Answered step by step

Verified Expert Solution

Question

1 Approved Answer

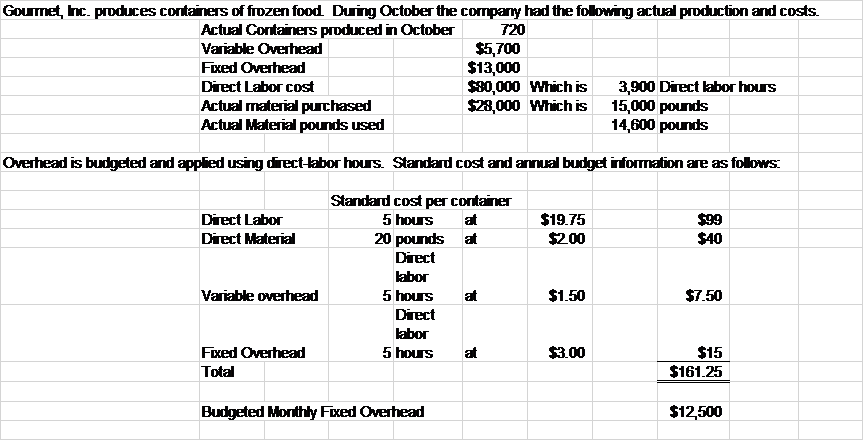

Based on the following information below: 1.Calculate the direct materials price and quantity variance. 2. Calculate the direct labor rate and efficiency variances. 3. Calculate

Based on the following information below:

1.Calculate the direct materials price and quantity variance.

2. Calculate the direct labor rate and efficiency variances.

3. Calculate the variable overhead spending and efficiency variances.

4. Calculate the fixed overhead budget variance.

5. Pick out the two variances that you computed above that you think should be further investigated. Explain why you picked these 2 variances and what might be the possible cause of the variances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started