Question

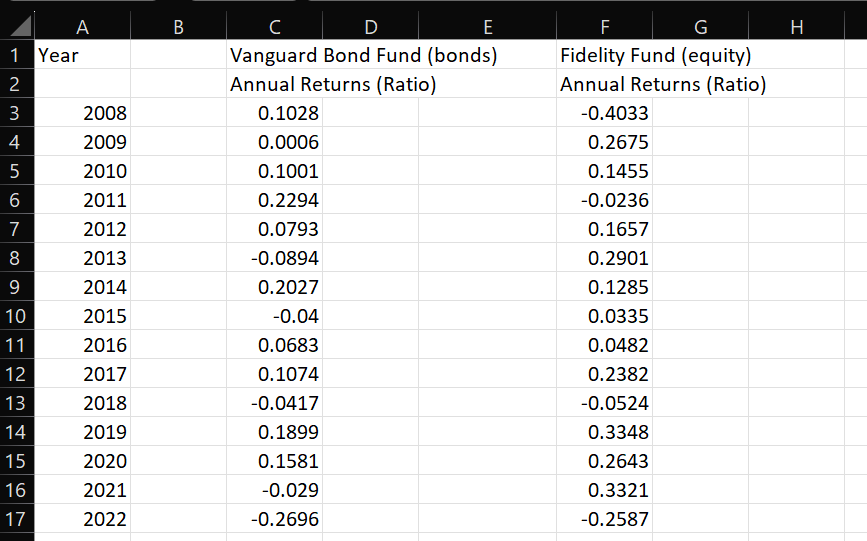

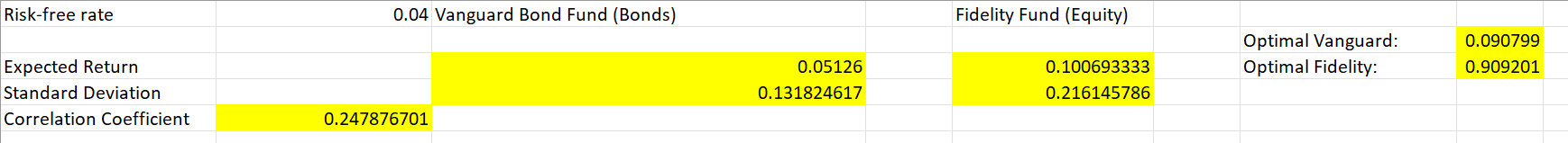

Based on the data and the optimal risky portfolio above, calculate the following optimal complete portfolio, comprised of a bond and equity fund. for a

Based on the data and the optimal risky portfolio above, calculate the following optimal complete portfolio, comprised of a bond and equity fund. for a client looking to invest $100,000. There are two classes of funds that you are able to purchase for your clients portfolio, class A and class B funds. The class A funds have a front-end load fee of 4% and an annual operating expense fee of 1%. The class B funds have no front-end load fee and an annual operating expense fee of 1.5%. The client has a risk aversion score of 3.5, and a holding period of 14. These are the items that need to be calculated:

- Ending dollar amount in risk-free

- Ending dollar amount risky (Class A)

- Ending dollar amount risky (Class B)

- Ending dollar amount total (Class A)

- Ending dollar amount total (Class B)

- Expected returns from Risky Portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started