Answered step by step

Verified Expert Solution

Question

1 Approved Answer

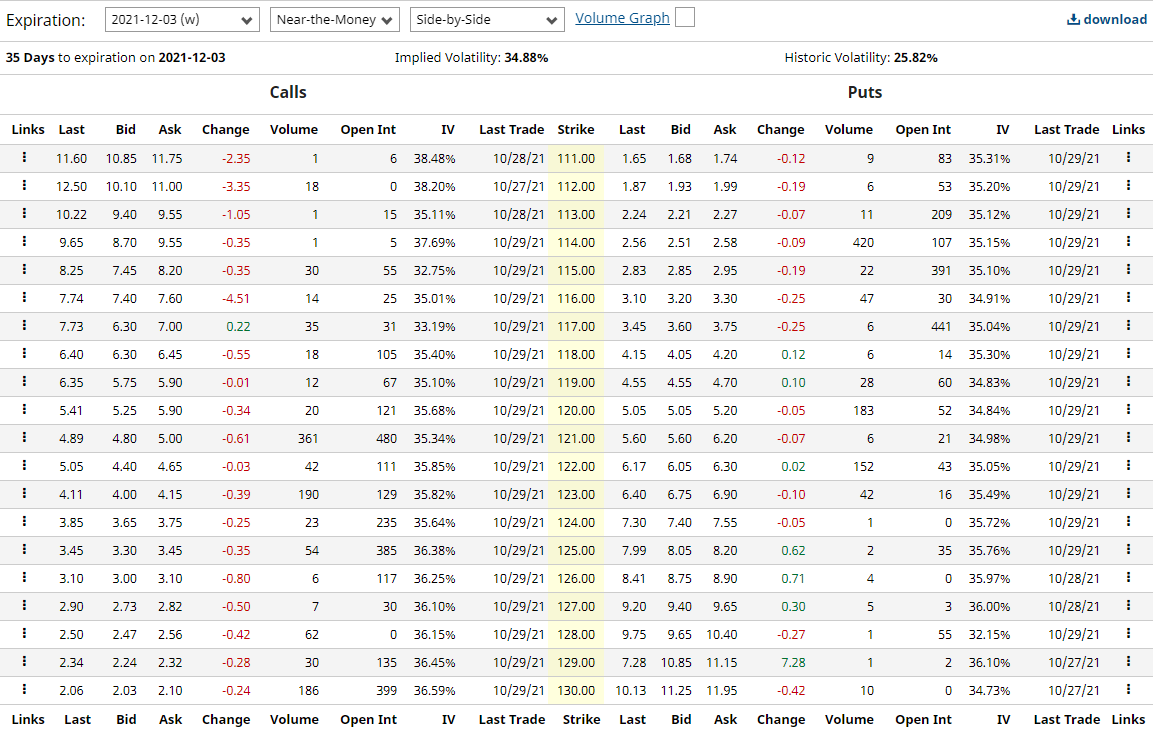

Based on the chart, Please fill in the chart by calculating Strike, Breakeven Point, Max Profit, and Max Loss for the Bull Call Spread (Include

Based on the chart, Please fill in the chart by calculating Strike, Breakeven Point, Max Profit, and Max Loss for the Bull Call Spread (Include the math for your net premium PAID) (Please show work for calculation for each column)

Net Premium PAID:

Chart:

| Strike = ? | Breakeven Point | Max Profit | Max Loss |

| N/A | N/A | N/A |

Guidance:

Select a strike for the long call that is a few (1 or 2) price notches above the current market price. The strike for the short call should be 1 or 2 notches above the strike on the long call (i.e., the lower-priced call).

Expiration: 2021-12-03 (w) Near-the-Money Side-by-Side V Volume Graph download 35 Days to expiration on 2021-12-03 Implied Volatility: 34.88% Historic Volatility: 25.82% Calls Puts Links Last Bid Ask Change Volume Open Int IV Last Trade Strike Last Bid Ask Change Volume Open Int IV Last Trade Links 11.60 10.85 11.75 -2.35 1 6 38.48% 10/28/21 111.00 1.65 1.68 1.74 -0.12 9 83 35.31% 10/29/21 12.50 10.10 11.00 -3.35 18 0 38.20% 10/27/21 112.00 1.87 1.93 1.99 -0.19 6 53 35.20% 10/29/21 10.22 9.40 9.55 -1.05 1 15 35.11% % 10/28/21 113.00 2.24 2.21 2.27 -0.07 11 209 35.12% 10/29/21 9.65 8.70 9.55 -0.35 1 5 37.69% 10/29/21 114.00 2.56 2.51 2.58 -0.09 420 107 35.15% 10/29/21 8.25 7.45 8.20 -0.35 30 55 32.75% 10/29/21 115.00 2.83 2.85 2.95 -0.19 22 391 35.10% 10/29/21 7.74 7.40 7.60 -4.51 14 25 35.01% 10/29/21 116.00 3.10 3.20 3.30 -0.25 47 30 34.91% 10/29/21 7.73 6.30 7.00 0.22 35 31 33.19% 10/29/21 117.00 3.45 3.60 3.75 -0.25 6 441 35.04% 10/29/21 6.40 6.30 6.45 -0.55 18 105 35.40% 10/29/21 118.00 4.15 4.05 4.20 0.12 6 14 35.30% 10/29/21 6.35 5.75 5.90 -0.01 12 67 35.10% 10/29/21 119.00 4.55 4.55 4.70 0.10 28 60 34.83% 10/29/21 5.41 5.25 5.90 -0.34 20 121 35.68% 10/29/21 120.00 5.05 5.05 5.20 -0.05 183 52 34.84% 10/29/21 4.89 4.80 5.00 -0.61 361 480 35.34% 10/29/21 121.00 5.60 5.60 6.20 -0.07 6 21 34.98% 10/29/21 5.05 4.40 4.65 -0.03 42 111 35.85% 10/29/21 122.00 6.17 6.05 6.30 0.02 152 43 35.05% 10/29/21 4.11 4.00 4.15 -0.39 190 129 35.82% 10/29/21 123.00 6.40 6.75 6.90 -0.10 42 16 35.49% 10/29/21 3.85 3.65 3.75 -0.25 23 235 35.64% 10/29/21 124.00 7.30 7.40 7.55 -0.05 1 0 35.72% 10/29/21 : 3.45 3.30 3.45 -0.35 54 385 36.38% 10/29/21 125.00 7.99 8.05 8.20 0.62 2 35 35.76% 10/29/21 3.10 3.00 3.10 -0.80 6 117 36.25% 10/29/21 126.00 8.41 8.75 8.90 0.71 4 0 35.97% 10/28/21 2.90 2.73 2.82 -0.50 7 30 36.10% 10/29/21 127.00 9.20 9.40 9.65 0.30 5 3 36.00% 10/28/21 2.50 2.47 2.56 -0.42 62 0 36.15% 10/29/21 128.00 9.75 9.65 10.40 -0.27 1 55 32.15% 10/29/21 1 2.34 2.24 2.32 -0.28 30 135 36.45% 10/29/21 129.00 7.28 10.85 11.15 7.28 1 2 36.10% 10/27/21 2.06 2.03 2.10 -0.24 186 399 36.59% 10/29/21 130.00 10.13 11.25 11.95 -0.42 10 0 34.73% 10/27/21 1 Links Last Bid Ask Change Volume Open Int IV Last Trade Strike Last Bid Ask Change Volume Open Int IV Last Trade Links Expiration: 2021-12-03 (w) Near-the-Money Side-by-Side V Volume Graph download 35 Days to expiration on 2021-12-03 Implied Volatility: 34.88% Historic Volatility: 25.82% Calls Puts Links Last Bid Ask Change Volume Open Int IV Last Trade Strike Last Bid Ask Change Volume Open Int IV Last Trade Links 11.60 10.85 11.75 -2.35 1 6 38.48% 10/28/21 111.00 1.65 1.68 1.74 -0.12 9 83 35.31% 10/29/21 12.50 10.10 11.00 -3.35 18 0 38.20% 10/27/21 112.00 1.87 1.93 1.99 -0.19 6 53 35.20% 10/29/21 10.22 9.40 9.55 -1.05 1 15 35.11% % 10/28/21 113.00 2.24 2.21 2.27 -0.07 11 209 35.12% 10/29/21 9.65 8.70 9.55 -0.35 1 5 37.69% 10/29/21 114.00 2.56 2.51 2.58 -0.09 420 107 35.15% 10/29/21 8.25 7.45 8.20 -0.35 30 55 32.75% 10/29/21 115.00 2.83 2.85 2.95 -0.19 22 391 35.10% 10/29/21 7.74 7.40 7.60 -4.51 14 25 35.01% 10/29/21 116.00 3.10 3.20 3.30 -0.25 47 30 34.91% 10/29/21 7.73 6.30 7.00 0.22 35 31 33.19% 10/29/21 117.00 3.45 3.60 3.75 -0.25 6 441 35.04% 10/29/21 6.40 6.30 6.45 -0.55 18 105 35.40% 10/29/21 118.00 4.15 4.05 4.20 0.12 6 14 35.30% 10/29/21 6.35 5.75 5.90 -0.01 12 67 35.10% 10/29/21 119.00 4.55 4.55 4.70 0.10 28 60 34.83% 10/29/21 5.41 5.25 5.90 -0.34 20 121 35.68% 10/29/21 120.00 5.05 5.05 5.20 -0.05 183 52 34.84% 10/29/21 4.89 4.80 5.00 -0.61 361 480 35.34% 10/29/21 121.00 5.60 5.60 6.20 -0.07 6 21 34.98% 10/29/21 5.05 4.40 4.65 -0.03 42 111 35.85% 10/29/21 122.00 6.17 6.05 6.30 0.02 152 43 35.05% 10/29/21 4.11 4.00 4.15 -0.39 190 129 35.82% 10/29/21 123.00 6.40 6.75 6.90 -0.10 42 16 35.49% 10/29/21 3.85 3.65 3.75 -0.25 23 235 35.64% 10/29/21 124.00 7.30 7.40 7.55 -0.05 1 0 35.72% 10/29/21 : 3.45 3.30 3.45 -0.35 54 385 36.38% 10/29/21 125.00 7.99 8.05 8.20 0.62 2 35 35.76% 10/29/21 3.10 3.00 3.10 -0.80 6 117 36.25% 10/29/21 126.00 8.41 8.75 8.90 0.71 4 0 35.97% 10/28/21 2.90 2.73 2.82 -0.50 7 30 36.10% 10/29/21 127.00 9.20 9.40 9.65 0.30 5 3 36.00% 10/28/21 2.50 2.47 2.56 -0.42 62 0 36.15% 10/29/21 128.00 9.75 9.65 10.40 -0.27 1 55 32.15% 10/29/21 1 2.34 2.24 2.32 -0.28 30 135 36.45% 10/29/21 129.00 7.28 10.85 11.15 7.28 1 2 36.10% 10/27/21 2.06 2.03 2.10 -0.24 186 399 36.59% 10/29/21 130.00 10.13 11.25 11.95 -0.42 10 0 34.73% 10/27/21 1 Links Last Bid Ask Change Volume Open Int IV Last Trade Strike Last Bid Ask Change Volume Open Int IV Last Trade Links

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started