY1 Growth Years Transitional Years Long Term Growth Rate Closing Price Computed Values Theoretical Price Percentage Change from Cl... Internal Rate of Return Expected Return Implied Growth Rate 2.417 2.476 2.510 1.117 9 8 2.437% 15.060 24.601 63.351 % 10.535% 34.807 % N.A. % Risk Premium Country/Region United States Bond Rate Country/Region Premium Beta 1) Risk Premium AT&T Inc Payout during Growth yrs Payout at Maturity Growth Rate at Maturity Currency 4.278% 5.899% 0.636 3.750% 46.214% 45.000 4.416% USD Model Assumptions Earnings Per Share FY1 Earnings Per Share FY2 Earnings Per Share FY3 Dividends Per Share FY1 Growth Years Transitional Years Long Term Growth Rate Closing Price Computed Values Theoretical Price Percentage Change from Cl.. Internal Rate of Return Expected Return Implied Growth Rate 7.314 9.977 12.570 0.237 9 8 5.000% 143.120 14 79.655 -44.3448 7.462 % -21.130% 10.411 % Risk Premium Country/Region United States Bond Rate Country/Region Premium Beta 1) Risk Premium Payout during Growth yrs Payout at Maturity Growth Rate at Maturity Currency T-Mobile US Inc X EXAN Wilkin 4.280% 5.897% 0.770 4.5418 3.2408 45.000% 4.851% USD

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started