Answered step by step

Verified Expert Solution

Question

1 Approved Answer

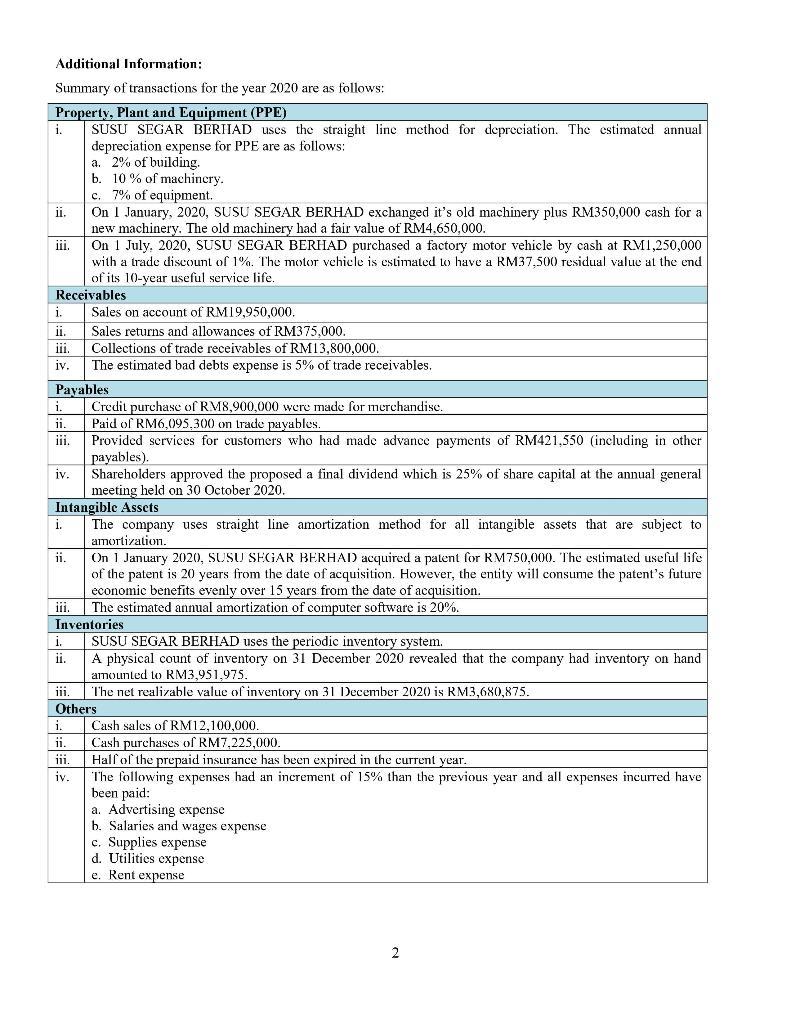

Based on the knowledge you have acquired, complete the followings: Journalize all transactions for the year 2020. Post all journals to respective column account. Prepare

Based on the knowledge you have acquired, complete the followings:

- Journalize all transactions for the year 2020.

- Post all journals to respective column account.

- Prepare an adjusted trial balance as at 31 December, 2020.

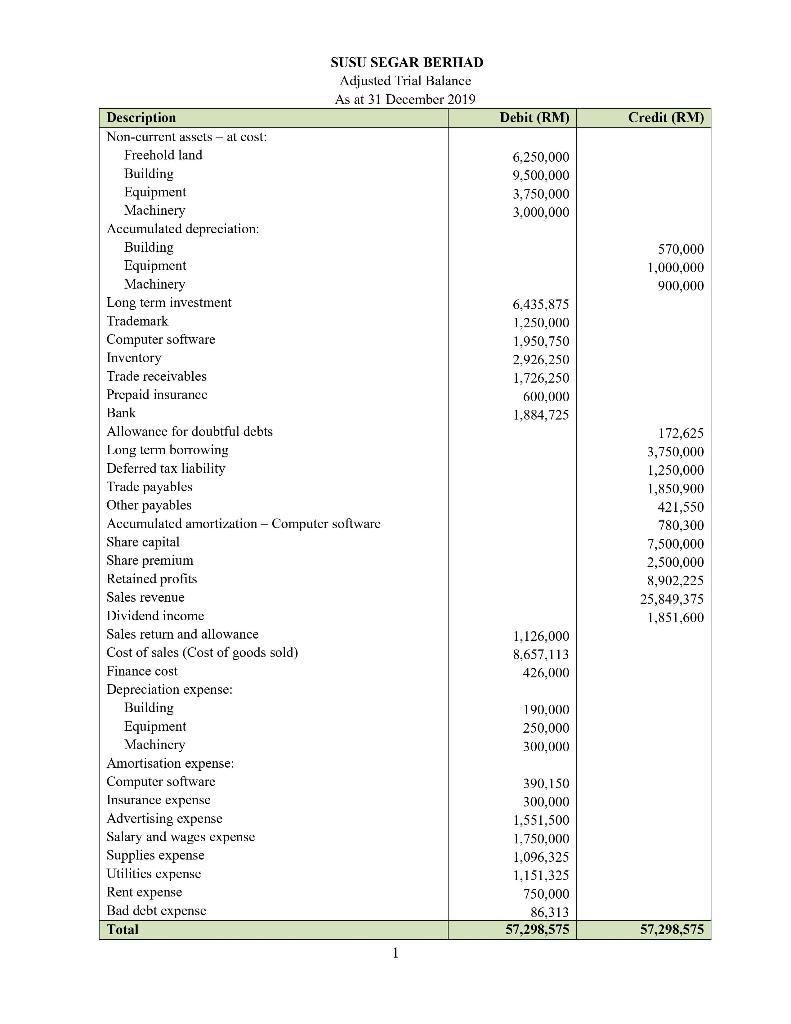

SUSU SEGAR BERIJAD Adjusted Trial Balance As at 31 December 2019 Description Debit (RM) Credit (RM) Non-current assets at cost: Freehold land 6,250,000 9,500,000 Building Equipment Machinery Accumulated depreciation: 3,750,000 3.000,000 Building Equipment Machinery 570,000 1,000,000 900,000 Long term investment 6.435,875 Trademark 1,250,000 Computer software Inventory 1,950,750 2,926,250 1,726.250 Trade receivables Prepaid insurance 600,000 Bank 1,884,725 Allowance for doubtful debts 172,625 Long term borrowing Deferred tax liability Trade payables Other payables Accumulated amortization - Computer software 3,750,000 1,250,000 1,850,900 421,550 780.300 Share capital Share premium Retained profits 7,500,000 2,500,000 8,902,225 Sales revenue 25,849,375 1,851,600 Dividend income Sales return and allowance 1,126,000 Cost of sales (Cost of goods sold) 8,657,113 Finance cost 426,000 Depreciation expense: Building Equipment Machinery Amortisation expense: 190,000 250.000 300,000 Computer software 390,150 Insurance expense 300,000 Advertising expense Salary and wages expense 1,551,500 1.750,000 Supplies expense Utilities expense 1,096,325 1,151.325 Rent expense Bad debt expense 750,000 86.313 57,298,575 Total 57,298,575

Step by Step Solution

★★★★★

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60d5e1d222896_215346.pdf

180 KBs PDF File

60d5e1d222896_215346.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started