Question

Based on the multiples for comparable companies, what is the range of possible values for PCP? What questions might you have about this range? To

Based on the multiples for comparable companies, what is the range of possible values for PCP? What questions might you have about this range?

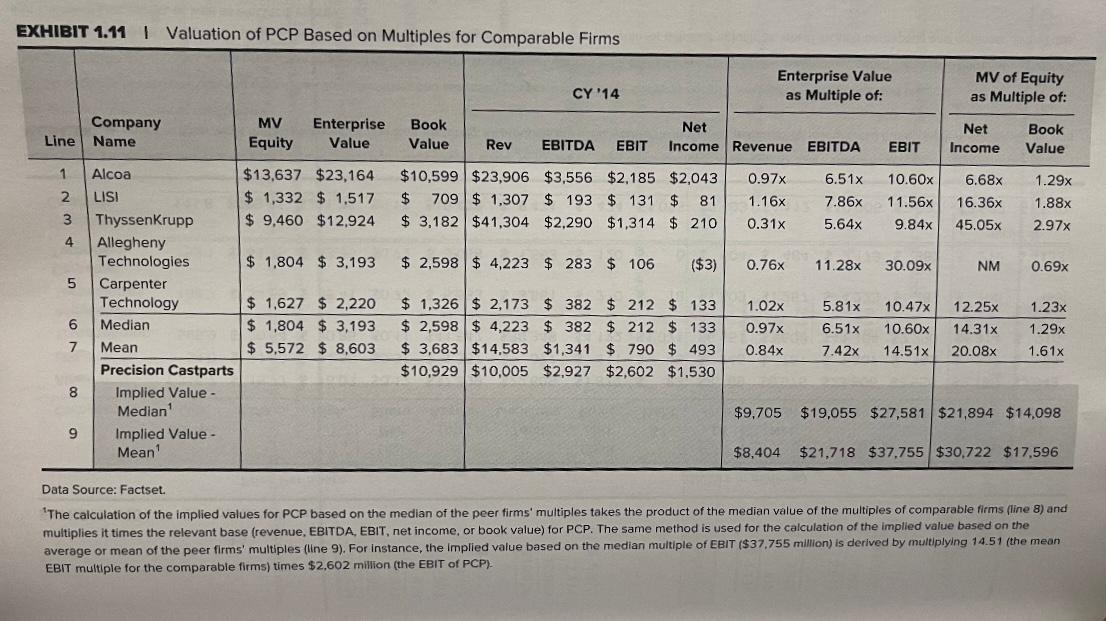

To answer this question, please look at the Exhibit 1.11 (page 22) in the case. If you look at the Exhibit 1.11, the implied valuations for PCP using the averages and medians of other firms multiples are presented. You can see in two aspects which are the enterprise value and market value of equity. In the beginning of this case, you can find the bid for PCP equity ($32.3 billion) and the bid for the total transaction value (enterprise value = $37.2 billion). You can compare the implied values to the bids. Then Buffetts bid can be justified.

EXHIBIT 1.11 1 Valuation of PCP Based on Multiples for comparable Firms CY '14 Enterprise Value as Multiple of: MV of Equity as Multiple of: Company Line Name MV Equity Enterprise Value Book Value Rev EBITDA Net Income Revenue EBIT Net Income Book Value EBITDA EBIT 1 $10,599 $23,906 $3,556 $2,185 $2,043 $ 709$ 1,307 $ 193 $ 131 $ 81 $ 3,182 $41.304 $2,290 $1,314 $ 210 0.97x 1.16x 2 3 6.51x 7.86x 5.64x 10.60x 11.56x 9.84x 6.68x 16.36x 45.05x 1.29x 1.88x 2.97x 0.31x 4 $ 2,598 $ 4,223 $ 283 $ 106 ($3) 0.76x 11.28x 30.09x NM 0.69x 5 1.02x Alcoa $13,637 $23,164 LISI $ 1,332 $ 1,517 ThyssenKrupp $ 9,460 $12,924 Allegheny Technologies $ 1,804 $ 3.193 Carpenter Technology $ 1.627 $ 2,220 Median $ 1,804 $ 3,193 Mean $ 5,572 $ 8,603 Precision Castparts Implied Value - Median Implied Value - Mean 6 $ 1,326 $ 2,173 $ 382 $ 212 $ 133 $ 2,598 $ 4,223 $ 382 $ 212 $ 133 $ 3,683 $14,583 $1,341 $ 790 $ 493 $10,929 $10,005 $2,927 $2,602 $1,530 0.97x 0.84x 5.81x 6.51x 7.42x 10.47x 10.60x 14.51x 12.25x 14.31x 20.08x 1.23x 1.29x 1.61x 7 8 $9,705 $19,055 $27,581 $21,894 $14,098 9 $8,404 $21,718 $37,755 $30,722 $17,596 Data Source: Factset. *The calculation of the implied values for PCP based on the median of the peer firms' multiples takes the product of the median value of the multiples of comparable firms (line 8) and multiplies it times the relevant base (revenue, EBITDA, EBIT, net income, or book value) for PCP. The same method is used for the calculation of the implied value based on the average or mean of the peer firms' multiples (line 9). For instance, the implied value based on the median multiple of EBIT ($37.755 million) is derived by multiplying 14.51 (the mean EBIT multiple for the comparable firms) times $2,602 million (the EBIT of PCP)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started