Question

Based on the Expected Return of the portfolio calculated in the previous section, and comparing it to the market portfolio. I. Would you consider Susannes

Based on the Expected Return of the portfolio calculated in the previous section, and comparing it to the market portfolio.

I. Would you consider Susannes portfolio to be a high-growth strategy portfolio? (2 points)

II. If the computed standard deviation of Susannes portfolio is 18%. Is Susannes portfolio riskier than the market portfolio? Please explain your choice. (3 points)

Adam, a CEO of a tech company is a client of Extreme Wealth Funds and is considering parking his $5 million bonus he received last year in Susannes portfolio. He remembered learning about the concept of Security Market Line (SML) and CAPM back in his MBA classes. And he wants to use this concept to determine if investing in Susannes portfolio is indeed a good decision.

Using information in the table from Part A, and assuming that the Beta of Susannes portfolio is 3.

Calculate

I. The Required Return of Susannes portfolio according to CAPM (the risk-free rate is the expected return of long-term US government bonds) (5 points)

II. Comparing the expected return calculated in part A, with the required return of Susannes portfolio using CAPM. Should Adam invest in Susannes portfolio? (5 points)

During the portfolio review, Susannes manager asks her to consider adding real-estate as an asset class to her portfolio. Real estate as an asset class has an expected return of 15%, standard deviation of 8%, and a beta if 0.8.

I. In terms of total risk is real estate as an asset class more or less risky than the market portfolio? Explain your choice. (2.5 points)

II. In terms of systematic risk is real estate as an asset class more or less risky than the market portfolio? Explain your choice. (2.5 points)

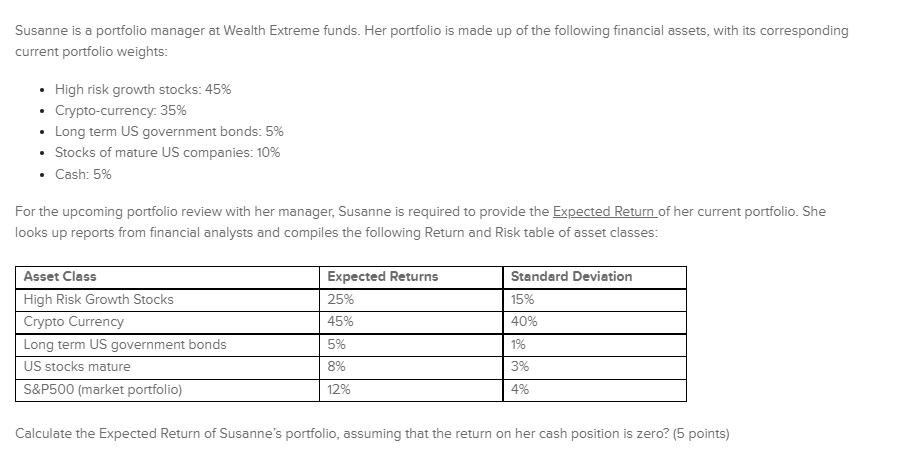

Susanne is a portfolio manager at Wealth Extreme funds. Her portfolio is made up of the following financial assets, with its corresponding current portfolio weights: High risk growth stocks: 45% Crypto-currency: 35% Long term US government bonds: 5% Stocks of mature US companies: 10% Cash: 5% For the upcoming portfolio review with her manager, Susanne is required to provide the Expected Return of her current portfolio. She looks up reports from financial analysts and compiles the following Return and Risk table of asset classes: Asset Class Expected Returns Standard Deviation High Risk Growth Stocks 25% 15% Crypto Currency 45% 40% Long term US government bonds 5% 1% US stocks mature 8% 3% S&P500 (market portfolio) 12% 4% Calculate the Expected Return of Susanne's portfolio, assuming that the return on her cash position is zero? (5 points) Susanne is a portfolio manager at Wealth Extreme funds. Her portfolio is made up of the following financial assets, with its corresponding current portfolio weights: High risk growth stocks: 45% Crypto-currency: 35% Long term US government bonds: 5% Stocks of mature US companies: 10% Cash: 5% For the upcoming portfolio review with her manager, Susanne is required to provide the Expected Return of her current portfolio. She looks up reports from financial analysts and compiles the following Return and Risk table of asset classes: Asset Class Expected Returns Standard Deviation High Risk Growth Stocks 25% 15% Crypto Currency 45% 40% Long term US government bonds 5% 1% US stocks mature 8% 3% S&P500 (market portfolio) 12% 4% Calculate the Expected Return of Susanne's portfolio, assuming that the return on her cash position is zero? (5 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started