Answered step by step

Verified Expert Solution

Question

1 Approved Answer

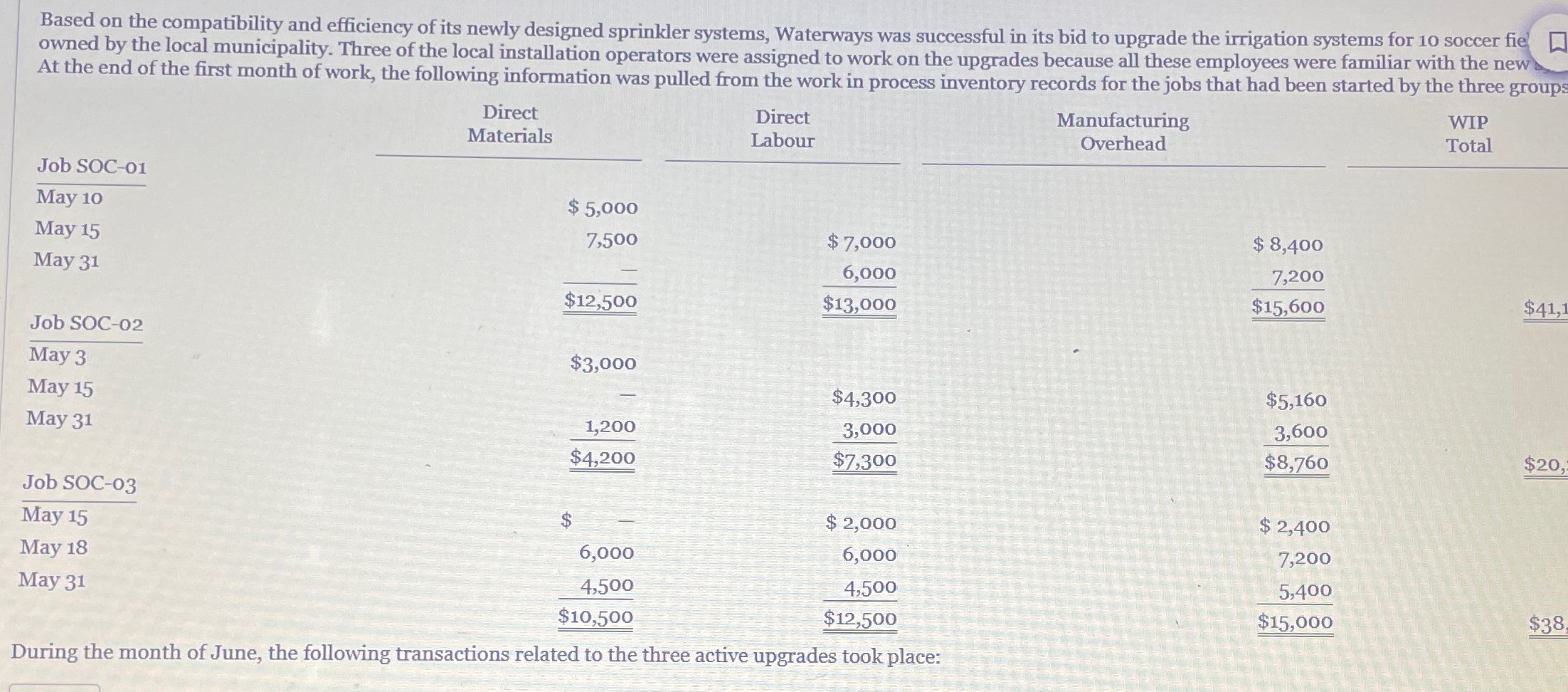

Based on the compatibility and efficiency of its newly designed sprinkler systems, Waterways was successful in its bid to upgrade the irrigation systems for 1

Based on the compatibility and efficiency of its newly designed sprinkler systems, Waterways was successful in its bid to upgrade the irrigation systems for soccer fie

owned by the local municipality. Three of the local installation operators were assigned to work on the upgrades because all these employees were familiar with the new

At the end of the first month of work, the following information was pulled from the work in process inventory records for the jobs that had been started by the three groups

During the month of June, the following transactions related to the three active upgrades took place:During the month of June, the following transactions related to the three active upgrades took place: June

Requisitioned site supplies from raw materials inventoryJob SOC $; Job SOC $ June

Annual construction liability insurance premium paid for three site crews, $ June Monthly rental

of small equipment for all three sites, $ June Requisitioned site supplies from raw materials

inventoryJob SOC $ June Requisitioned direct materials from raw materials inventoryJob SOC $; Job SOC $; Job SOC $ June Paid direct labour costs: Job SOC $; Job

SOC $; Job SOC $ June Job SOC completed. June Requisitioned direct materials

from raw materials inventoryJob SOC $ June Requisitioned site supplies from raw materials

inventoryJob SOC $ June Job SOC completed. June Monthly depreciation on large

equipment for three sites, $ June Paid direct labour costs: Job SOC $; Job SOC

$ June Paid salary for site supervisors, delivery driver, and site cleaners, $ June Paid

rent for onsite portable toilets and garbage containers for the month, $ Instructions Using just the

information provided from the work in process balances for May calculate the predetermined

overhead rate that Waterways has been using for its installations. Waterways writes off any balance in the

manufacturing overhead account to Cost of Goods Sold at the end of every month. Assuming that all the

transactions listed above are related to the three upgrades, calculate the balance in the manufacturing

overhead account at the end of June, and indicate if it is over or underapplied. Prepare summary journal

entries to record all the transactions for the month of June. Dates and explanations are not required.

Determine the balance in the Work in Process account at the end of the month, and reconcile this balance

to the jobs not completed at the end of the month. Waterways received a contract price of $ for

each upgrade completed. Determine the gross profit on the completed jobs during the month of June

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started