Based on the General Valuation Model, Constant Growth Model, and Nonconstant Growth Model for stock valuation, Estimate and explain the rate(s) you would use for valuation of the firm's growth with calculation.

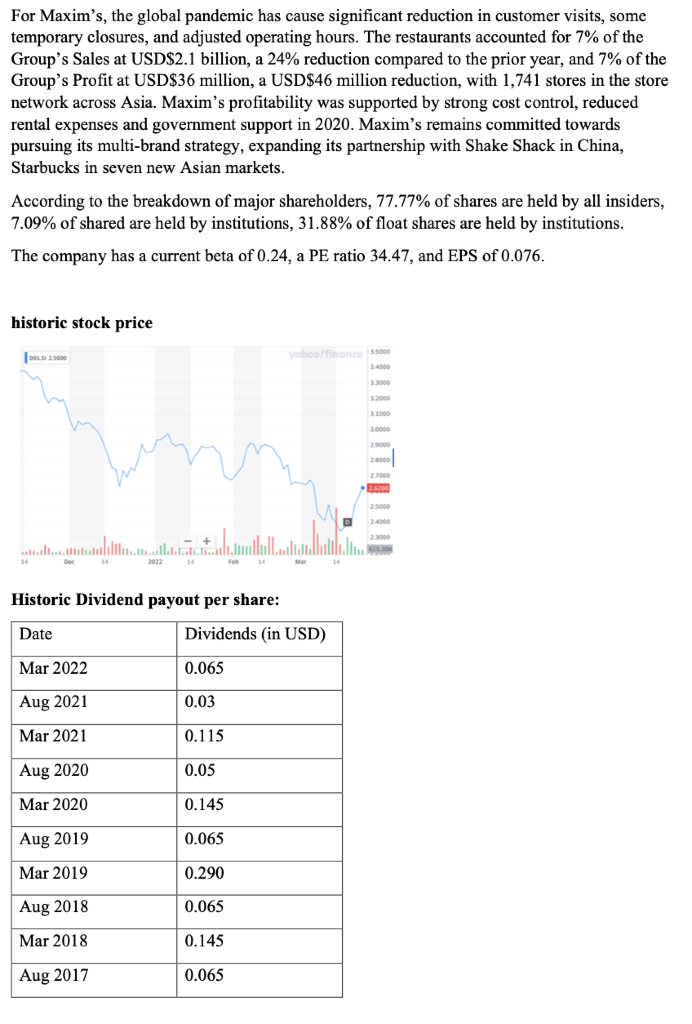

For Maxim's, the global pandemic has cause significant reduction in customer visits, some temporary closures, and adjusted operating hours. The restaurants accounted for 7% of the Group's Sales at USD$2.1 billion, a 24% reduction compared to the prior year, and 7% of the Group's Profit at USD$36 million, a USD$46 million reduction, with 1,741 stores in the store network across Asia. Maxim's profitability was supported by strong cost control, reduced rental expenses and government support in 2020. Maxim's remains committed towards pursuing its multi-brand strategy, expanding its partnership with Shake Shack in China, Starbucks in seven new Asian markets. According to the breakdown of major shareholders, 77.77% of shares are held by all insiders, 7.09% of shared are held by institutions, 31.88% of float shares are held by institutions. The company has a current beta of 0.24, a PE ratio 34.47, and EPS of 0.076. historic stock price DOLS 2.500 Yahoo Finance 3.5000 34000 3.3000 3.2000 3.1000 30000 25000 27000 2.6.200 ................... ali ana Historic Dividend payout per share: Date Dividends in USD) Mar 2022 0.065 Aug 2021 0.03 Mar 2021 0.115 Aug 2020 0.05 Mar 2020 0.145 Aug 2019 0.065 Mar 2019 0.290 Aug 2018 0.065 Mar 2018 0.145 Aug 2017 0.065 For Maxim's, the global pandemic has cause significant reduction in customer visits, some temporary closures, and adjusted operating hours. The restaurants accounted for 7% of the Group's Sales at USD$2.1 billion, a 24% reduction compared to the prior year, and 7% of the Group's Profit at USD$36 million, a USD$46 million reduction, with 1,741 stores in the store network across Asia. Maxim's profitability was supported by strong cost control, reduced rental expenses and government support in 2020. Maxim's remains committed towards pursuing its multi-brand strategy, expanding its partnership with Shake Shack in China, Starbucks in seven new Asian markets. According to the breakdown of major shareholders, 77.77% of shares are held by all insiders, 7.09% of shared are held by institutions, 31.88% of float shares are held by institutions. The company has a current beta of 0.24, a PE ratio 34.47, and EPS of 0.076. historic stock price DOLS 2.500 Yahoo Finance 3.5000 34000 3.3000 3.2000 3.1000 30000 25000 27000 2.6.200 ................... ali ana Historic Dividend payout per share: Date Dividends in USD) Mar 2022 0.065 Aug 2021 0.03 Mar 2021 0.115 Aug 2020 0.05 Mar 2020 0.145 Aug 2019 0.065 Mar 2019 0.290 Aug 2018 0.065 Mar 2018 0.145 Aug 2017 0.065