Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the company's growth forecast, will it likely need additional external financing or have excess financing in the next operating cycle? State the amount

Based on the company's growth forecast, will it likely need additional external financing or have excess financing in the next operating cycle? State the amount that would be needed or held in excess. For possible partial credit, be sure to show as much work as possible. Make sure your final answer is clearly labeled.

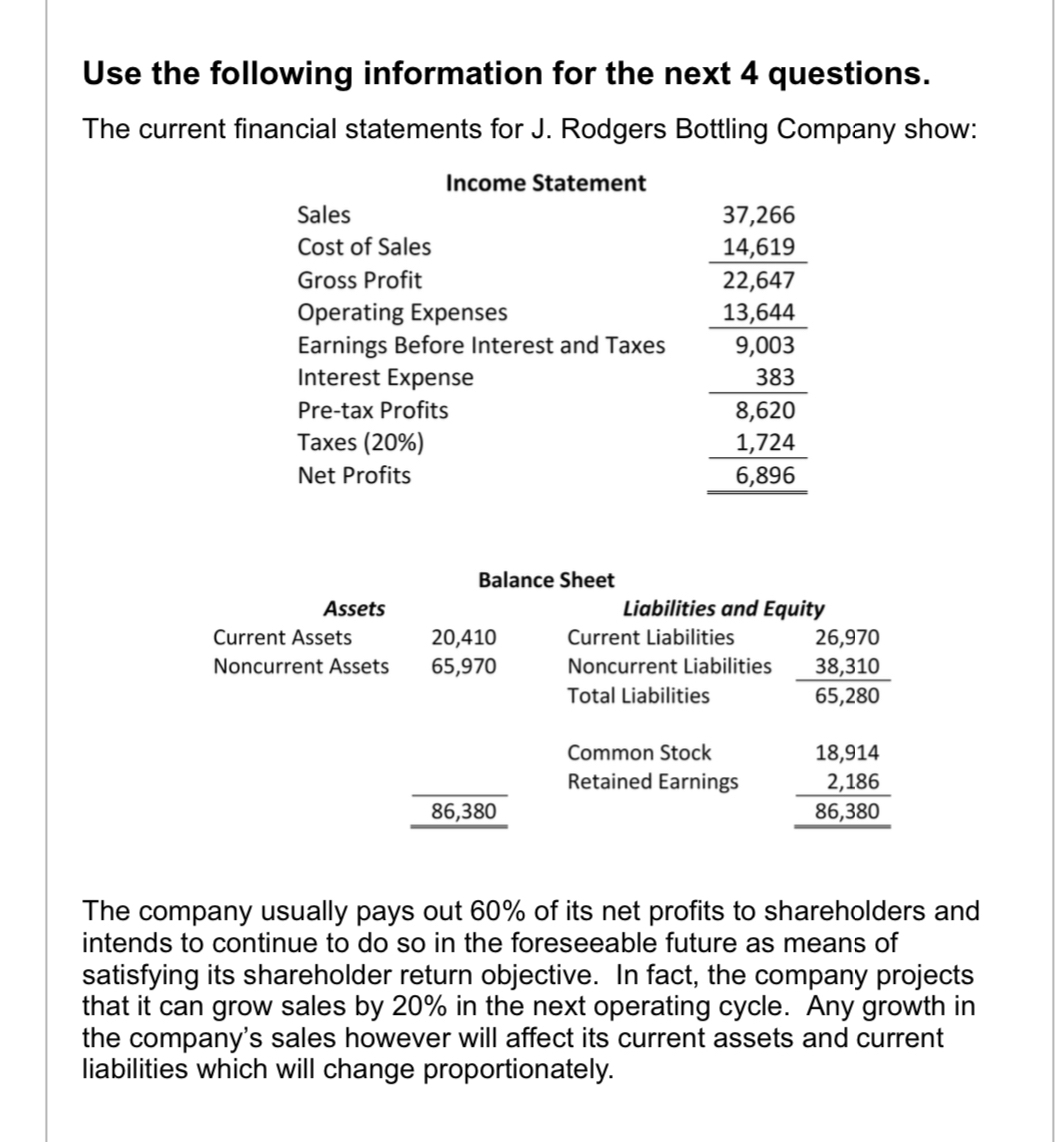

Use the following information for the next questions.

The current financial statements for J Rodgers Bottling Company show:

tableIncome Statement,SalesCost of Sales,Gross Profit,Operating Expenses,Earnings Before Interest and Taxes,Interest Expense,Pretax Profits,Taxes Net Profits,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started