Answered step by step

Verified Expert Solution

Question

1 Approved Answer

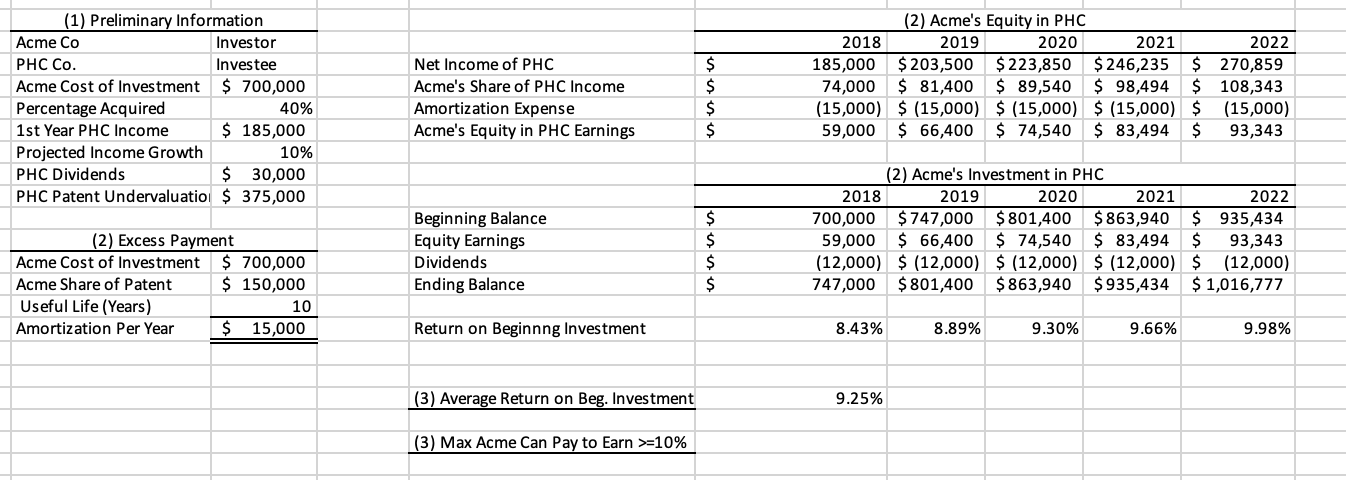

Based on the information provided in the screenshot below, I need to either use the Goal Seek or Solver tool in Excel to figure out

Based on the information provided in the screenshot below, I need to either use the Goal Seek or Solver tool in Excel to figure out the maximum amount Acme can pay for PHC if it wishes to maintain at least at 10% average return on beginning investment allowance. If someone could provide an explanation on how to use solver/goal seek to find the answer, I would be grateful!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started