Answered step by step

Verified Expert Solution

Question

1 Approved Answer

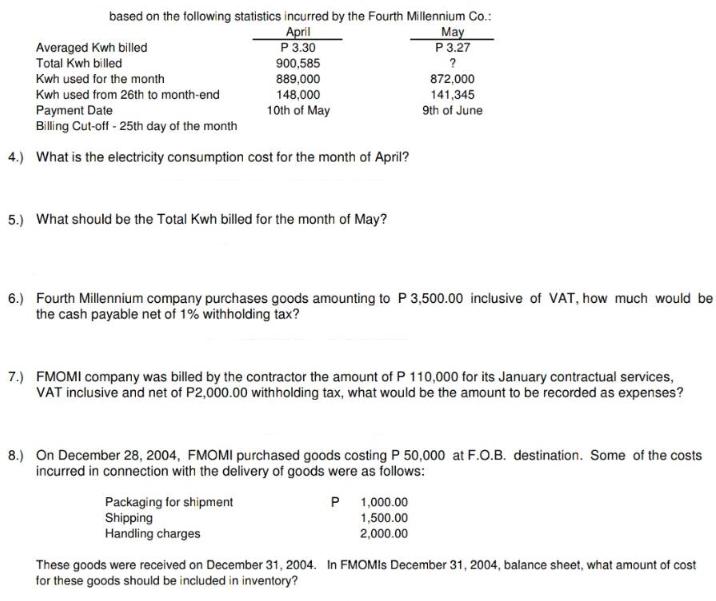

based on the following statistics incurred by the Fourth Millennium Co.: April P 3.30 900,585 889,000 148,000 10th of May Averaged Kwh billed Total

based on the following statistics incurred by the Fourth Millennium Co.: April P 3.30 900,585 889,000 148,000 10th of May Averaged Kwh billed Total Kwh billed Kwh used for the month Kwh used from 26th to month-end Payment Date Billing Cut-off - 25th day of the month 4.) What is the electricity consumption cost for the month of April? 5.) What should be the Total Kwh billed for the month of May? 6.) Fourth Millennium company purchases goods amounting to P 3,500.00 inclusive of VAT, how much would be the cash payable net of 1% withholding tax? May P 3.27 ? 872,000 141,345 9th of June 7.) FMOMI company was billed by the contractor the amount of P 110,000 for its January contractual services, VAT inclusive and net of P2,000.00 withholding tax, what would be the amount to be recorded as expenses? 8.) On December 28, 2004, FMOMI purchased goods costing P 50,000 at F.O.B. destination. Some of the costs incurred in connection with the delivery of goods were as follows: Packaging for shipment Shipping Handling charges P 1,000.00 1,500.00 2,000.00 These goods were received on December 31, 2004. In FMOMIS December 31, 2004, balance sheet, what amount of cost for these goods should be included in inventory?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

4 To calculate the electricity consumption cost for the month of April we need to multiply the Kwh used for the month by the electricity rate Electric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started