Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the following information, draw up an Income Statement and a Balance Sheet for Hugh Ltd for 20XX and 20XX+1. The tax rate is

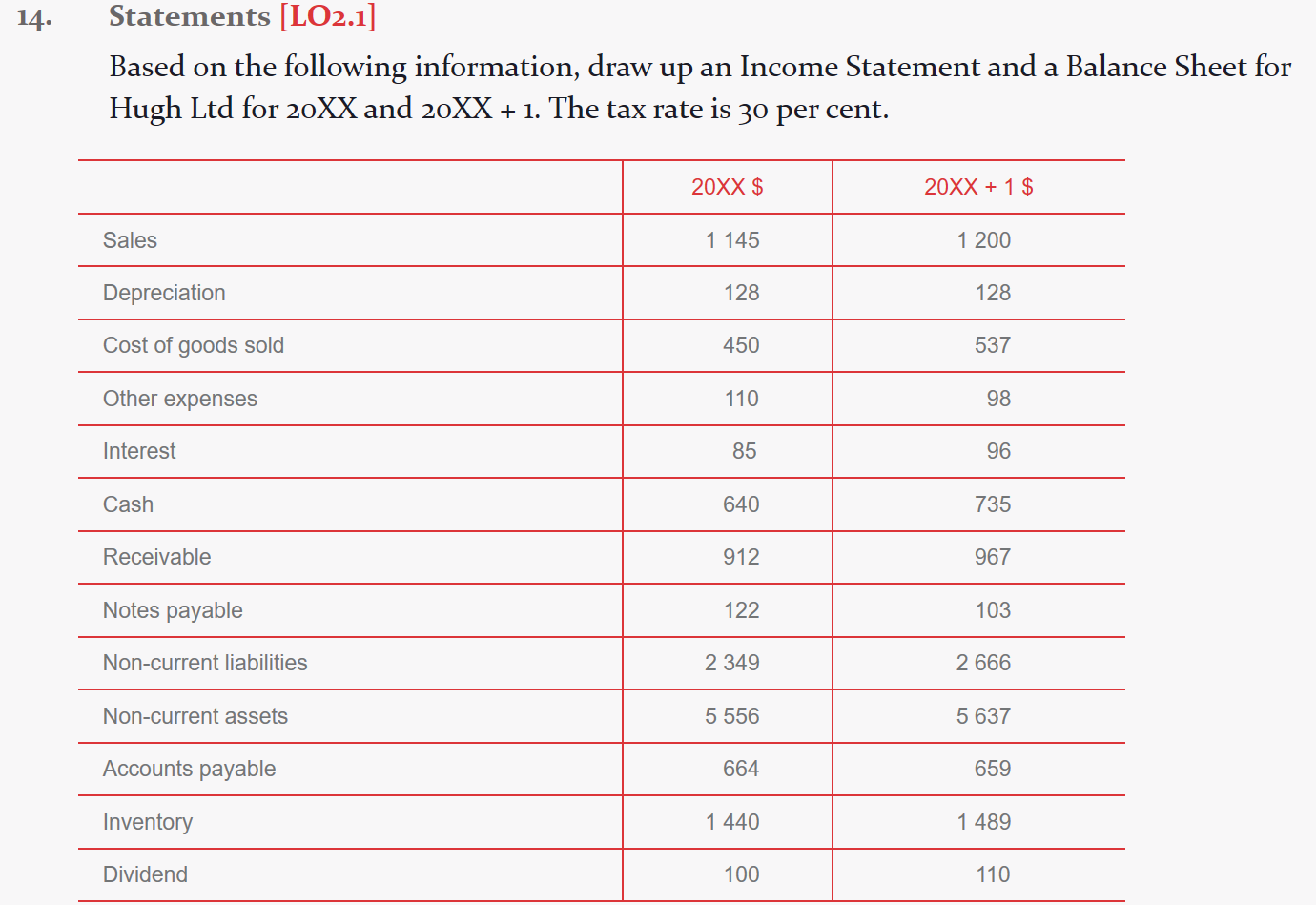

Based on the following information, draw up an Income Statement and a Balance Sheet for Hugh Ltd for 20XX and 20XX+1. The tax rate is 30 per cent.

Using the information in Problem 14, calculate Hughs cash flow from assets, cash flow to debtholders and cash flow to shareholders for 20XX + 1. The tax rate is 30 per cent.

14. Statements [LO2.1] Based on the following information, draw up an Income Statement and a Balance Sheet for Hugh Ltd for 20XX and 20XX + 1. The tax rate is 30 per cent. 20XX $ 20XX + 1 $ Sales 1 145 1 200 Depreciation 128 128 Cost of goods sold 450 537 Other expenses 110 98 Interest 85 96 Cash 640 735 Receivable 912 967 Notes payable 122 103 Non-current liabilities 2 349 2 666 Non-current assets 5 556 5 637 Accounts payable 664 659 Inventory 1 440 1 489 Dividend 100 110Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started