Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the given information, please provide a recommendation of: 1) How liquid is the firm? 2) Is management generating adequate operating profits on the

Based on the given information, please provide a recommendation of: 1) How liquid is the firm? 2) Is management generating adequate operating profits on the firms assets?

3) How is the firm financing its assets?

4) Is management providing a good return on the capital provided by the shareholders?

Write more than 130 words for each please.

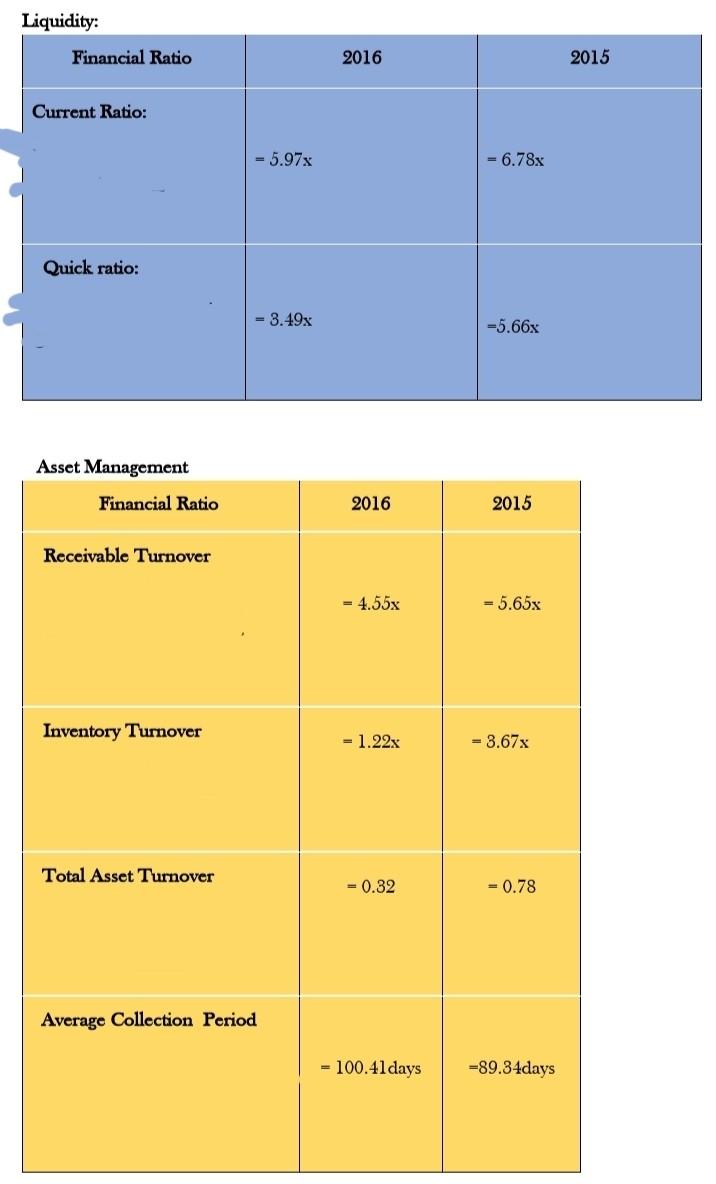

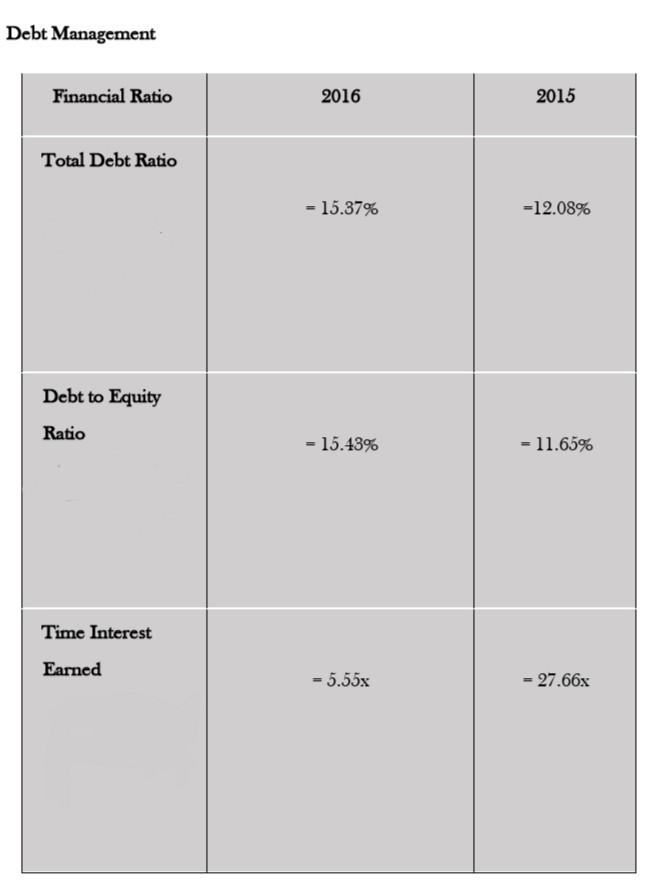

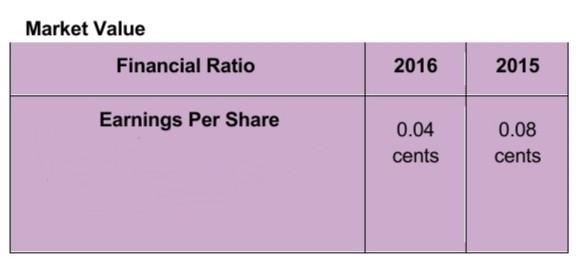

Liquidity: Financial Ratio 2016 2015 Current Ratio: = 5.97x = 6.78x Quick ratio: = 3.49x -5.66x Asset Management Financial Ratio 2016 2015 Receivable Turnover = 4.55x = 5.65x Inventory Turnover = 1.22x = 3.67% Total Asset Turnover = 0.32 = 0.78 Average Collection Period - 100.41 days -89.34days Profitability Financial Ratio 2016 2015 Return on Asset =2.35% 1.76% Return on Equity =2.38% =1.02% Gross Profit Margin =29.57% =23.22% Net Profit Margin = 4.38% 2.63% Operating Profit Margin =7.03% = 3.56% Debt Management Financial Ratio 2016 2015 Total Debt Ratio - 15.37% =12.08% Debt to Equity Ratio = 15.43% = 11.65% Time Interest Earned - 5.55x - 27.66x Market Value Financial Ratio 2016 2015 Earnings Per Share 0.04 cents 0.08 centsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started