Answered step by step

Verified Expert Solution

Question

1 Approved Answer

based on the information below calculate the current ratio working capital acid test ratio inventory turnover days in sales recievable debt to equity ratio times

based on the information below calculate the

current ratio

working capital

acid test ratio

inventory turnover

days in sales recievable

debt to equity ratio

times interest earned

asset turnover

return on sales

return on assets

return on equity

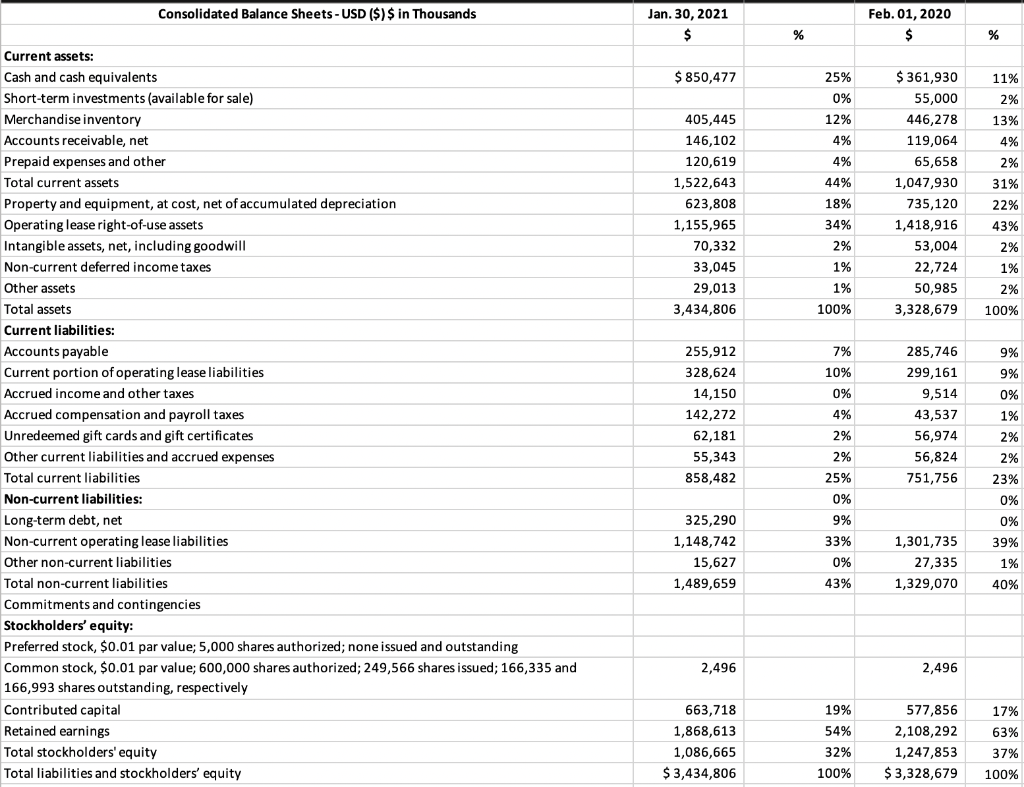

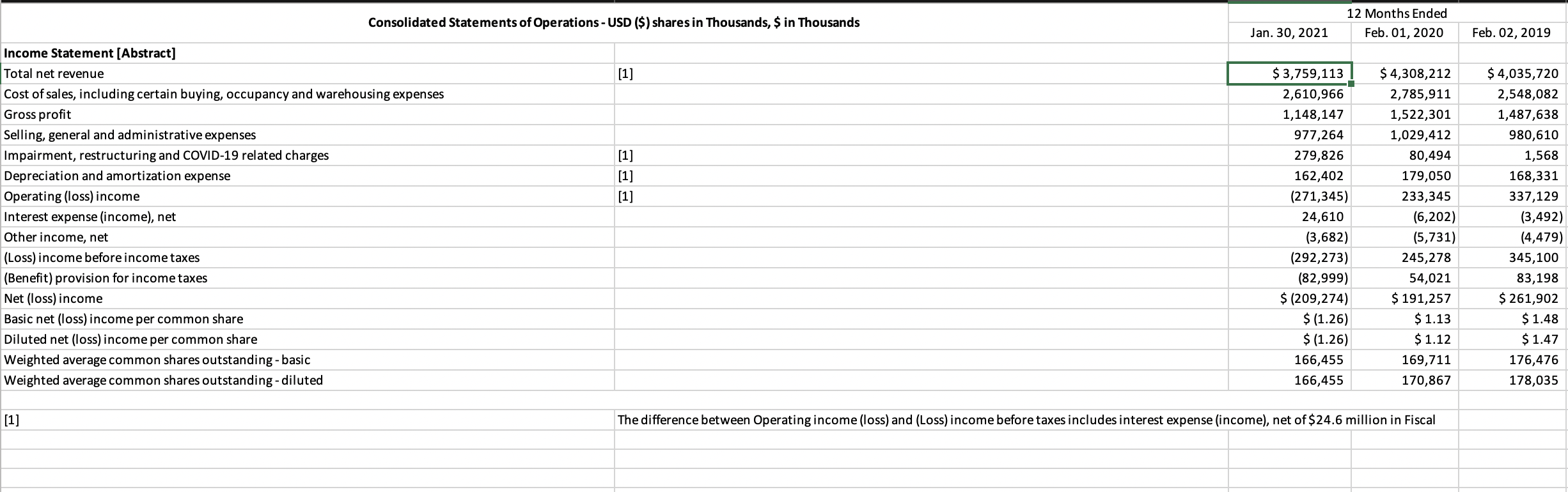

Consolidated Balance Sheets - USD ($) $ in Thousands Jan. 30, 2021 $ Feb. 01, 2020 $ % % $ 850,477 25% 0% 12% 405,445 146,102 120,619 1,522,643 623,808 1,155,965 70,332 33,045 29,013 3,434,806 4% 4% 44% 18% 34% 2% 1% 1% 100% $361,930 55,000 446,278 119,064 65,658 1,047,930 735,120 1,418,916 53,004 22,724 50,985 3,328,679 11% 2% 13% 4% 2% 31% 22% 43% 2% 1% 2% 100% 7% 10% 0% Current assets: Cash and cash equivalents Short-term investments (available for sale) Merchandise inventory Accounts receivable, net Prepaid expenses and other Total current assets Property and equipment, at cost, net of accumulated depreciation Operating lease right-of-use assets Intangible assets, net, including goodwill Non-current deferred income taxes Other assets Total assets Current liabilities: Accounts payable Current portion of operating lease liabilities Accrued income and other taxes Accrued compensation and payroll taxes Unredeemed gift cards and gift certificates Other current liabilities and accrued expenses Total current liabilities Non-current liabilities: Long-term debt, net Non-current operating lease liabilities Other non-current liabilities Total non-current liabilities Commitments and contingencies Stockholders' equity: Preferred stock, $0.01 par value; 5,000 shares authorized; none issued and outstanding Common stock, $0.01 par value; 600,000 shares authorized; 249,566 shares issued; 166,335 and 166,993 shares outstanding, respectively Contributed capital Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 255,912 328,624 14,150 142,272 62,181 55,343 858,482 285,746 299,161 9,514 43,537 56,974 56,824 751,756 4% 2% 2% 25% 0% 9% 33% 0% 9% 9% 0% 1% 2% 2% 23% 0% 0% 39% 325,290 1,148,742 15,627 1,489,659 1,301,735 27,335 1,329,070 1% 43% 40% 2,496 2,496 663,718 1,868,613 1,086,665 $ 3,434,806 19% 54% 32% 100% 577,856 2,108,292 1,247,853 $3,328,679 17% 63% 37% 100% Consolidated Statements of Operations - USD ($) shares in Thousands, $ in Thousands 12 Months Ended Feb. 01, 2020 Jan. 30, 2021 Feb. 02, 2019 [1] [1] [1] [1] Income Statement [Abstract] Total net revenue Cost of sales, including certain buying, occupancy and warehousing expenses Gross profit Selling, general and administrative expenses Impairment, restructuring and COVID-19 related charges Depreciation and amortization expense Operating (loss) income Interest expense (income), net Other income, net (Loss) income before income taxes (Benefit) provision for income taxes Net (loss) income Basic net (loss) income per common share Diluted net (loss) income per common share Weighted average common shares outstanding-basic Weighted average common shares outstanding-diluted $ 3,759,113 2,610,966 1,148,147 977,264 279,826 162,402 (271,345) 24,610 (3,682) (292,273) (82,999) $ (209,274) $ (1.26) $ (1.26) 166,455 166,455 $ 4,308,212 2,785,911 1,522,301 1,029,412 80,494 179,050 233,345 (6,202) (5,731) 245,278 54,021 $ 191,257 $ 1.13 $ 1.12 169,711 170,867 $ 4,035,720 2,548,082 1,487,638 980,610 1,568 168,331 337,129 (3,492) (4,479) 345,100 83,198 $ 261,902 $ 1.48 $ 1.47 176,476 178,035 [1] The difference between Operating income (loss) and (Loss) income before taxes includes interest expense (income), net of $24.6 million in Fiscal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started