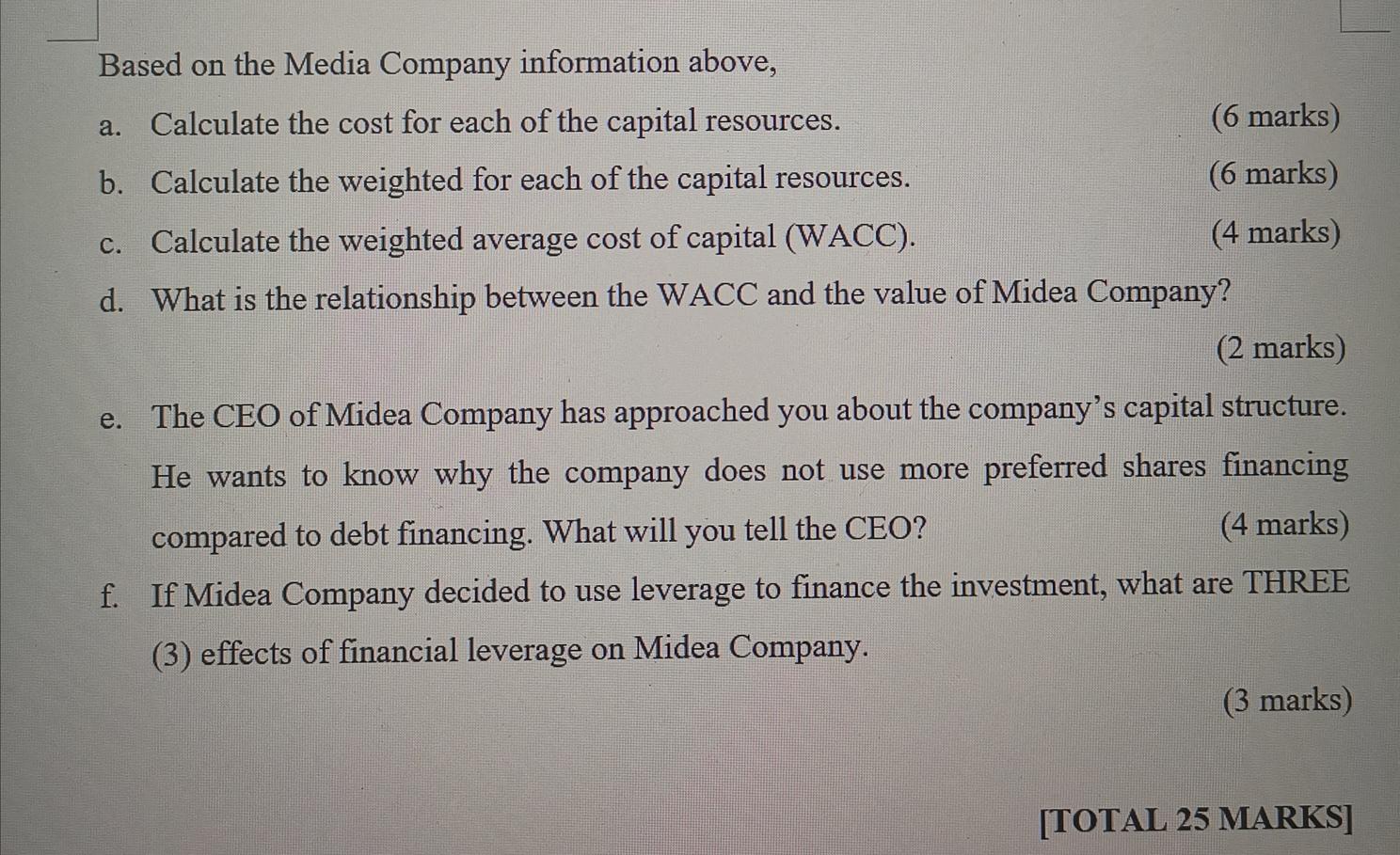

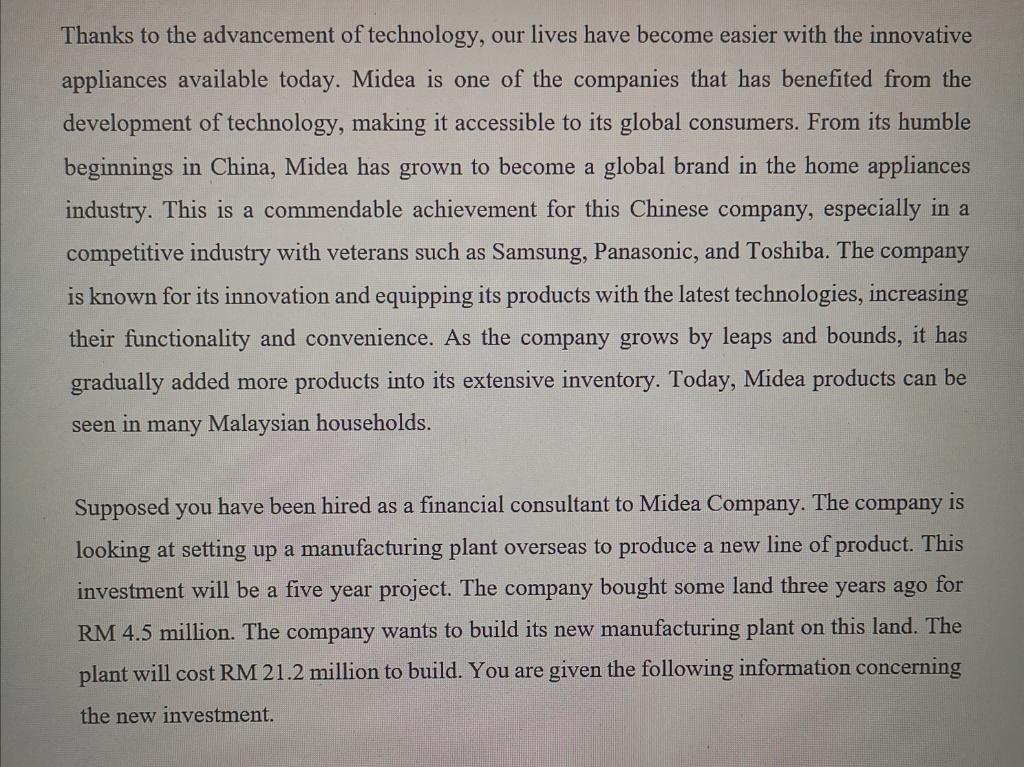

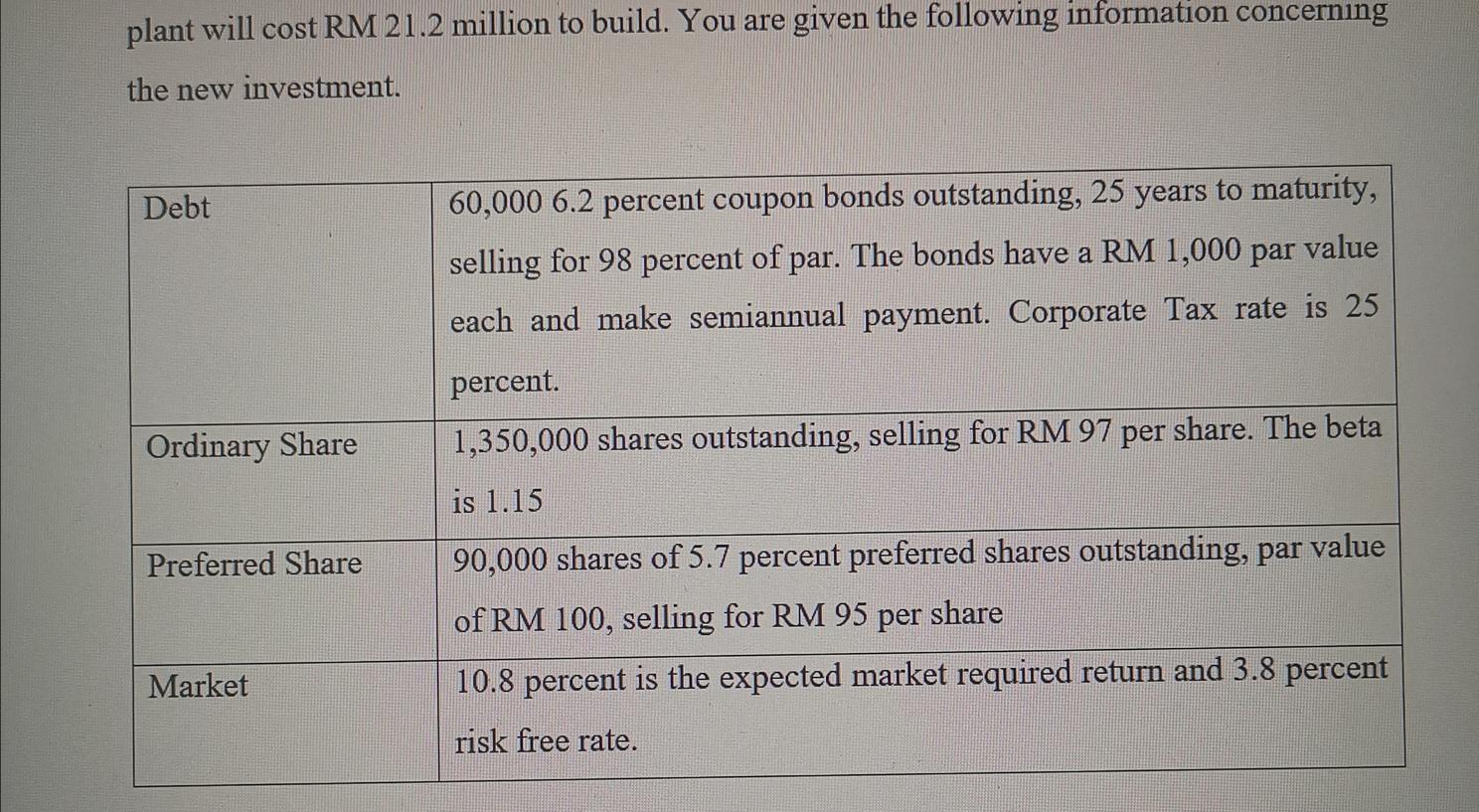

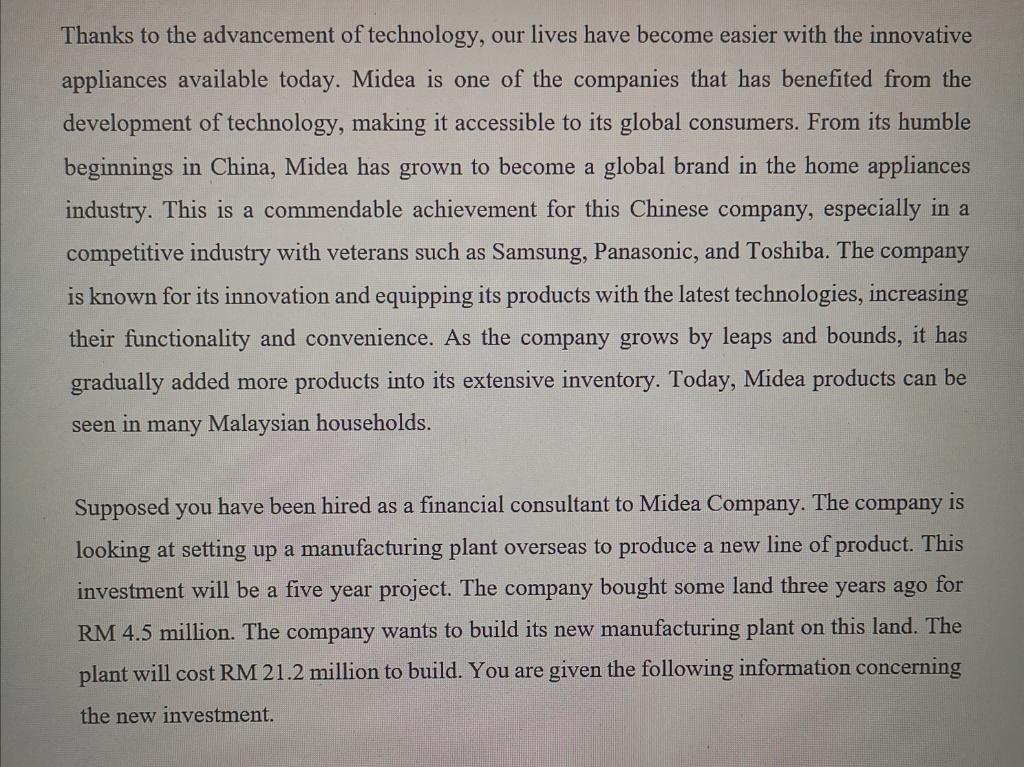

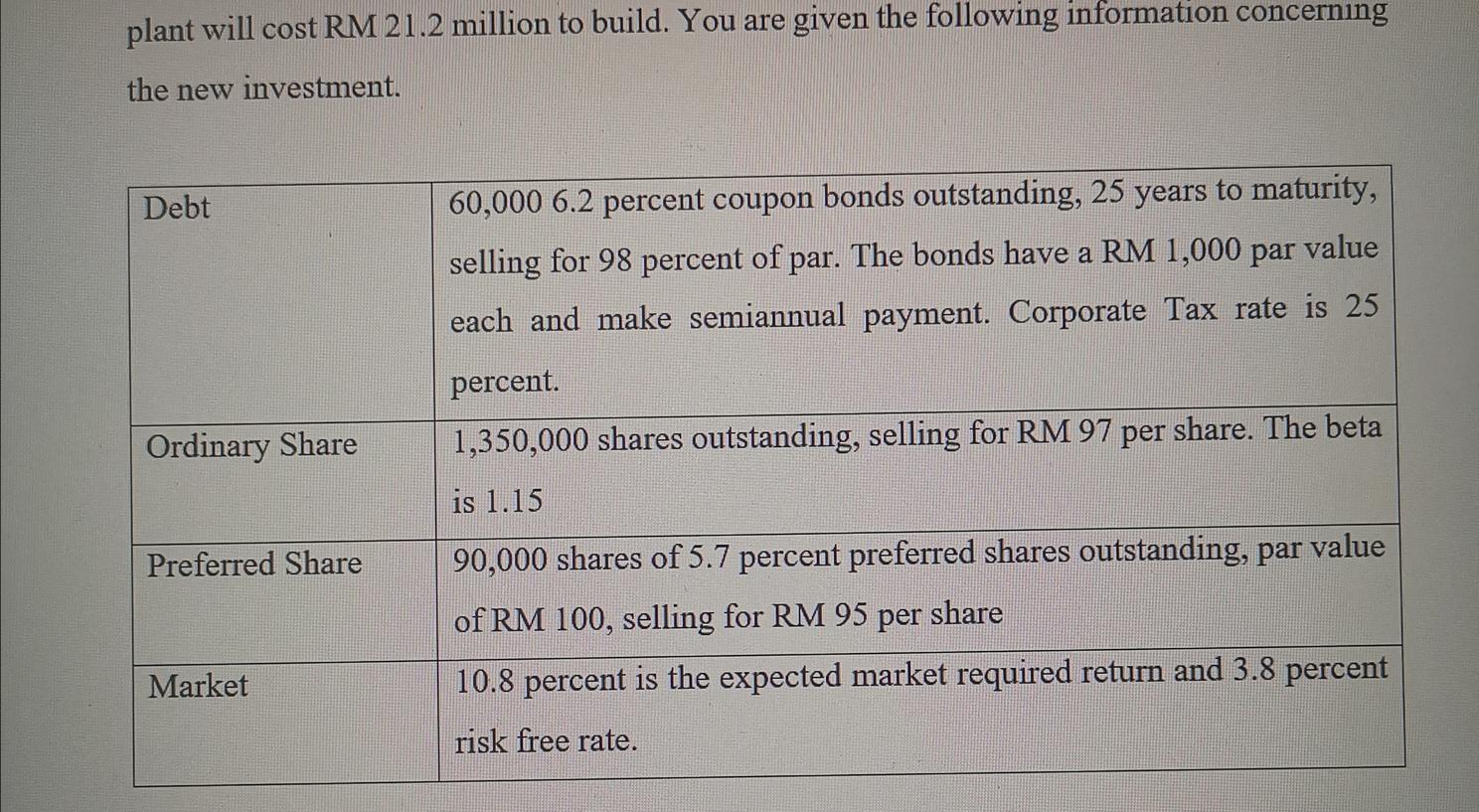

Based on the Media Company information above, a. Calculate the cost for each of the capital resources. (6 marks) b. Calculate the weighted for each of the capital resources. (6 marks) c. Calculate the weighted average cost of capital (WACC). (4 marks) d. What is the relationship between the WACC and the value of Midea Company? (2 marks) e. The CEO of Midea Company has approached you about the company's capital structure. He wants to know why the company does not use more preferred shares financing compared to debt financing. What will you tell the CEO? (4 marks) f. If Midea Company decided to use leverage to finance the investment, what are THREE (3) effects of financial leverage on Midea Company. (3 marks) [TOTAL 25 MARKS] Thanks to the advancement of technology, our lives have become easier with the innovative appliances available today. Midea is one of the companies that has benefited from the development of technology, making it accessible to its global consumers. From its humble beginnings in China, Midea has grown to become a global brand in the home appliances industry. This is a commendable achievement for this Chinese company, especially in a competitive industry with veterans such as Samsung, Panasonic, and Toshiba. The company is known for its innovation and equipping its products with the latest technologies, increasing their functionality and convenience. As the company grows by leaps and bounds, it has gradually added more products into its extensive inventory. Today, Midea products can be seen in many Malaysian households. Supposed you have been hired as a financial consultant to Midea Company. The company is looking at setting up a manufacturing plant overseas to produce a new line of product. This investment will be a five year project. The company bought some land three years ago for RM 4.5 million. The company wants to build its new manufacturing plant on this land. The plant will cost RM 21.2 million to build. You are given the following information concerning the new investment. plant will cost RM 21.2 million to build. You are given the following information concerning the new investment. Debt 60,000 6.2 percent coupon bonds outstanding, 25 years to maturity, selling for 98 percent of par. The bonds have a RM 1,000 par value each and make semiannual payment. Corporate Tax rate is 25 percent. Ordinary Share 1,350,000 shares outstanding, selling for RM 97 per share. The beta is 1.15 Preferred Share 90,000 shares of 5.7 percent preferred shares outstanding, par value of RM 100, selling for RM 95 per share 10.8 percent is the expected market required return and 3.8 percent Market risk free rate