Answered step by step

Verified Expert Solution

Question

1 Approved Answer

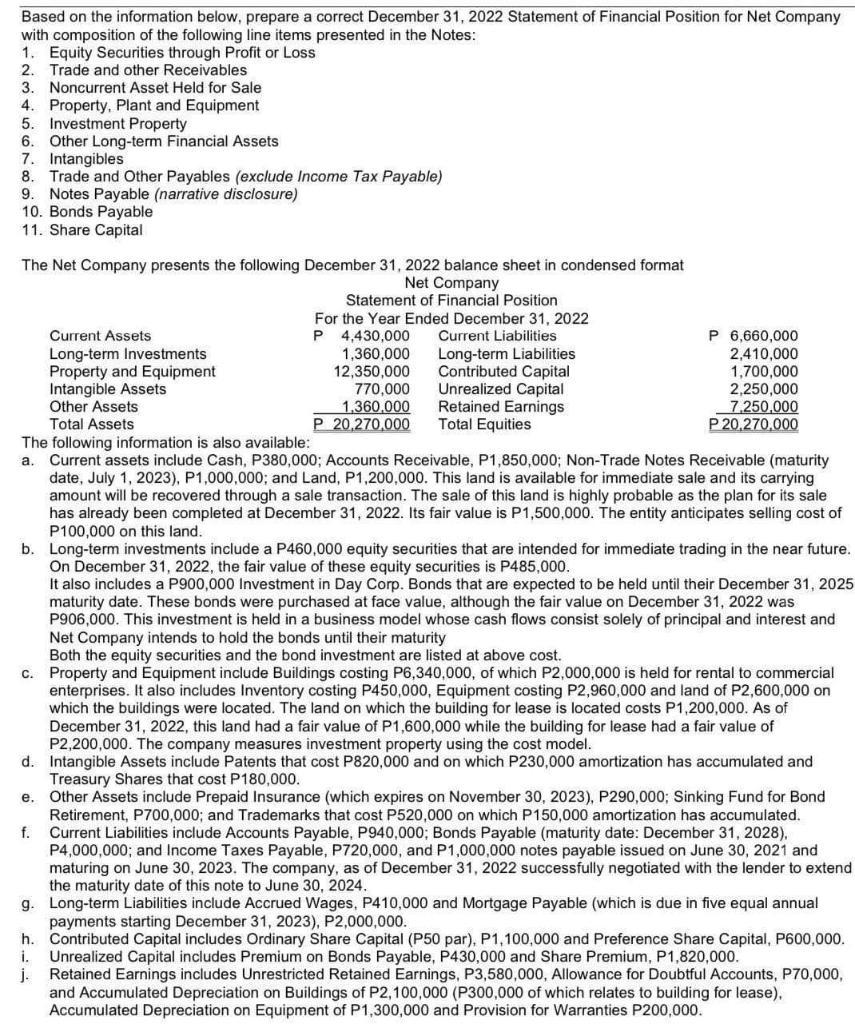

Based on the information below, prepare a correct December 31, 2022 Statement of Financial Position for Net Company with composition of the following line

Based on the information below, prepare a correct December 31, 2022 Statement of Financial Position for Net Company with composition of the following line items presented in the Notes: 1. Equity Securities through Profit or Loss 2. Trade and other Receivables 3. Noncurrent Asset Held for Sale 4. Property, Plant and Equipment 5. Investment Property 6. Other Long-term Financial Assets 7. Intangibles 8. Trade and Other Payables (exclude Income Tax Payable) 9. Notes Payable (narrative disclosure) 10. Bonds Payable 11. Share Capital The Net Company presents the following December 31, 2022 balance sheet in condensed format Net Company Statement of Financial Position For the Year Ended December 31, 2022 P 4,430,000 Current Liabilities 1,360,000 12,350,000 770,000 1,360,000 P 20,270,000 Current Assets Long-term Investments Property and Equipment Intangible Assets Other Assets Total Assets Long-term Liabilities Contributed Capital Unrealized Capital Retained Earnings Total Equities P 6,660,000 2,410,000 1,700,000 2,250,000 7,250,000 P 20,270,000 The following information is also available: a. Current assets include Cash, P380,000; Accounts Receivable, P1,850,000; Non-Trade Notes Receivable (maturity date, July 1, 2023), P1,000,000; and Land, P1,200,000. This land is available for immediate sale and its carrying amount will be recovered through a sale transaction. The sale of this land is highly probable as the plan for its sale has already been completed at December 31, 2022. Its fair value is P1,500,000. The entity anticipates selling cost of P100,000 on this land. b. Long-term investments include a P460,000 equity securities that are intended for immediate trading in the near future. On December 31, 2022, the fair value of these equity securities is P485,000. It also includes a P900,000 Investment in Day Corp. Bonds that are expected to be held until their December 31, 2025 maturity date. These bonds were purchased at face value, although the fair value on December 31, 2022 was P906,000. This investment is held in a business model whose cash flows consist solely of principal and interest and Net Company intends to hold the bonds until their maturity Both the equity securities and the bond investment are listed at above cost. c. Property and Equipment include Buildings costing P6,340,000, of which P2,000,000 is held for rental to commercial enterprises. It also includes Inventory costing P450,000, Equipment costing P2,960,000 and land of P2,600,000 on which the buildings were located. The land on which the building for lease is located costs P1,200,000. As of December 31, 2022, this land had a fair value of P1,600,000 while the building for lease had a fair value of P2,200,000. The company measures investment property using the cost model. Intangible Assets include Patents that cost P820,000 and on which P230,000 amortization has accumulated and Treasury Shares that cost P180,000. d. f. e. Other Assets include Prepaid Insurance (which expires on November 30, 2023), P290,000; Sinking Fund for Bond Retirement, P700,000; and Trademarks that cost P520,000 on which P150,000 amortization has accumulated. Current Liabilities include Accounts Payable, P940,000; Bonds Payable (maturity date: December 31, 2028), P4,000,000; and Income Taxes Payable, P720,000, and P1,000,000 notes payable issued on June 30, 2021 and maturing on June 30, 2023. The company, as of December 31, 2022 successfully negotiated with the lender to extend the maturity date of this note to June 30, 2024. g. Long-term Liabilities include Accrued Wages, P410,000 and Mortgage Payable (which is due in five equal annual payments starting December 31, 2023), P2,000,000. h. Contributed Capital includes Ordinary Share Capital (P50 par), P1,100,000 and Preference Share Capital, P600,000. i. Unrealized Capital includes Premium on Bonds Payable, P430,000 and Share Premium, P1,820,000. j. Retained Earnings includes Unrestricted Retained Earnings, P3,580,000, Allowance for Doubtful Accounts, P70,000, and Accumulated Depreciation on Buildings of P2,100,000 (P300,000 of which relates to building for lease), Accumulated Depreciation on Equipment of P1,300,000 and Provision for Warranties P200,000.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 Balance sheet lists all assets liabilities and equity at the year end It shows all the asset...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started