Based on the given information, please answer part b. Thanks.

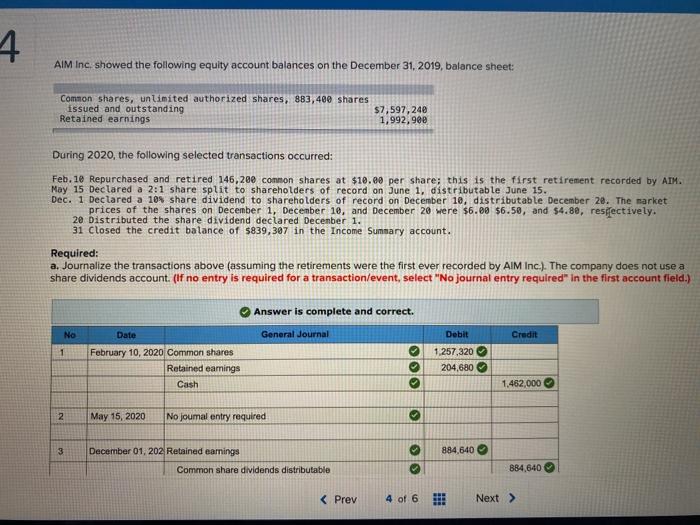

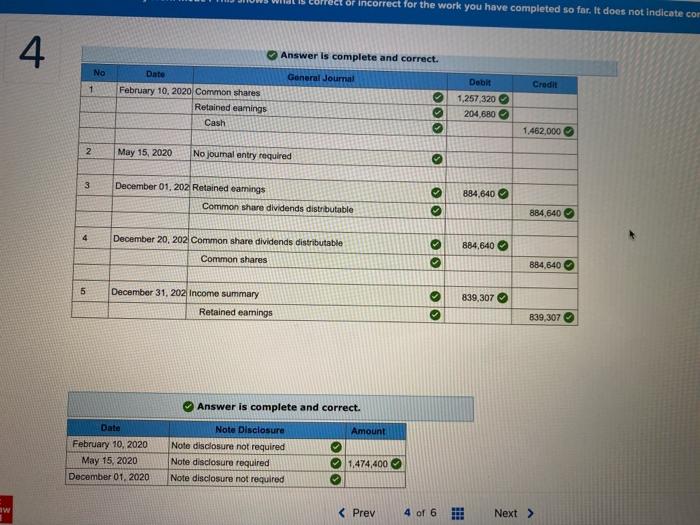

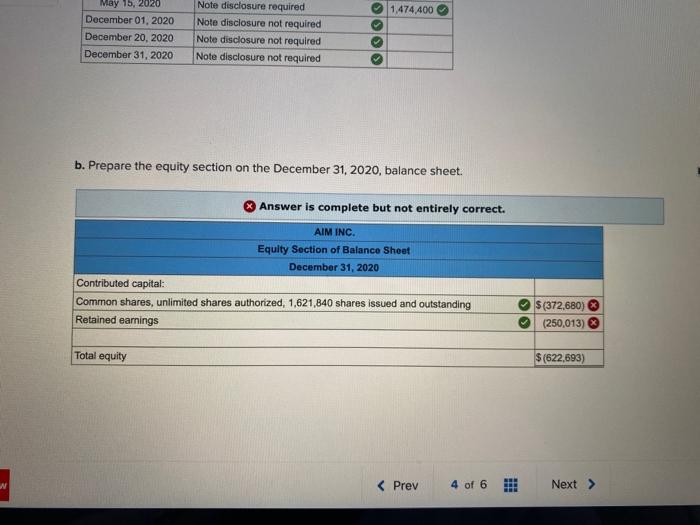

4 AIM Inc. showed the following equity account balances on the December 31, 2019, balance sheet: Common shares, unlimited authorized shares, 883,400 shares issued and outstanding Retained earnings $7,597,240 1,992,980 During 2020, the following selected transactions occurred: Feb. 1e Repurchased and retired 146,200 common shares at $10.00 per share; this is the first retirement recorded by AIM May 15 Declared a 2:1 share split to shareholders of record on June 1, distributable June 15. Dec. 1 Declared a 10% share dividend to shareholders of record on December 10, distributable December 2e. The market prices of the shares on December 1, December 10, and December 20 were $6.00 $6.50, and $4.80, respectively. 20 Distributed the share dividend declared December 1. 31 Closed the credit balance of $839,387 in the Income Summary unt. Required: a. Journalize the transactions above (assuming the retirements were the first ever recorded by AIM Inc.). The company does not use a share dividends account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete and correct. No Date General Journal Credit 1 February 10, 2020 Common shares Retained eamings Cash Debit 1.257,320 204,680 1,462,000 2 May 15, 2020 No joumal entry required 3 December 01, 202 Retained earnings 884,640 Common share dividends distributable 884,640 Sorrect or incorrect for the work you have completed so far. It does not indicate com 4 Answer is complete and correct. No General Journal Credit 1 Date February 10, 2020 Common shares Retained earings Cash Debit 1,257,320 204,680 1.462,000 2 May 15, 2020 No journal entry required 3 December 01, 202 Retained earnings Common share dividends distributable 884,640 884,640 4 December 20, 202 Common share dividends distributable 884,640 Common shares 884,640 5 December 31, 202 Income summary Retained earnings 839,307 839,307 Answer is complete and correct. Date Amount February 10, 2020 May 15, 2020 December 01, 2020 Note Disclosure Note disclosure not required Note disclosure required Note disclosure not required OOO 1,474,400 aw 1.474.400 May 15, 2020 December 01, 2020 December 20, 2020 December 31, 2020 Note disclosure required Note disclosure not required Note disclosure not required Note disclosure not required b. Prepare the equity section on the December 31, 2020, balance sheet. Answer is complete but not entirely correct. AIM INC. Equity Section of Balance Sheet December 31, 2020 Contributed capital: Common shares, unlimited shares authorized, 1,621,840 shares issued and outstanding Retained earnings $(372,680) (250,013) Total equity $(622,693) N