Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the given pro forma, which statement is correct? Sales are projected to increase by 15 percent. Total of $75,000 in dividends will be

Based on the given pro forma, which statement is correct?

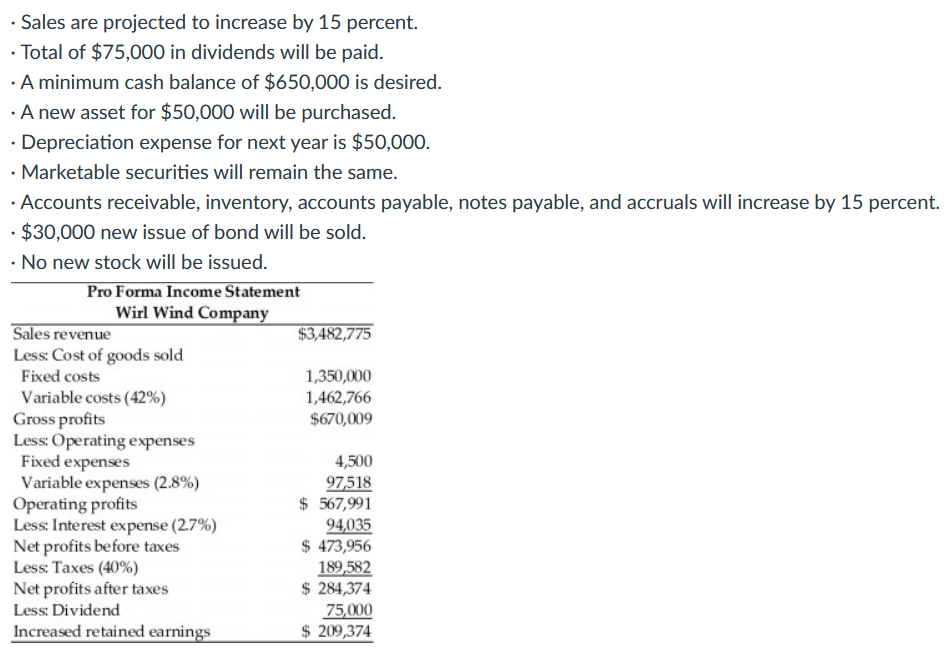

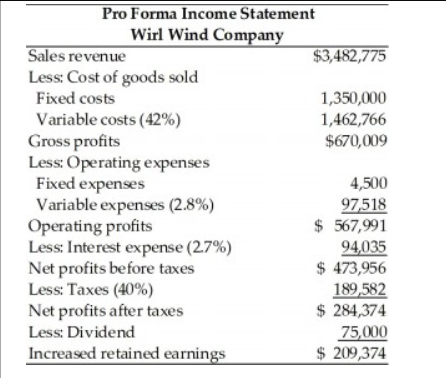

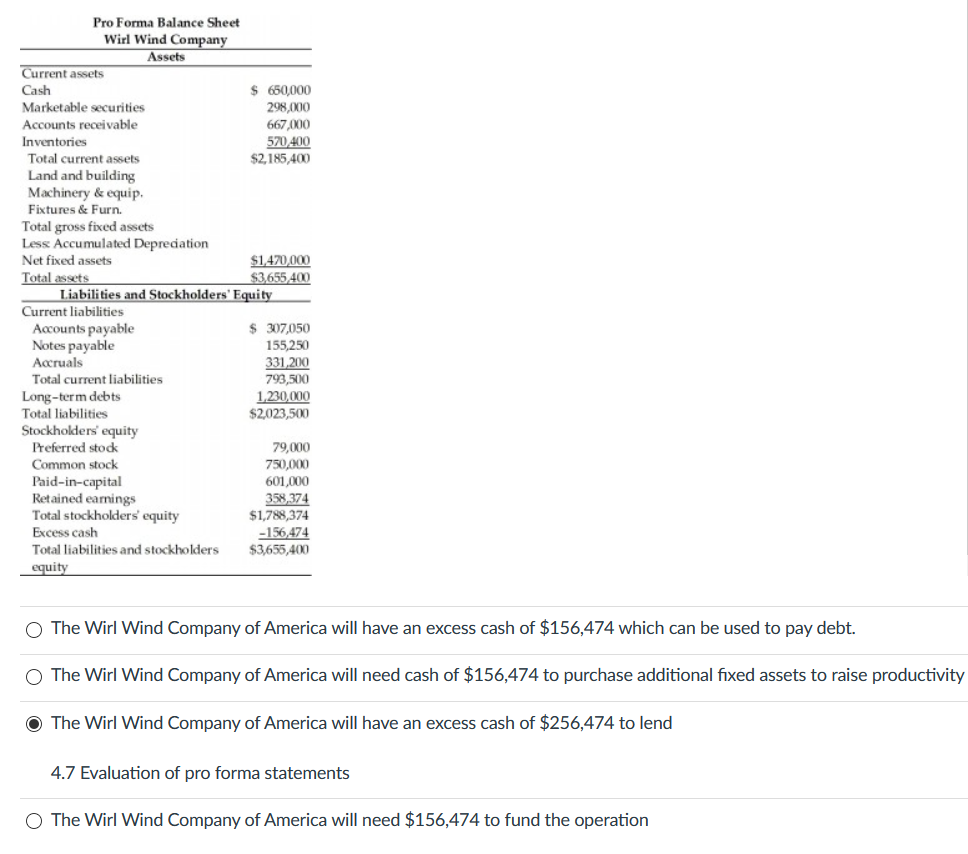

Sales are projected to increase by 15 percent. Total of $75,000 in dividends will be paid. A minimum cash balance of $650,000 is desired. A new asset for $50,000 will be purchased. Depreciation expense for next year is $50,000. Marketable securities will remain the same. Accounts receivable, inventory, accounts payable, notes payable, and accruals will increase by 15 percent. $30,000 new issue of bond will be sold. No new stock will be issued. Pro Forma Income Statement Wirl Wind Company Sales revenue $3,482,775 Less: Cost of goods sold Fixed costs 1,350,000 Variable costs (42%) 1,462,766 Gross profits $670,009 Less: Operating expenses Fixed expenses 4,500 Variable expenses (2.8%) 97,518 Operating profits $ 567,991 Less: Interest expense (2.7%) 94,035 Net profits before taxes $ 473,956 Less: Taxes (40%) 189,582 Net profits after taxes $ 284,374 Less: Dividend 75,000 Increased retained earnings $ 209,374 Pro Forma Income Statement Wirl Wind Company Sales revenue $3,482,775 Less: Cost of goods sold Fixed costs 1,350,000 Variable costs (42%) 1,462,766 Gross profits $670,009 Less: Operating expenses Fixed expenses 4,500 Variable expenses (2.8%) 97,518 Operating profits $ 567,991 Less: Interest expense (27%) 94,035 Net profits before taxes $ 473,956 Less: Taxes (40%) 189,582 Net profits after taxes $ 284,374 Less: Dividend 75,000 Increased retained earnings $ 209,374 Pro Forma Balance Sheet Wirl Wind Company Assets Current assets Cash $ 650,000 Marketable securities 298,000 Accounts receivable 667,000 Inventories 570 400 Total current assets $2,185,400 Land and building Machinery & equip. Fixtures & Furn. Total gross fixed assets Less Accumulated Depreciation Net fixed assets $1,470,000 Total assets $3,655,400 Liabilities and Stockholders' Equity Current liabilities Accounts payable $ 307,050 Notes payable 155,250 Accruals 331,200 Total current liabilities 793,500 Long-term debts 1.230,000 Total liabilities $2,023,500 Stockholders' equity Preferred stock 79,000 Common stock 750,000 Paid-in-capital 601,000 Retained earnings 358,374 Total stockholders' equity $1,788,374 Excess cash -156,474 Total liabilities and stockholders $3,655,400 equity The Wirl Wind Company of America will have an excess cash of $156,474 which can be used to pay debt. The Wirl Wind Company of America will need cash of $156,474 to purchase additional fixed assets to raise productivity The Wirl Wind Company of America will have an excess cash of $256,474 to lend 4.7 Evaluation of pro forma statements The Wirl Wind Company of America will need $156,474 to fund the operation Sales are projected to increase by 15 percent. Total of $75,000 in dividends will be paid. A minimum cash balance of $650,000 is desired. A new asset for $50,000 will be purchased. Depreciation expense for next year is $50,000. Marketable securities will remain the same. Accounts receivable, inventory, accounts payable, notes payable, and accruals will increase by 15 percent. $30,000 new issue of bond will be sold. No new stock will be issued. Pro Forma Income Statement Wirl Wind Company Sales revenue $3,482,775 Less: Cost of goods sold Fixed costs 1,350,000 Variable costs (42%) 1,462,766 Gross profits $670,009 Less: Operating expenses Fixed expenses 4,500 Variable expenses (2.8%) 97,518 Operating profits $ 567,991 Less: Interest expense (2.7%) 94,035 Net profits before taxes $ 473,956 Less: Taxes (40%) 189,582 Net profits after taxes $ 284,374 Less: Dividend 75,000 Increased retained earnings $ 209,374 Pro Forma Income Statement Wirl Wind Company Sales revenue $3,482,775 Less: Cost of goods sold Fixed costs 1,350,000 Variable costs (42%) 1,462,766 Gross profits $670,009 Less: Operating expenses Fixed expenses 4,500 Variable expenses (2.8%) 97,518 Operating profits $ 567,991 Less: Interest expense (27%) 94,035 Net profits before taxes $ 473,956 Less: Taxes (40%) 189,582 Net profits after taxes $ 284,374 Less: Dividend 75,000 Increased retained earnings $ 209,374 Pro Forma Balance Sheet Wirl Wind Company Assets Current assets Cash $ 650,000 Marketable securities 298,000 Accounts receivable 667,000 Inventories 570 400 Total current assets $2,185,400 Land and building Machinery & equip. Fixtures & Furn. Total gross fixed assets Less Accumulated Depreciation Net fixed assets $1,470,000 Total assets $3,655,400 Liabilities and Stockholders' Equity Current liabilities Accounts payable $ 307,050 Notes payable 155,250 Accruals 331,200 Total current liabilities 793,500 Long-term debts 1.230,000 Total liabilities $2,023,500 Stockholders' equity Preferred stock 79,000 Common stock 750,000 Paid-in-capital 601,000 Retained earnings 358,374 Total stockholders' equity $1,788,374 Excess cash -156,474 Total liabilities and stockholders $3,655,400 equity The Wirl Wind Company of America will have an excess cash of $156,474 which can be used to pay debt. The Wirl Wind Company of America will need cash of $156,474 to purchase additional fixed assets to raise productivity The Wirl Wind Company of America will have an excess cash of $256,474 to lend 4.7 Evaluation of pro forma statements The Wirl Wind Company of America will need $156,474 to fund the operationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started