Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the following Actuals and Projections construct a Q2 & Q3 Cash Flow Forecast and determine the liquidity ratios for XYZ Corp to see

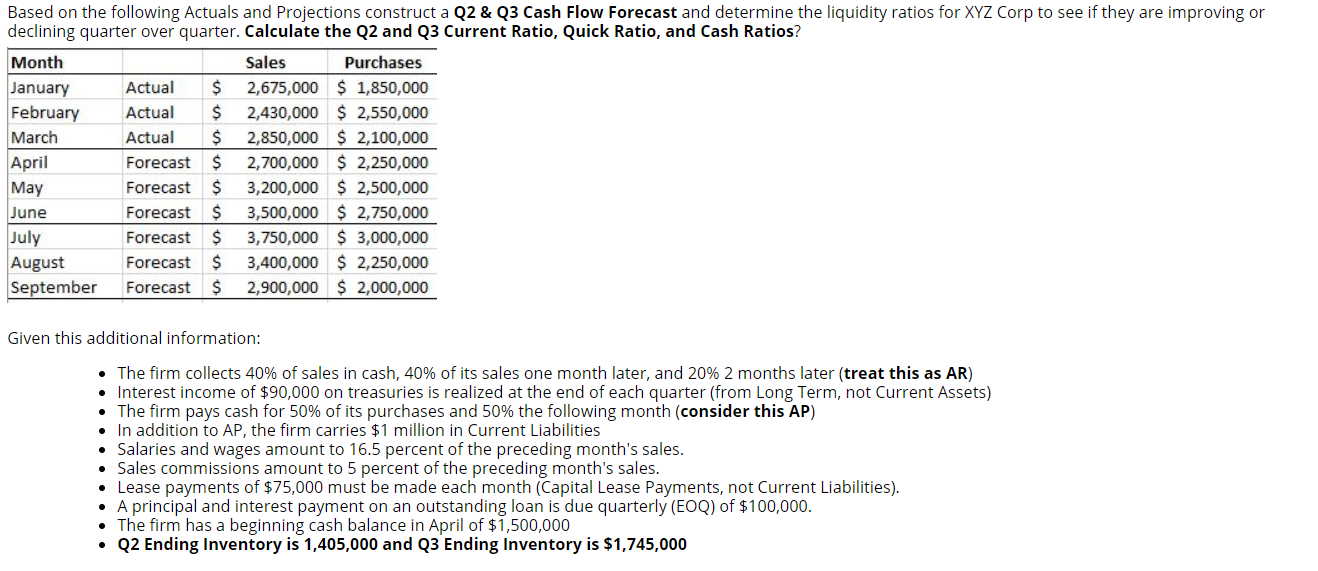

Based on the following Actuals and Projections construct a Q2 & Q3 Cash Flow Forecast and determine the liquidity ratios for XYZ Corp to see if they are improving or declining quarter over quarter. Calculate the Q2 and Q3 Current Ratio, Quick Ratio, and Cash Ratios?

Based on the following Actuals and Projections construct a Q2 & Q3 Cash Flow Forecast and determine the liquidity ratios for XYZ Corp to see if they are improving or declining quarter over quarter. Calculate the Q2 and Q3 Current Ratio, Quick Ratio, and Cash Ratios?

Given this additional information:

- The firm collects 40% of sales in cash, 40% of its sales one month later, and 20% 2 months later (treat this as AR)

- Interest income of $90,000 on treasuries is realized at the end of each quarter (from Long Term, not Current Assets)

- The firm pays cash for 50% of its purchases and 50% the following month (consider this AP)

- In addition to AP, the firm carries $1 million in Current Liabilities

- Salaries and wages amount to 16.5 percent of the preceding month's sales.

- Sales commissions amount to 5 percent of the preceding month's sales.

- Lease payments of $75,000 must be made each month (Capital Lease Payments, not Current Liabilities).

- A principal and interest payment on an outstanding loan is due quarterly (EOQ) of $100,000.

- The firm has a beginning cash balance in April of $1,500,000

- Q2 Ending Inventory is 1,405,000 and Q3 Ending Inventory is $1,745,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started