Question

Based on the information Corny had provided, Claire realized that she would need a loan of $23,533,000 to complete construction of the project, after the

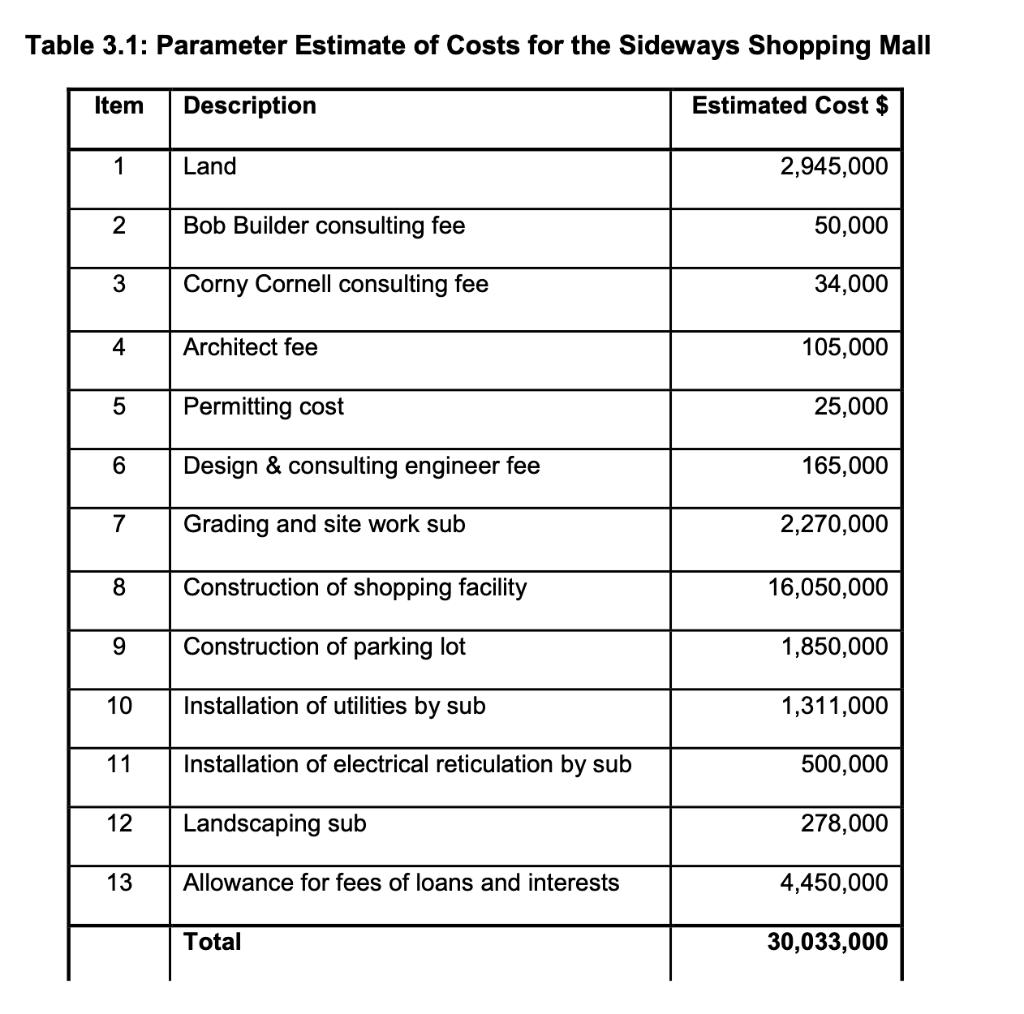

Based on the information Corny had provided, Claire realized that she would need a loan of $23,533,000 to complete construction of the project, after the use of the $6.5 million inheritance. She estimated the interest on the loan would be 7.5 percent, compounded annually over a 20-year period. Claire also estimated that she could expect $30 per square foot of rental space (150,000 SF) and that her maintenance and operating costs would be approximately 2 percent of total cost of the project. She began to wonder exactly how much profit (if any) she could expect to make from the project while she was paying off such a substantial loan over the next twenty years. It would be necessary to convey this to the bank to receive funding. After she returned to her office, Claire set about developing a profit picture for the Sideways shopping facility to determine if the project was economically feasible. Assume you are Claire and are trying to determine if the Sideways shopping mall is a good investment of your $6.5 million inheritance, using a 20-year period. Assume operation of the facility begins in year 2 and the equity is utilized in year 1. Determine the: •Gross annual revenue

•Annual Maintenance Costs

•Net Annual Revenue

•Estimated Annual Debt Service

•Estimated Annual Profit

•Net Present Value of Claire's investment, if the discount rate = 9%

•Internal Rate of Return for the project investment

Table 3.1: Parameter Estimate of Costs for the Sideways Shopping Mall Item Description Estimated Cost $ 1 Land 2,945,000 2 Bob Builder consulting fee 50,000 3 Corny Cornell consulting fee 34,000 4 Architect fee 105,000 Permitting cost 25,000 Design & consulting engineer fee 165,000 7 Grading and site work sub 2,270,000 8. Construction of shopping facility 16,050,000 9. Construction of parking lot 1,850,000 10 Installation of utilities by sub 1,311,000 11 Installation of electrical reticulation by sub 500,000 12 Landscaping sub 278,000 13 Allowance for fees of loans and interests 4,450,000 Total 30,033,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Gross annual revenue Rent per square feet X Area in square feet 30 X 150000 4500000 b Annual Maint...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started