Question

Based on the following JBHs projected free cash flows to equity holders between 2020 and 2022, estimate the total equity value of JBH using the

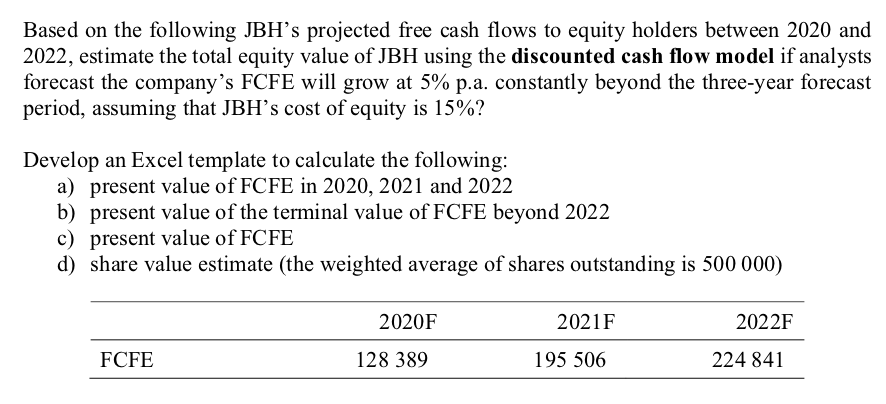

Based on the following JBHs projected free cash flows to equity holders between 2020 and 2022, estimate the total equity value of JBH using the discounted cash flow model if analysts forecast the companys FCFE will grow at 5% p.a. constantly beyond the three-year forecast period, assuming that JBHs cost of equity is 15%? Develop an Excel template to calculate the following: a) present value of FCFE in 2020, 2021 and 2022 b) present value of the terminal value of FCFE beyond 2022 c) present value of FCFE d) share value estimate (the weighted average of shares outstanding is 500 000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started