Based on the Income Statement and the Balance Sheet provided, conduct a financial analysis using:

a) Horizontal Analysis

b) Vertical Analysis

c) Ratio Analysis

Explain how the company is doing financially in sentences based on the data provided.

Note: Figures are all in millions of dollars.

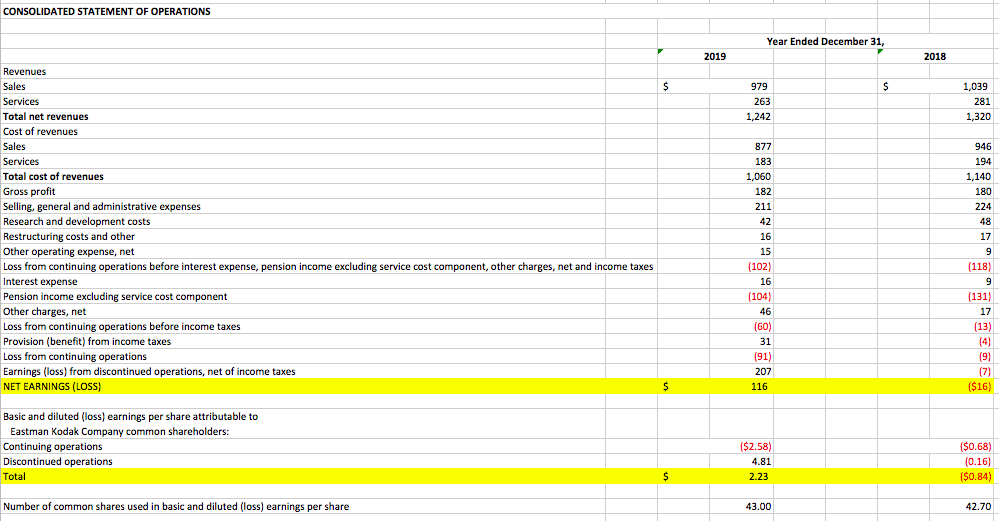

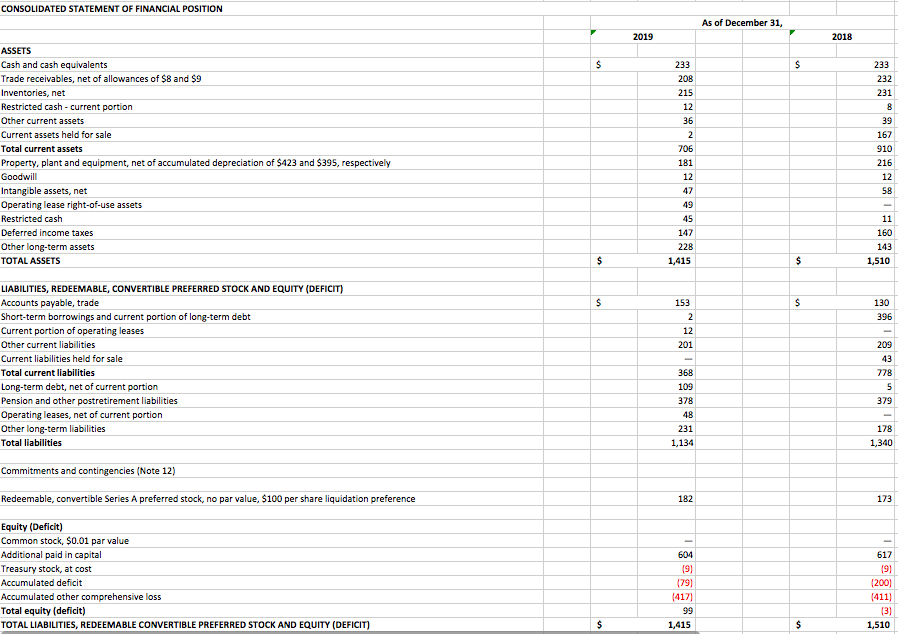

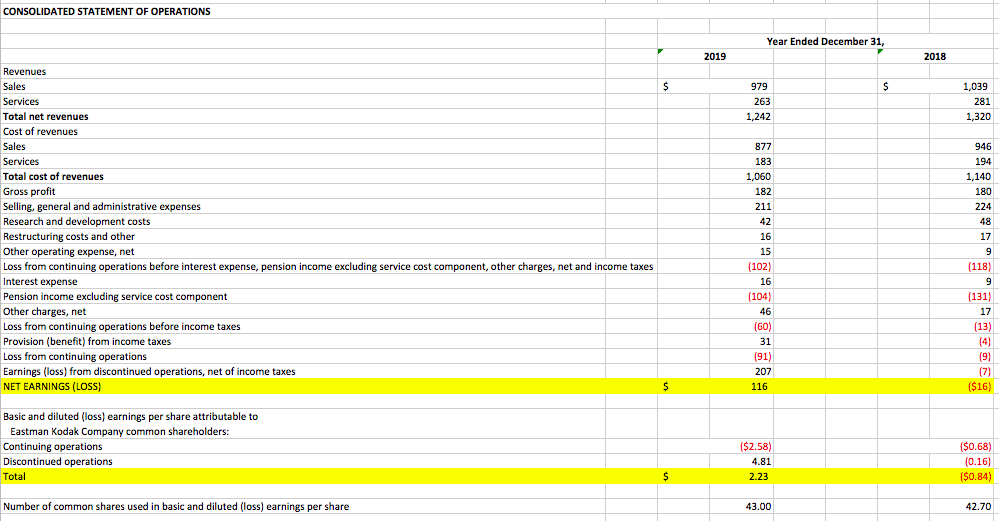

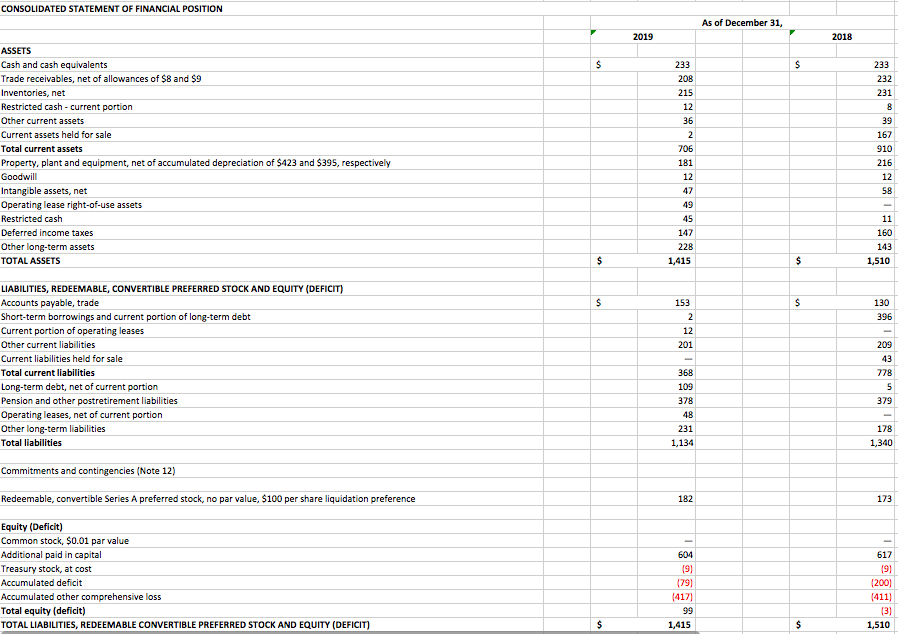

CONSOLIDATED STATEMENT OF OPERATIONS Year Ended December 31, 2019 2018 $ $ Revenues Sales Services Total net revenues Cost of revenues Sales 979 263 1,242 1,039 281 1,320 Services 877 183 Total cost of revenues Gross profit Selling, general and administrative expenses Research and development costs Restructuring costs and other Other operating expense, net Loss from continuing operations before interest expense, pension income excluding service cost component, other charges, net and income taxes Interest expense Pension income excluding service cost component Other charges, net Loss from continuing operations before income taxes Provision (benefit from income taxes Loss from continuing operations Earnings (loss) from discontinued operations, net of income taxes NET EARNINGS (LOSS) 1,060 182 211 42 16 15 (102) 16 (104) 46 (60) 31 (91) 207 116 946 194 1,140 180 224 48 17 9 (118) 9 9 (131) 17 (13) (4) (9) (7) ( ($16) $ Basic and diluted (loss) earnings per share attributable to Eastman Kodak Company common shareholders: Continuing operations Discontinued operations Total ($2.58) 4.81 2.23 ($0.68) (0.16) ($0.84) $ Number of common shares used in basic and diluted (loss) earnings per share 43.00 42.70 CONSOLIDATED STATEMENT OF FINANCIAL POSITION As of December 31, 2019 2018 $ $ 233 233 208 232 215 231 ASSETS Cash and cash equivalents Trade receivables, net of allowances of $8 and $9 Inventories, net Restricted cash - current portion Other current assets Current assets held for sale Total current assets Property, plant and equipment, net of accumulated depreciation of $423 and $395, respectively Goodwill Intangible assets, net Operating lease right-of-use assets Restricted cash Deferred income taxes Other long-term assets TOTAL ASSETS 12 36 2 706 181 12 47 49 45 147 8 39 167 910 216 12 58 11 160 143 1,510 228 $ 1,415 $ $ $ 130 396 153 2 12 201 LIABILITIES, REDEEMABLE, CONVERTIBLE PREFERRED STOCK AND EQUITY (DEFICIT) Accounts payable, trade Short-term borrowings and current portion of long-term debt Current portion of operating leases Other current liabilities Current liabilities held for sale Total current liabilities Long-term debt, net of current portion Pension and other postretirement liabilities Operating leases, net of current portion Other long-term liabilities Total liabilities 209 43 778 5 379 368 109 378 48 231 1,134 178 1,340 Commitments and contingencies (Note 12) Redeemable, convertible Series A preferred stock, no par value, $100 per share liquidation preference 182 173 Equity (Deficit) Common stock, $0.01 par value Additional paid in capital Treasury stock, at cost Accumulated deficit Accumulated other comprehensive loss Total equity (deficit) TOTAL LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND EQUITY (DEFICIT) 604 19) (79) (417) 99 1,415 617 19) (200) (411) 13) 1,510 $ $ CONSOLIDATED STATEMENT OF OPERATIONS Year Ended December 31, 2019 2018 $ $ Revenues Sales Services Total net revenues Cost of revenues Sales 979 263 1,242 1,039 281 1,320 Services 877 183 Total cost of revenues Gross profit Selling, general and administrative expenses Research and development costs Restructuring costs and other Other operating expense, net Loss from continuing operations before interest expense, pension income excluding service cost component, other charges, net and income taxes Interest expense Pension income excluding service cost component Other charges, net Loss from continuing operations before income taxes Provision (benefit from income taxes Loss from continuing operations Earnings (loss) from discontinued operations, net of income taxes NET EARNINGS (LOSS) 1,060 182 211 42 16 15 (102) 16 (104) 46 (60) 31 (91) 207 116 946 194 1,140 180 224 48 17 9 (118) 9 9 (131) 17 (13) (4) (9) (7) ( ($16) $ Basic and diluted (loss) earnings per share attributable to Eastman Kodak Company common shareholders: Continuing operations Discontinued operations Total ($2.58) 4.81 2.23 ($0.68) (0.16) ($0.84) $ Number of common shares used in basic and diluted (loss) earnings per share 43.00 42.70 CONSOLIDATED STATEMENT OF FINANCIAL POSITION As of December 31, 2019 2018 $ $ 233 233 208 232 215 231 ASSETS Cash and cash equivalents Trade receivables, net of allowances of $8 and $9 Inventories, net Restricted cash - current portion Other current assets Current assets held for sale Total current assets Property, plant and equipment, net of accumulated depreciation of $423 and $395, respectively Goodwill Intangible assets, net Operating lease right-of-use assets Restricted cash Deferred income taxes Other long-term assets TOTAL ASSETS 12 36 2 706 181 12 47 49 45 147 8 39 167 910 216 12 58 11 160 143 1,510 228 $ 1,415 $ $ $ 130 396 153 2 12 201 LIABILITIES, REDEEMABLE, CONVERTIBLE PREFERRED STOCK AND EQUITY (DEFICIT) Accounts payable, trade Short-term borrowings and current portion of long-term debt Current portion of operating leases Other current liabilities Current liabilities held for sale Total current liabilities Long-term debt, net of current portion Pension and other postretirement liabilities Operating leases, net of current portion Other long-term liabilities Total liabilities 209 43 778 5 379 368 109 378 48 231 1,134 178 1,340 Commitments and contingencies (Note 12) Redeemable, convertible Series A preferred stock, no par value, $100 per share liquidation preference 182 173 Equity (Deficit) Common stock, $0.01 par value Additional paid in capital Treasury stock, at cost Accumulated deficit Accumulated other comprehensive loss Total equity (deficit) TOTAL LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND EQUITY (DEFICIT) 604 19) (79) (417) 99 1,415 617 19) (200) (411) 13) 1,510 $ $