Answered step by step

Verified Expert Solution

Question

1 Approved Answer

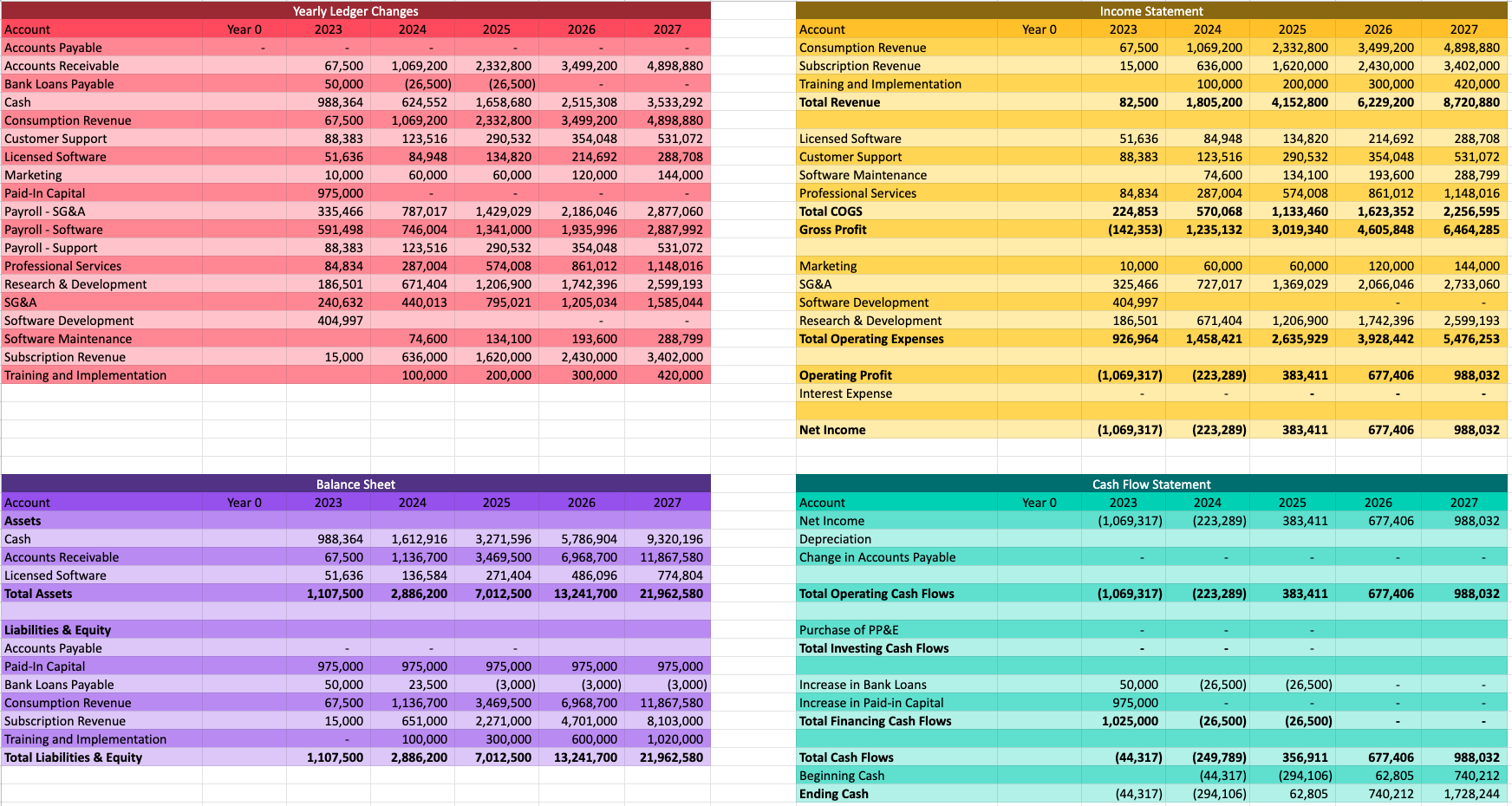

Based on the income statements attached. calculate these items for 2023-2027 - Operating Margin - Net Margin Yearly Ledger Changes Income Statement Account Accounts Payable

Based on the income statements attached. calculate these items for 2023-2027

- Operating Margin

- Net Margin

Yearly Ledger Changes Income Statement Account Accounts Payable Accounts Receivable Bank Loans Payable Cash Consumption Revenue Customer Support Licensed Software Marketing Paid-In Capital Year 0 2023 2024 2025 2026 2027 Account Year O 2023 2024 Consumption Revenue 67,500 1,069,200 2,332,800 3,499,200 4,898,880 Subscription Revenue 67,500 1,069,200 15,000 50,000 988,364 (26,500) 624,552 (26,500) 1,658,680 Training and Implementation 636,000 100,000 2025 2,332,800 1,620,000 2026 3,499,200 2027 4,898,880 200,000 2,515,308 3,533,292 Total Revenue 82,500 1,805,200 4,152,800 2,430,000 300,000 6,229,200 3,402,000 420,000 8,720,880 67,500 1,069,200 2,332,800 3,499,200 4,898,880 88,383 123,516 290,532 354,048 531,072 Licensed Software 51,636 84,948 134,820 214,692 288,708 51,636 84,948 134,820 214,692 288,708 Customer Support 88,383 123,516 290,532 354,048 531,072 10,000 60,000 60,000 120,000 144,000 Software Maintenance 74,600 134,100 193,600 288,799 975,000 Professional Services 84,834 287,004 Payroll - SG&A 335,466 787,017 Payroll - Software 591,498 746,004 1,429,029 2,186,046 1,341,000 2,877,060 Total COGS 224,853 1,935,996 2,887,992 Gross Profit (142,353) 574,008 570,068 1,133,460 1,623,352 1,235,132 3,019,340 4,605,848 861,012 1,148,016 2,256,595 6,464,285 Payroll - Support 88,383 123,516 290,532 354,048 531,072 Professional Services 84,834 287,004 574,008 861,012 1,148,016 Research & Development 186,501 671,404 1,206,900 SG&A 240,632 440,013 795,021 1,742,396 1,205,034 2,599,193 1,585,044 Software Development 404,997 - Software Maintenance 74,600 134,100 Subscription Revenue 15,000 Training and Implementation 636,000 100,000 1,620,000 200,000 193,600 2,430,000 300,000 288,799 3,402,000 420,000 Marketing SG&A Software Development Research & Development Total Operating Expenses 10,000 325,466 60,000 727,017 60,000 1,369,029 120,000 2,066,046 144,000 2,733,060 404,997 186,501 926,964 671,404 1,206,900 1,458,421 2,635,929 1,742,396 2,599,193 3,928,442 5,476,253 Operating Profit Interest Expense (1,069,317) (223,289) 383,411 677,406 988,032 Net Income (1,069,317) (223,289) 383,411 677,406 988,032 Account Assets Cash Balance Sheet Year 0 2023 2024 2025 2026 2027 Account Net Income Year 0 Cash Flow Statement 2023 (1,069,317) 2024 (223,289) 2025 383,411 2026 677,406 2027 988,032 Accounts Receivable Licensed Software Total Assets Liabilities & Equity Accounts Payable Paid-In Capital Bank Loans Payable Consumption Revenue 988,364 1,612,916 67,500 51,636 1,107,500 1,136,700 136,584 2,886,200 3,271,596 3,469,500 271,404 7,012,500 5,786,904 6,968,700 486,096 13,241,700 9,320,196 11,867,580 774,804 21,962,580 Depreciation Change in Accounts Payable Total Operating Cash Flows (1,069,317) (223,289) 383,411 677,406 988,032 Purchase of PP&E Total Investing Cash Flows Subscription Revenue 975,000 50,000 67,500 15,000 Training and Implementation Total Liabilities & Equity 1,107,500 975,000 23,500 1,136,700 651,000 100,000 2,886,200 975,000 (3,000) 3,469,500 2,271,000 300,000 7,012,500 975,000 (3,000) 6,968,700 4,701,000 600,000 13,241,700 975,000 (3,000) Increase in Bank Loans 50,000 (26,500) (26,500) 11,867,580 8,103,000 Increase in Paid-in Capital 975,000 Total Financing Cash Flows 1,025,000 (26,500) (26,500) 1,020,000 21,962,580 Total Cash Flows (44,317) (249,789) Beginning Cash Ending Cash (44,317) 356,911 (44,317) (294,106) (294,106) 62,805 677,406 62,805 740,212 988,032 740,212 1,728,244

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started