Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the calculation for financial ratios, interpret, and compare the performance for the year 2022 on the companies on the following categories of ratio:

- Based on the calculation for financial ratios, interpret, and compare the performance for the year 2022 on the companies on the following categories of ratio:

Liquidity:

i. Current ratio

ii. Quick ratio

references :

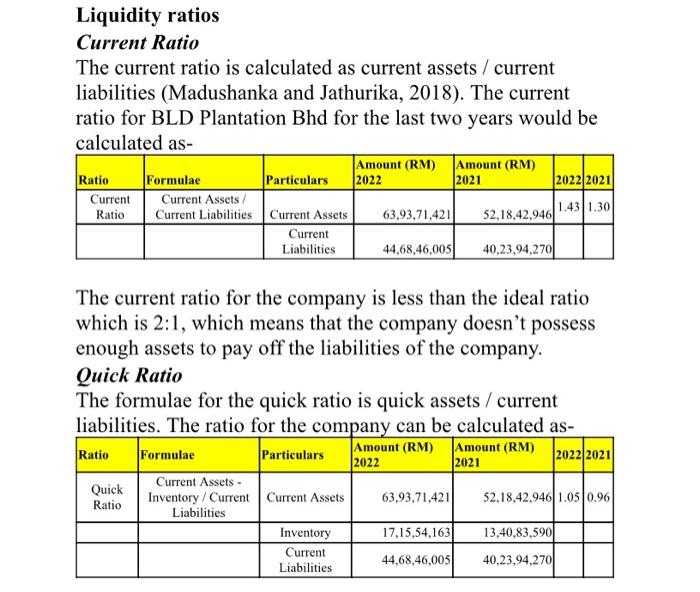

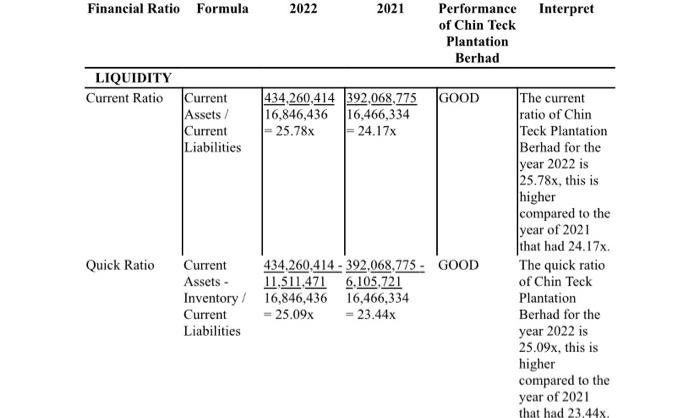

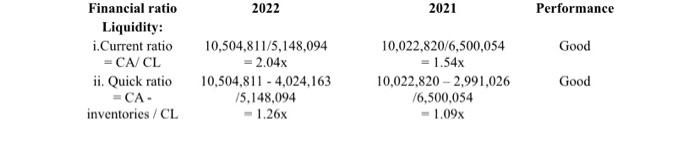

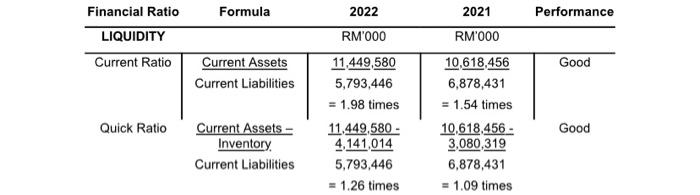

Liquidity ratios Current Ratio The current ratio is calculated as current assets / current liabilities (Madushanka and Jathurika, 2018). The current ratio for BLD Plantation Bhd for the last two years would be calculated as- The current ratio for the company is less than the ideal ratio which is 2:1, which means that the company doesn't possess enough assets to pay off the liabilities of the company. Quick Ratio The formulae for the quick ratio is quick assets / current liabilities. The ratio for the company can be calculated as- FinancialratioLiquidity:i.Currentratio=CA/CLii.Quickratio=CA-inventories/CL202210,504,811/5,148,094=2.04x10,504,8114,024,16315,148,094=1.26x202110,022,820/6,500,054=1.54x10,022,8202,991,02616,500,054=1.09xPerformance Liquidity ratios Current Ratio The current ratio is calculated as current assets / current liabilities (Madushanka and Jathurika, 2018). The current ratio for BLD Plantation Bhd for the last two years would be calculated as- The current ratio for the company is less than the ideal ratio which is 2:1, which means that the company doesn't possess enough assets to pay off the liabilities of the company. Quick Ratio The formulae for the quick ratio is quick assets / current liabilities. The ratio for the company can be calculated as- FinancialratioLiquidity:i.Currentratio=CA/CLii.Quickratio=CA-inventories/CL202210,504,811/5,148,094=2.04x10,504,8114,024,16315,148,094=1.26x202110,022,820/6,500,054=1.54x10,022,8202,991,02616,500,054=1.09xPerformance 1. http://www.bldpb.com.my/downloads/AR2022.pdf

2. https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=221844&name=EA_DS_ATTACHMENTS

3. https://www.klk.com.my/wp-content/uploads/2023/01/Annual-Report-2022-1.pdf

4. https://www.bursamalaysia.com/market_information/announcements/company_announcement?company=1899&cat=AR,ARCO

5. https://www.malaysiastock.biz/Listed-Companies.aspx?type=S&s1=12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started